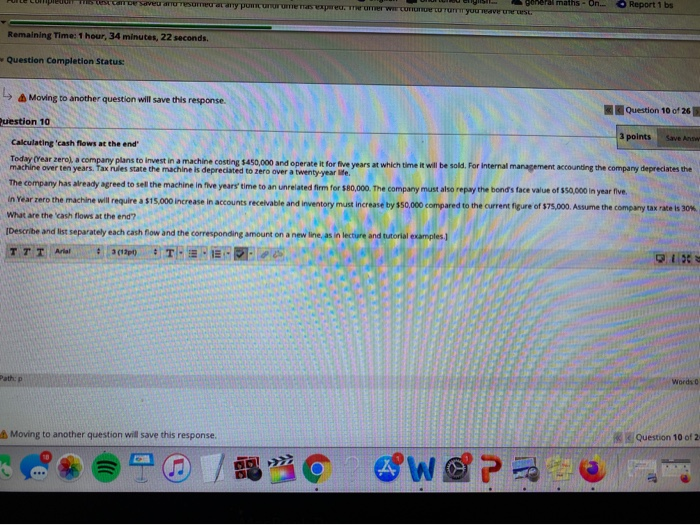

goneral maths Can Deveu a Test any pum UTE WIE COTIL LUTUT you event On Report 1 bs Remaining Time: 1 hour, 34 minutes, 22 seconds. Question Completion Statuse 4 Moving to another question will save this response. Question 10 of 26 Puestion 10 3 points Save Anw Calculating 'cash flows at the end Today (Year Zerol. a company plans to invest in a machine costing $450,000 and operate it for five years at which time it will be sold. For internal management accounting the company deprecates the machine over ten years. Tax Rules state the machine is depreciated to zero over a twenty year life. The company has already agreed to sell the machine in five years time to an unrelated firm for $80,000. The company must also repay the bond's face value of $50,000 in year five In Year zero the machine will require a $15,000 increase in accounts receivable and inventory must increase by $50,000 compared to the current figure of 375.000. Assume the company tax rate is 30% What are the cash flows at the end? [Describe and list separately each cash flow and the corresponding amount on a new line, as in lecture and tutorial examples TTT A THE Words Moving to another question will save this response. Question 10 of 2 goneral maths Can Deveu a Test any pum UTE WIE COTIL LUTUT you event On Report 1 bs Remaining Time: 1 hour, 34 minutes, 22 seconds. Question Completion Statuse 4 Moving to another question will save this response. Question 10 of 26 Puestion 10 3 points Save Anw Calculating 'cash flows at the end Today (Year Zerol. a company plans to invest in a machine costing $450,000 and operate it for five years at which time it will be sold. For internal management accounting the company deprecates the machine over ten years. Tax Rules state the machine is depreciated to zero over a twenty year life. The company has already agreed to sell the machine in five years time to an unrelated firm for $80,000. The company must also repay the bond's face value of $50,000 in year five In Year zero the machine will require a $15,000 increase in accounts receivable and inventory must increase by $50,000 compared to the current figure of 375.000. Assume the company tax rate is 30% What are the cash flows at the end? [Describe and list separately each cash flow and the corresponding amount on a new line, as in lecture and tutorial examples TTT A THE Words Moving to another question will save this response. Question 10 of 2