Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Good day Any assistance, tips or guidance will be appreciated. Thanks in advance. Case Study assignment question Simon Mtshali, a 67-year-old South African resident, is

Good day

Any assistance, tips or guidance will be appreciated. Thanks in advance.

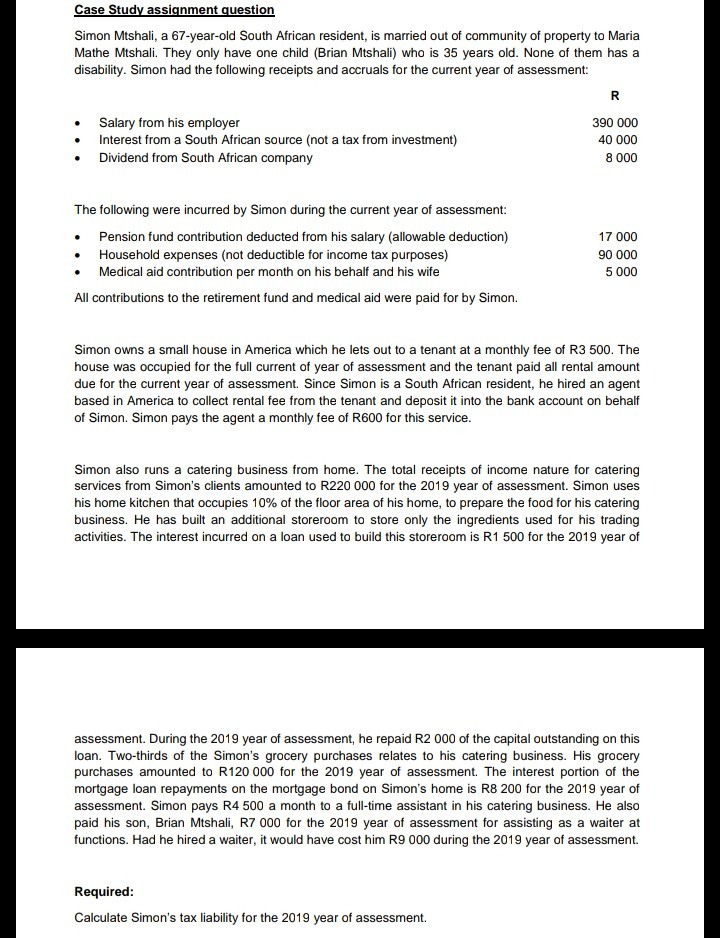

Case Study assignment question Simon Mtshali, a 67-year-old South African resident, is married out of community of property to Maria Mathe Mtshali. They only have one child (Brian Mtshali) who is 35 years old. None of them has a disability. Simon had the following receipts and accruals for the current year of assessment: Salary from his employer Interest from a South African source (not a tax from investment) Dividend from South African company 390 000 40 000 8 000 The following were incurred by Simon during the current year of assessment: Pension fund contribution deducted from his salary (allowable deduction) Household expenses (not deductible for income tax purposes) Medical aid contribution per month on his behalf and his wife 17 000 90 000 5 000 All contributions to the retirement fund and medical aid were paid for by Simon. Simon owns a small house in America which he lets out to a tenant at a monthly fee of R3 500. The house was occupied for the full current of year of assessment and the tenant paid all rental amount due for the current year of assessment. Since Simon is a South African resident, he hired an agent based in America to collect rental fee from the tenant and deposit it into the bank account on behalf of Simon. Simon pays the agent a monthly fee of R600 for this service. Simon also runs a catering business from home. The total receipts of income nature for catering services from Simon's clients amounted to R220 000 for the 2019 year of assessment. Simon uses his home kitchen that occupies 10% of the floor area of his home, to prepare the food for his catering business. He has built an additional storeroom to store only the ingredients used for his trading activities. The interest incurred on a loan used to build this storeroom is R1 500 for the 2019 year of assessment. During the 2019 year of assessment, he repaid R2 000 of the capital outstanding on this loan. Two-thirds of the Simon's grocery purchases relates to his catering business. His grocery purchases amounted to R120 000 for the 2019 year of assessment. The interest portion of the mortgage loan repayments on the mortgage bond on Simon's home is R8 200 for the 2019 year of assessment. Simon pays R4 500 a month to a full-time assistant in his catering business. He also paid his son, Brian Mtshali, R7 000 for the 2019 year of assessment for assisting as a waiter at functions. Had he hired a waiter, it would have cost him R9 000 during the 2019 year of assessment. Required: Calculate Simon's tax liability for the 2019 year of assessmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started