Question

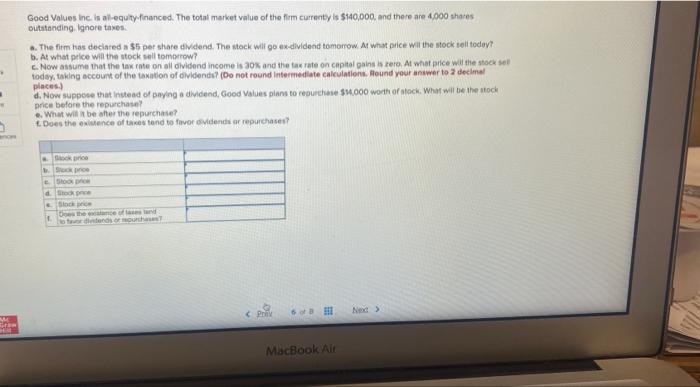

Good Values Inc. is al equity financed. The total market value of the firm currently is $140,000. and there are 4.000 shares outstanding Ignore taxes

MacBook Air Good Values Inc. is al equity financed. The total market value of the firm currently is $140,000. and there are 4.000 shares outstanding Ignore taxes The firm has declared $5 per share dividend. The stock wilgo ex dividend tomorrow. At what price will the stock tell today? b. At what price will the stock sell tomorrow c. Now assume that the tax rate on all dividend income is 30% and the tax rate on capital gains is zero. At what price will the stock set today, taking account of the taxation of dividends? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) d. Now suppose that instead of paying a dividend, Good Values plans to repurchase $1,000 worth of stock. What will be the stock price before the repurchase What will be after the repurchase? Does the sence of stond to favor dende o repurchases? ric GO d. to the end

MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started