Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Good Buy purchases merchandise inventory by the crate; each crate of inventory is a unit. The fiscal year of Good Buy ends each February 28.

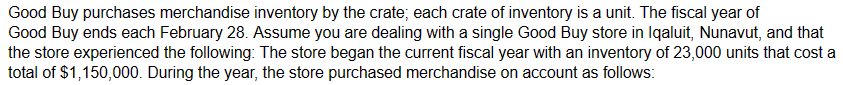

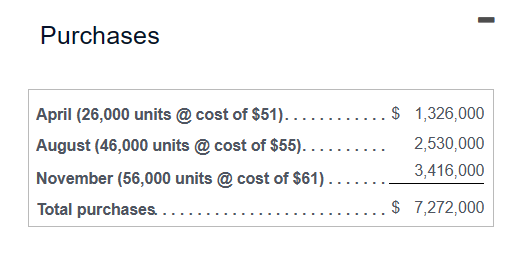

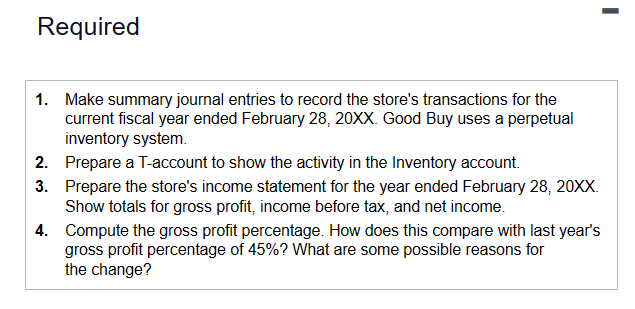

Good Buy purchases merchandise inventory by the crate; each crate of inventory is a unit. The fiscal year of Good Buy ends each February 28. Assume you are dealing with a single Good Buy store in Iqaluit, Nunavut, and that the store experienced the following: The store began the current fiscal year with an inventory of 23,000 units that cost a total of $1,150,000. During the year, the store purchased merchandise on account as follows: Purchases 1. Make summary journal entries to record the store's transactions for the current fiscal year ended February 28, 20XX. Good Buy uses a perpetual inventory system. 2. Prepare a T-account to show the activity in the Inventory account. 3. Prepare the store's income statement for the year ended February 28,20XX. Show totals for gross profit, income before tax, and net income. 4. Compute the gross profit percentage. How does this compare with last year's gross profit percentage of 45% ? What are some possible reasons for the change? Good Buy purchases merchandise inventory by the crate; each crate of inventory is a unit. The fiscal year of Good Buy ends each February 28. Assume you are dealing with a single Good Buy store in Iqaluit, Nunavut, and that the store experienced the following: The store began the current fiscal year with an inventory of 23,000 units that cost a total of $1,150,000. During the year, the store purchased merchandise on account as follows: Purchases 1. Make summary journal entries to record the store's transactions for the current fiscal year ended February 28, 20XX. Good Buy uses a perpetual inventory system. 2. Prepare a T-account to show the activity in the Inventory account. 3. Prepare the store's income statement for the year ended February 28,20XX. Show totals for gross profit, income before tax, and net income. 4. Compute the gross profit percentage. How does this compare with last year's gross profit percentage of 45% ? What are some possible reasons for the change

Good Buy purchases merchandise inventory by the crate; each crate of inventory is a unit. The fiscal year of Good Buy ends each February 28. Assume you are dealing with a single Good Buy store in Iqaluit, Nunavut, and that the store experienced the following: The store began the current fiscal year with an inventory of 23,000 units that cost a total of $1,150,000. During the year, the store purchased merchandise on account as follows: Purchases 1. Make summary journal entries to record the store's transactions for the current fiscal year ended February 28, 20XX. Good Buy uses a perpetual inventory system. 2. Prepare a T-account to show the activity in the Inventory account. 3. Prepare the store's income statement for the year ended February 28,20XX. Show totals for gross profit, income before tax, and net income. 4. Compute the gross profit percentage. How does this compare with last year's gross profit percentage of 45% ? What are some possible reasons for the change? Good Buy purchases merchandise inventory by the crate; each crate of inventory is a unit. The fiscal year of Good Buy ends each February 28. Assume you are dealing with a single Good Buy store in Iqaluit, Nunavut, and that the store experienced the following: The store began the current fiscal year with an inventory of 23,000 units that cost a total of $1,150,000. During the year, the store purchased merchandise on account as follows: Purchases 1. Make summary journal entries to record the store's transactions for the current fiscal year ended February 28, 20XX. Good Buy uses a perpetual inventory system. 2. Prepare a T-account to show the activity in the Inventory account. 3. Prepare the store's income statement for the year ended February 28,20XX. Show totals for gross profit, income before tax, and net income. 4. Compute the gross profit percentage. How does this compare with last year's gross profit percentage of 45% ? What are some possible reasons for the change Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started