Good day, I need an only solution for this questions. There's an answer for every questions. Thank you!

17. (I'm not sure on my answer)

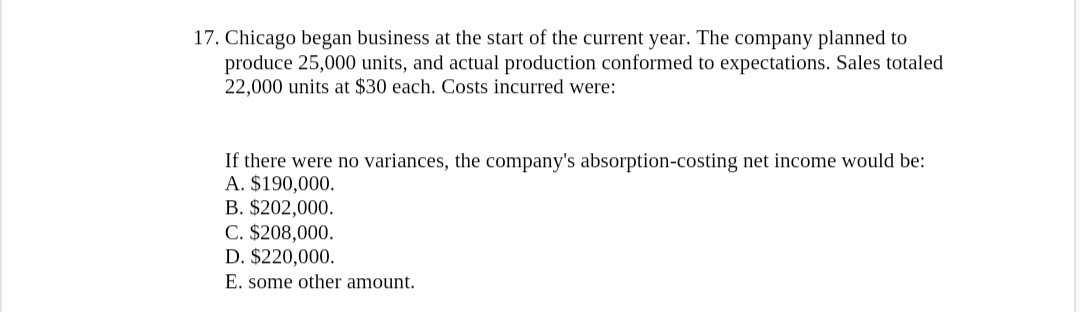

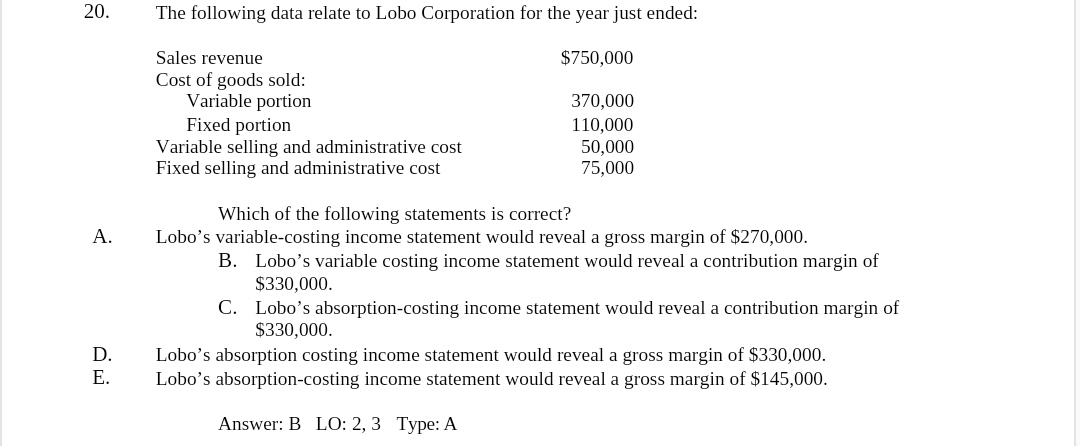

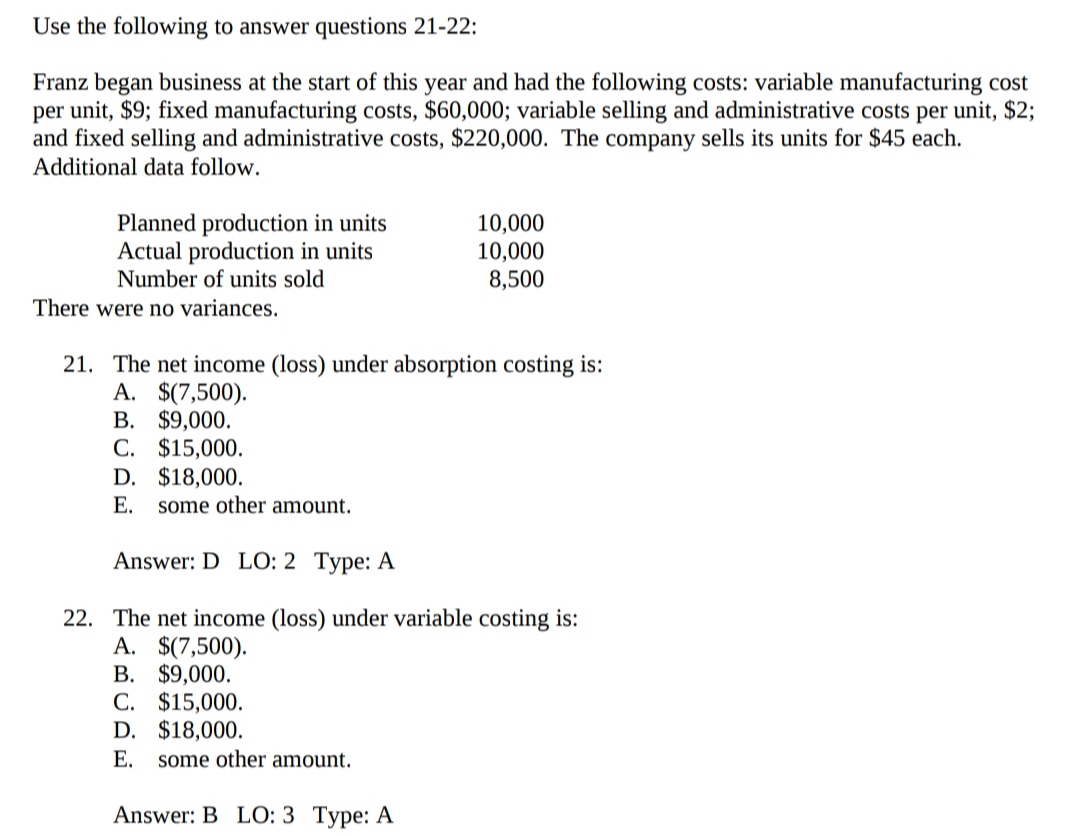

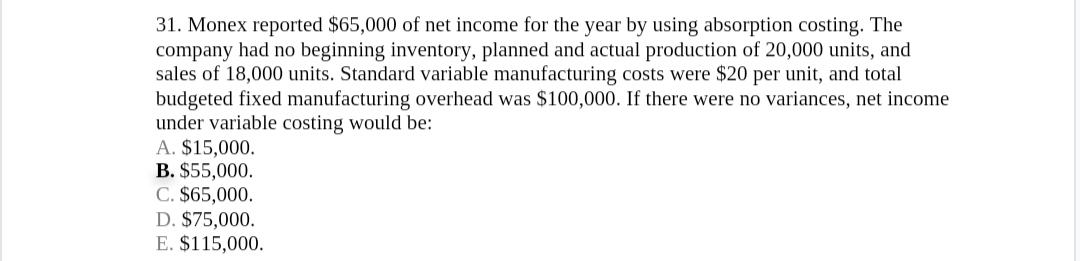

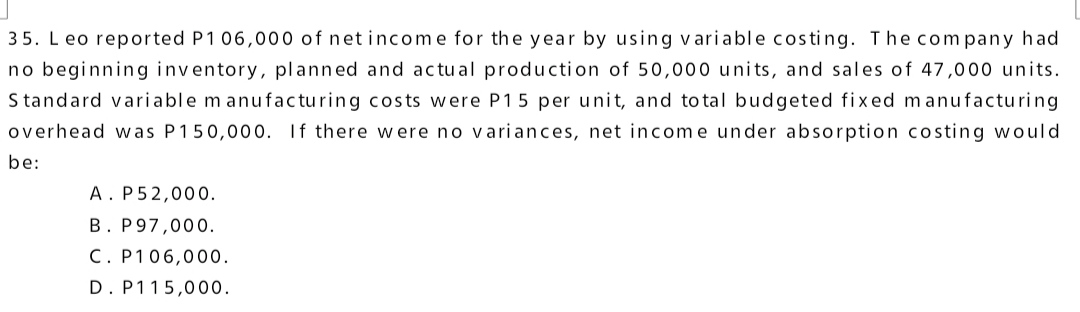

17. Chicago began business at the start of the current year. The company planned to produce 25,000 units, and actual production conformed to expectations. Sales totaled 22,000 units at $30 each. Costs incurred were: If there were no variances, the company's absorption-costing net income would be: A. $190,000. B. $202,000. C. $208,000. D. $220,000. E. some other amount. [-11.5 The following data relate to Lobo Corporation for the year just ended: Sales revenue $750,000 Cost of goods sold: Variable portion 370,000 Fixed portion 110,000 Variable selling and administrative cost 50,000 Fixed selling and administrative cost 75,000 Which of the following statements is correct? Lobo's variable-costing income statement would reveal a gross margin of $270,000. B. Lobo's variable costing income statement would reveal a contribution margin of $330,000. C. Lobo's absorption-costing income statement would reveal a contribution margin of $330,000. Lobo's absorption costing income statement would reveal a gross margin of $330,000. Lobo's absorption-costing income statement would reveal a gross margin of $145,000. Answer: B LO: 2, 3 Type: A Use the following to answer questions 21-22: Franz began business at the start of this year