Question

Golden Manufacturing Company started operations by acquiring $81,000 cash from the issue of common stock. On January 1, Year 1, the company purchased equipment that

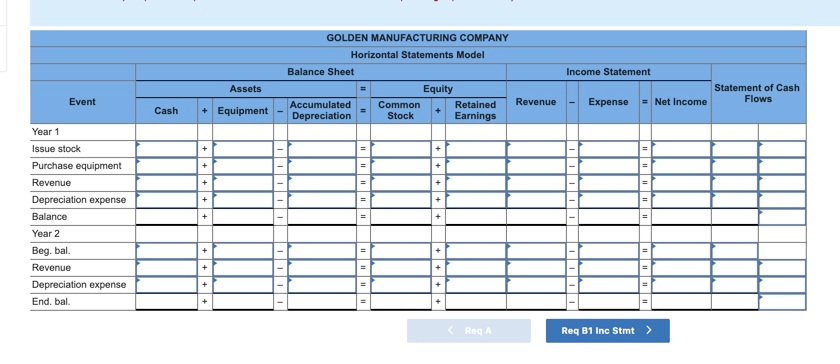

Golden Manufacturing Company started operations by acquiring $81,000 cash from the issue of common stock. On January 1, Year 1, the company purchased equipment that cost $71,000 cash, had an expected useful life of five years, and had an estimated salvage value of $7,100. Golden Manufacturing earned $85,690 and $61,380 of cash revenue during Year 1 and Year 2, respectively. Golden Manufacturing uses double-declining-balance depreciation

Record the purchase in a horizontal statements model. (In the Cash Flow column, indicate whether the item is an operating activity (OA), an investing activity (IA), a financing activity (FA) and net change in cash (NC).

B.

Prepare income statements for Year 1 and Year 2. (Do not round intermediate calculations. Round the final answers to nearest dollar amount.)

| |||||||||||||||||||

B2.

Prepare balance sheets for Year 1 and Year 2. (Do not round intermediate calculations. Round the final answers to nearest dollar amount.)

| ||||||||||||||||||||||||||||||||||||||||

B3.

| |||||||||||||||||||||||||||||||||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started