Answered step by step

Verified Expert Solution

Question

1 Approved Answer

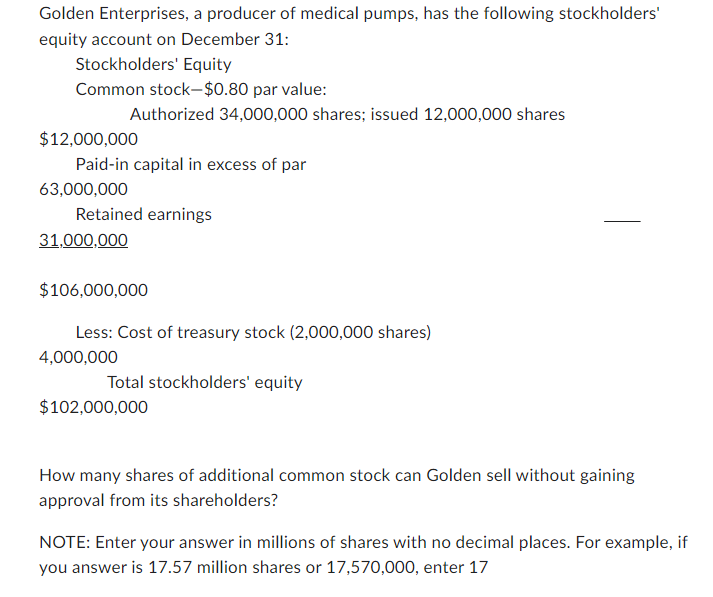

Golden Enterprises, a producer of medical pumps, has the following stockholders' equity account on December 31: Stockholders' Equity Common stock $0.80 par value: Authorized 34,000,000