and had the following costs: variable manufacturing cost per unit, $9; fixed manufacturing costs, $60,000; variable selling and administrative costs per unit, $2; and fixed selling and administrative costs, $220,000. The company sells its units for $45 each. Additional data follow. Planned production in units 10,000 Actual production in units 10,000 Number of units sold 8,500 There were no variances. 21. The net income (loss) under absorption costing is: A. $(7,500). B. $9,000. C. $15,000. D. $18,000. E. some other amount. Answer:D LO:2 Type:A 22. The net income (loss) under variable costing is: A. $0,500). B. $9,000. C. $15,000. D. $18,000. E. some other amount. Answer: B LO: 3 Type: A 31. Monex reported $65,000 of net income for the year by using absorption costing. The company had no beginning inventory, planned and actual production of 20,000 units, and sales of 18,000 units. Standard variable manufacturing costs were $20 per unit, and total budgeted fixed manufacturing overhead was $100,000. If there were no variances, net income under variable costing would be: A. $15,000. B. $55,000. C. $65,000. D. $75,000. E. $1 15,000. 35. L eo reported P106,000 of net income for the year by using variable costing. T he company had no beginning inventory, planned and actual production of 50,000 units, and sales of 47,000 units. Standard variable manufacturing costs were P15 per unit, and total budgeted fixed manufacturing overhead was P150,000. If there were no variances, net income under absorption costing would be: .P52,000. . P97,000. . P106,000. . P115,000. UHF-'1