Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Golden Manufacturing Company started operations by acquiring $116,000 cash from the issue of common stock. On January 1, Year 1, the company purchased equipment

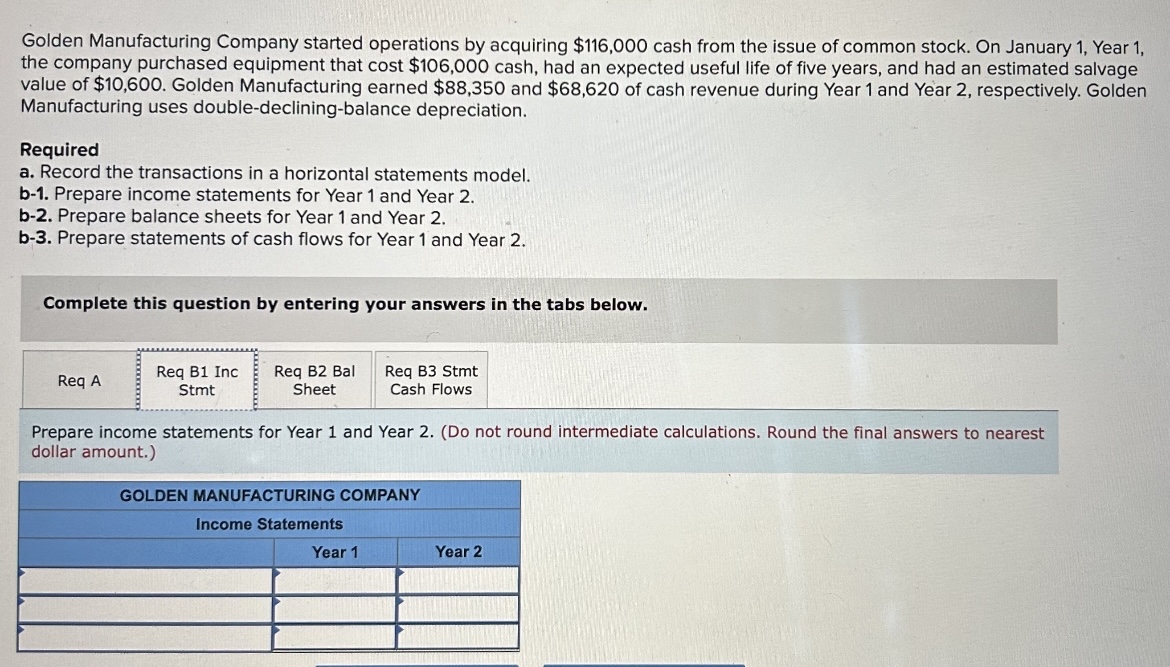

Golden Manufacturing Company started operations by acquiring $116,000 cash from the issue of common stock. On January 1, Year 1, the company purchased equipment that cost $106,000 cash, had an expected useful life of five years, and had an estimated salvage value of $10,600. Golden Manufacturing earned $88,350 and $68,620 of cash revenue during Year 1 and Year 2, respectively. Golden Manufacturing uses double-declining-balance depreciation. Required a. Record the transactions in a horizontal statements model. b-1. Prepare income statements for Year 1 and Year 2. b-2. Prepare balance sheets for Year 1 and Year 2. b-3. Prepare statements of cash flows for Year 1 and Year 2. Complete this question by entering your answers in the tabs below. Req A Req B1 Inc Req B2 Bal Stmt Sheet Req B3 Stmt Cash Flows Prepare income statements for Year 1 and Year 2. (Do not round intermediate calculations. Round the final answers to nearest dollar amount.) GOLDEN MANUFACTURING COMPANY Income Statements Year 1 Year 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started