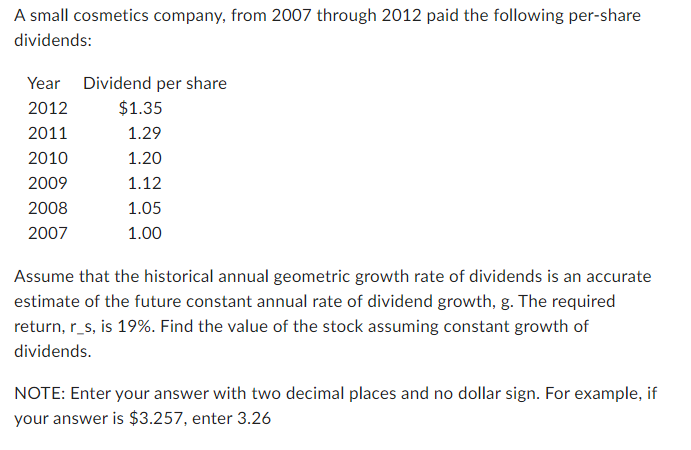

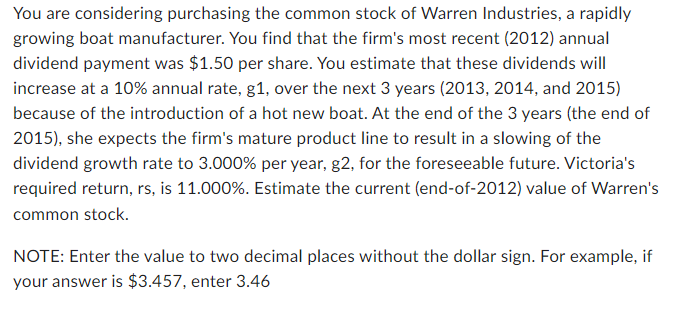

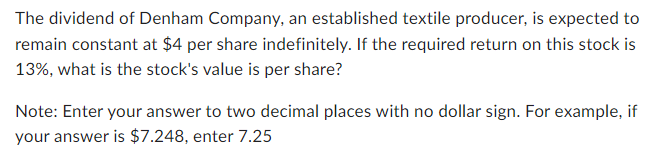

Golden Enterprises, a producer of medical pumps, has the following stockholders' equity account on December 31: Stockholders' Equity Common stock $0.80 par value: Authorized 34,000,000 shares; issued 12,000,000 shares $12,000,000 Paid-in capital in excess of par 63,000,000 Retained earnings 31,000,000 $106,000,000 Less: Cost of treasury stock (2,000,000 shares) 4,000,000 Total stockholders' equity $102,000,000 How many shares of additional common stock can Golden sell without gaining approval from its shareholders? NOTE: Enter your answer in millions of shares with no decimal places. For example, if you answer is 17.57 million shares or 17,570,000, enter 17 The dividend of Denham Company, an established textile producer, is expected to remain constant at $4 per share indefinitely. If the required return on this stock is 13%, what is the stock's value is per share? Note: Enter your answer to two decimal places with no dollar sign. For example, if your answer is $7.248, enter 7.25 You are considering purchasing the common stock of Warren Industries, a rapidly growing boat manufacturer. You find that the firm's most recent (2012) annual dividend payment was $1.50 per share. You estimate that these dividends will increase at a 10% annual rate, g1, over the next 3 years (2013,2014, and 2015) because of the introduction of a hot new boat. At the end of the 3 years (the end of 2015), she expects the firm's mature product line to result in a slowing of the dividend growth rate to 3.000% per year, g2, for the foreseeable future. Victoria's required return, rs, is 11.000%. Estimate the current (end-of-2012) value of Warren's common stock. NOTE: Enter the value to two decimal places without the dollar sign. For example, if your answer is $3.457, enter 3.46 A small cosmetics company, from 2007 through 2012 paid the following per-share dividends: Assume that the historical annual geometric growth rate of dividends is an accurate estimate of the future constant annual rate of dividend growth, g. The required return, r_s, is 19%. Find the value of the stock assuming constant growth of dividends. NOTE: Enter your answer with two decimal places and no dollar sign. For example, if your answer is $3.257, enter 3.26

Golden Enterprises, a producer of medical pumps, has the following stockholders' equity account on December 31: Stockholders' Equity Common stock $0.80 par value: Authorized 34,000,000 shares; issued 12,000,000 shares $12,000,000 Paid-in capital in excess of par 63,000,000 Retained earnings 31,000,000 $106,000,000 Less: Cost of treasury stock (2,000,000 shares) 4,000,000 Total stockholders' equity $102,000,000 How many shares of additional common stock can Golden sell without gaining approval from its shareholders? NOTE: Enter your answer in millions of shares with no decimal places. For example, if you answer is 17.57 million shares or 17,570,000, enter 17 The dividend of Denham Company, an established textile producer, is expected to remain constant at $4 per share indefinitely. If the required return on this stock is 13%, what is the stock's value is per share? Note: Enter your answer to two decimal places with no dollar sign. For example, if your answer is $7.248, enter 7.25 You are considering purchasing the common stock of Warren Industries, a rapidly growing boat manufacturer. You find that the firm's most recent (2012) annual dividend payment was $1.50 per share. You estimate that these dividends will increase at a 10% annual rate, g1, over the next 3 years (2013,2014, and 2015) because of the introduction of a hot new boat. At the end of the 3 years (the end of 2015), she expects the firm's mature product line to result in a slowing of the dividend growth rate to 3.000% per year, g2, for the foreseeable future. Victoria's required return, rs, is 11.000%. Estimate the current (end-of-2012) value of Warren's common stock. NOTE: Enter the value to two decimal places without the dollar sign. For example, if your answer is $3.457, enter 3.46 A small cosmetics company, from 2007 through 2012 paid the following per-share dividends: Assume that the historical annual geometric growth rate of dividends is an accurate estimate of the future constant annual rate of dividend growth, g. The required return, r_s, is 19%. Find the value of the stock assuming constant growth of dividends. NOTE: Enter your answer with two decimal places and no dollar sign. For example, if your answer is $3.257, enter 3.26 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started