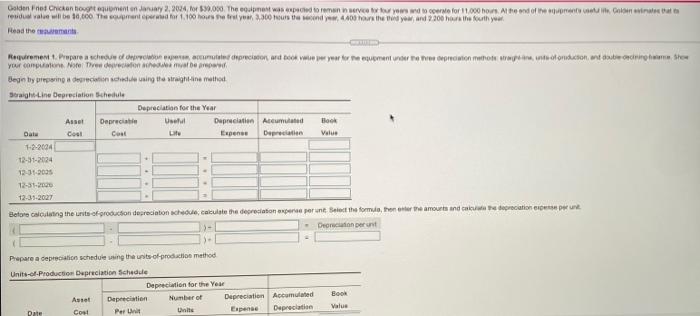

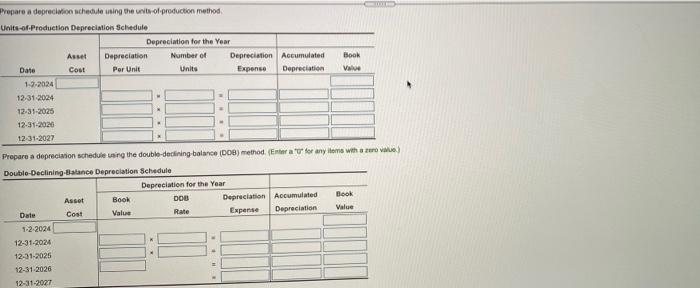

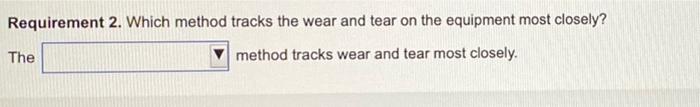

Goldenes Chicken tonement on any, 2014, 20.000. The coupnost speed tremannsviten und to certo for 1.000 hon the end of the women who is het en residual value will be 10.000 Thement period for 1.100 hours a 2.300 4400 hey, and 2200 hours the fout you Read the Requirement Prepare a school and recortes precisoon, and took an per year ter wereument under a cupciwon motor sempre, unde of onderon ont subi concreto home Show your The Begin by preparing a depreciation hade using the straightina metod Straight-Line Depreciation Schedule Depreciation for the Year Asset Depreciate Useful Depreciation Accumulated Book Dal Cosi Co Expense Deprecat Value 1-2-2004 12-31-2024 12-31-2005 12-31.2000 12-35-2027 Before calling the units of production depreciation schedule, calculate the degretatione per printed the formule, the amounts and actions Derection erunt ) Prepare a depreciation schedule wing the units of production method Units-of-Production Depreciation Schedule Depreciation for the Year Asset Depreciation Number of Depreciation Accumulated Book De Cost Per Unite Espen Depreciation Value Book Prepare a depreciation schedule using the unit of production method Units-of-Production Depreciation Schedule Depreciation for the Year Asset Depreciation Number of Depreciation Accumulated Date Cost Per Unit Units Expense Depreciation 1-2-2024 12.31.2024 12-31-2025 12-31-2020 12-31 2027 Book Prepare a depreciation schedule using the double-declining balance (06) method. (Enterar for anyone with a rov) Double-Declining-Balance Depreciation Schedule Depreciation for the Year Asset DOS Depreciation Accumulated Book Date Cost Value Rate Expense Depreciation Value 1-2-2024 12-31-2024 12-31-2025 12-31 2026 12-31-2027 Requirement 2. Which method tracks the wear and tear on the equipment most closely? The method tracks wear and tear most closely. Goldenes Chicken tonement on any, 2014, 20.000. The coupnost speed tremannsviten und to certo for 1.000 hon the end of the women who is het en residual value will be 10.000 Thement period for 1.100 hours a 2.300 4400 hey, and 2200 hours the fout you Read the Requirement Prepare a school and recortes precisoon, and took an per year ter wereument under a cupciwon motor sempre, unde of onderon ont subi concreto home Show your The Begin by preparing a depreciation hade using the straightina metod Straight-Line Depreciation Schedule Depreciation for the Year Asset Depreciate Useful Depreciation Accumulated Book Dal Cosi Co Expense Deprecat Value 1-2-2004 12-31-2024 12-31-2005 12-31.2000 12-35-2027 Before calling the units of production depreciation schedule, calculate the degretatione per printed the formule, the amounts and actions Derection erunt ) Prepare a depreciation schedule wing the units of production method Units-of-Production Depreciation Schedule Depreciation for the Year Asset Depreciation Number of Depreciation Accumulated Book De Cost Per Unite Espen Depreciation Value Book Prepare a depreciation schedule using the unit of production method Units-of-Production Depreciation Schedule Depreciation for the Year Asset Depreciation Number of Depreciation Accumulated Date Cost Per Unit Units Expense Depreciation 1-2-2024 12.31.2024 12-31-2025 12-31-2020 12-31 2027 Book Prepare a depreciation schedule using the double-declining balance (06) method. (Enterar for anyone with a rov) Double-Declining-Balance Depreciation Schedule Depreciation for the Year Asset DOS Depreciation Accumulated Book Date Cost Value Rate Expense Depreciation Value 1-2-2024 12-31-2024 12-31-2025 12-31 2026 12-31-2027 Requirement 2. Which method tracks the wear and tear on the equipment most closely? The method tracks wear and tear most closely