Good Evening, Please assist in making a Sales Budget for FY2018 and FY2019 (Budget).

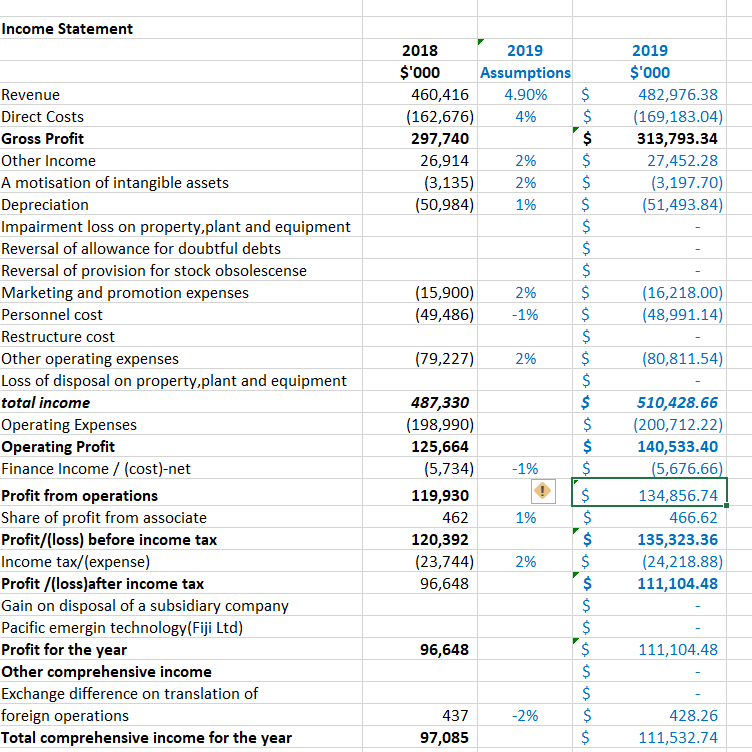

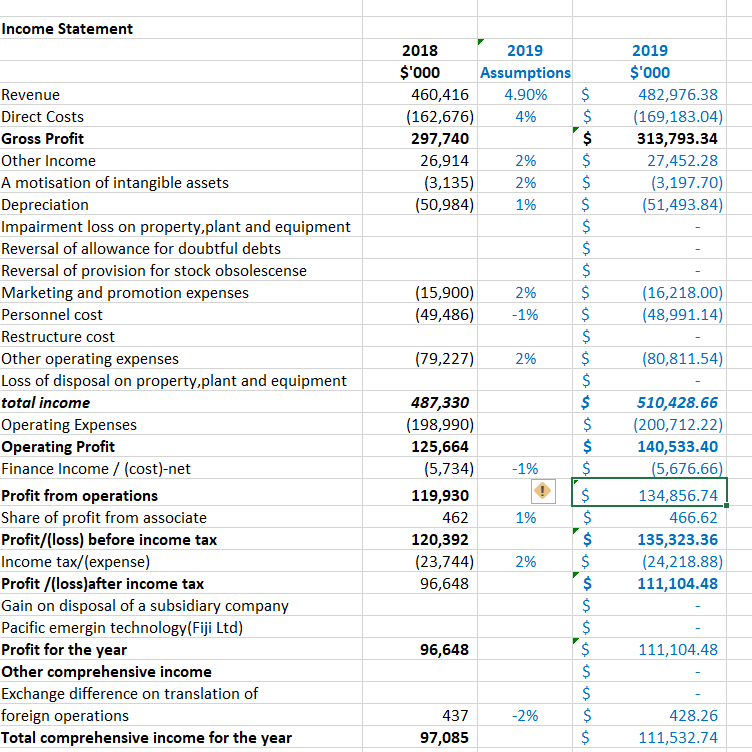

Income Statement 2019 2018 '000Assumptions 460,416 4.90% $ (162,676)4% 297,740 2019 $'000 482,976.38 496 $ (169,183.04) $313,793.34 27,452.28 (3,197.70) (51,493.84) Revenue Direct Costs Gross Profit Other Income A motisation of intangible assets Depreciation Impairment loss on property,plant and equipment Reversal of allowance for doubtful debts Reversal of provision for stock obsolescense Marketing and promotion expenses Personnel cost Restructure cost Other operating expenses Loss of disposal on property,plant and equipment total income Operating Expenses Operating Profit Finance Income (cost)-net Profit from operations Share of profit from associate Profit/(loss) before income tax Income tax/(expense) Profit /(loss)after income tax Gain on disposal of a subsidiary company Pacific emergin technology(Fiji Ltd) Profit for the year Other comprehensive income Exchange difference on translation of foreign operations Total comprehensive income for the year 26,914 2% 3,135) 2% (50,984)1% (15,900) (49,486) 2% -1% 16,218.00) 48,991.14) 79,227 2% (80,811.54) 487,330 (198,990) 125,664 5,734) 119,930 462 120,392 (23,744) 96,648 510,428.66 (200,712.22) 140,533.40 5,676.66 134,856.74 466.62 135,323.36 24,218.88) 111,104.48 -1% 1% 2% 96,648 111,104.48 428.26 111,532.74 437 -2% 97,085 Income Statement 2019 2018 '000Assumptions 460,416 4.90% $ (162,676)4% 297,740 2019 $'000 482,976.38 496 $ (169,183.04) $313,793.34 27,452.28 (3,197.70) (51,493.84) Revenue Direct Costs Gross Profit Other Income A motisation of intangible assets Depreciation Impairment loss on property,plant and equipment Reversal of allowance for doubtful debts Reversal of provision for stock obsolescense Marketing and promotion expenses Personnel cost Restructure cost Other operating expenses Loss of disposal on property,plant and equipment total income Operating Expenses Operating Profit Finance Income (cost)-net Profit from operations Share of profit from associate Profit/(loss) before income tax Income tax/(expense) Profit /(loss)after income tax Gain on disposal of a subsidiary company Pacific emergin technology(Fiji Ltd) Profit for the year Other comprehensive income Exchange difference on translation of foreign operations Total comprehensive income for the year 26,914 2% 3,135) 2% (50,984)1% (15,900) (49,486) 2% -1% 16,218.00) 48,991.14) 79,227 2% (80,811.54) 487,330 (198,990) 125,664 5,734) 119,930 462 120,392 (23,744) 96,648 510,428.66 (200,712.22) 140,533.40 5,676.66 134,856.74 466.62 135,323.36 24,218.88) 111,104.48 -1% 1% 2% 96,648 111,104.48 428.26 111,532.74 437 -2% 97,085