Answered step by step

Verified Expert Solution

Question

1 Approved Answer

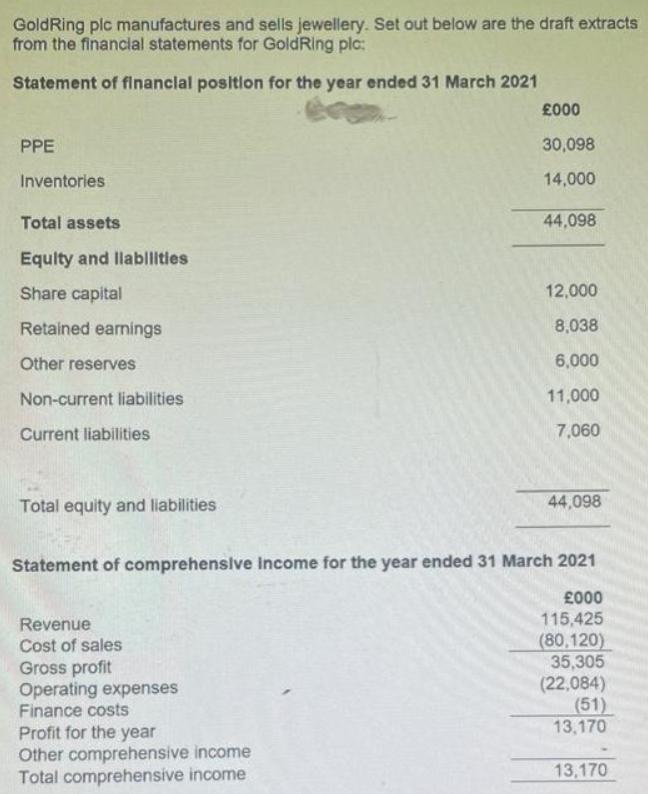

GoldRing plc manufactures and sells jewellery. Set out below are the draft extracts from the financial statements for GoldRing plc: Statement of financial position

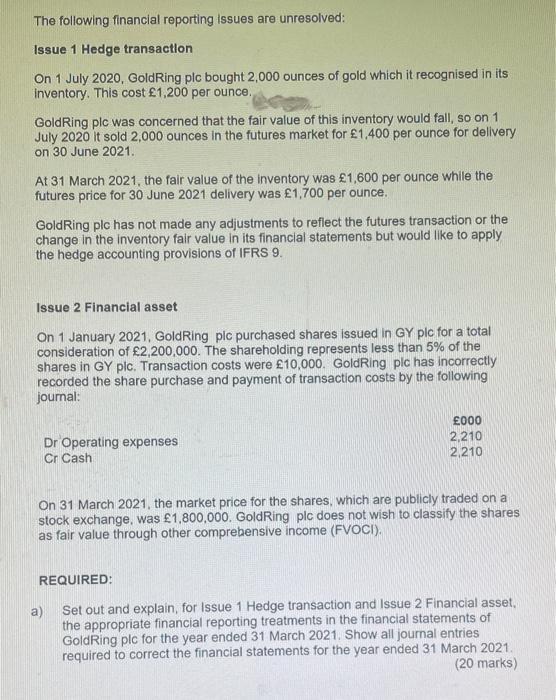

GoldRing plc manufactures and sells jewellery. Set out below are the draft extracts from the financial statements for GoldRing plc: Statement of financial position for the year ended 31 March 2021 PPE Inventories Total assets Equity and liabilities Share capital Retained earnings Other reserves Non-current liabilities Current liabilities Total equity and liabilities. Revenue Cost of sales Gross profit Operating expenses Finance costs 000 Profit for the year Other comprehensive income Total comprehensive income 30,098 14,000 44,098 Statement of comprehensive Income for the year ended 31 March 2021 000 115,425 (80,120) 35,305 (22,084) 12,000 8,038 6,000 11,000 7,060 44,098 (51) 13,170 13,170 The following financial reporting issues are unresolved: Issue 1 Hedge transaction On 1 July 2020, GoldRing plc bought 2,000 ounces of gold which it recognised in its inventory. This cost 1,200 per ounce. GoldRing plc was concerned that the fair value of this inventory would fall, so on 1 July 2020 it sold 2,000 ounces in the futures market for 1,400 per ounce for delivery on 30 June 2021. At 31 March 2021, the fair value of the inventory was 1,600 per ounce while the futures price for 30 June 2021 delivery was 1,700 per ounce. GoldRing plc has not made any adjustments to reflect the futures transaction or the change in the inventory fair value in its financial statements but would like to apply the hedge accounting provisions of IFRS 9. Issue 2 Financial asset On 1 January 2021, GoldRing plc purchased shares issued in GY plc for a total consideration of 2,200,000. The shareholding represents less than 5% of the shares in GY plc. Transaction costs were 10,000. GoldRing plc has incorrectly recorded the share purchase and payment of transaction costs by the following journal: Dr Operating expenses Cr Cash 000 2,210 2,210 On 31 March 2021, the market price for the shares, which are publicly traded on a stock exchange, was 1,800,000. GoldRing plc does not wish to classify the shares as fair value through other comprehensive income (FVOCI). REQUIRED: Set out and explain, for Issue 1 Hedge transaction and Issue 2 Financial asset, the appropriate financial reporting treatments in the financial statements of GoldRing plc for the year ended 31 March 2021. Show all journal entries required to correct the financial statements for the year ended 31 March 2021. (20 marks) b) Prepare a revised statement of financial position and a revised statement of comprehensive income for GoldRing plc for the year ended 31 March 2021 including your adjustments in part a). (15 marks)

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

aFor Issue 1 GoldRing pic should adjust its financial statements to reflect the gain or loss on the futures transaction If the futures transaction results in a loss then the loss should be recorded as ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started