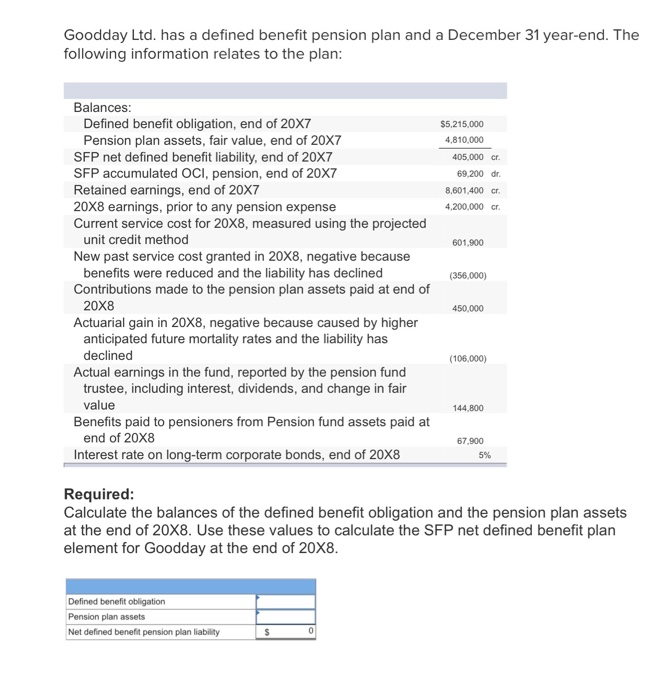

Goodday Ltd. has a defined benefit pension plan and a December 31 year-end. The following information relates to the plan: $5,215,000 4.810,000 405,000 cr. 69,200 dr. 8.601,400 r. 4,200,000 cr 601,900 Balances: Defined benefit obligation, end of 20X7 Pension plan assets, fair value, end of 20X7 SFP net defined benefit liability, end of 20X7 SFP accumulated OCI, pension, end of 20X7 Retained earnings, end of 20X7 20X8 earnings, prior to any pension expense Current service cost for 20X8, measured using the projected unit credit method New past service cost granted in 20X8, negative because benefits were reduced and the liability has declined Contributions made to the pension plan assets paid at end of 20X8 Actuarial gain in 20X8, negative because caused by higher anticipated future mortality rates and the liability has declined Actual earnings in the fund, reported by the pension fund trustee, including interest, dividends, and change in fair value Benefits paid to pensioners from Pension fund assets paid at end of 20X8 Interest rate on long-term corporate bonds, end of 20X8 (356,000) 450,000 (106,000) 144.800 67.900 5% Required: Calculate the balances of the defined benefit obligation and the pension plan assets at the end of 20X8. Use these values to calculate the SFP net defined benefit plan element for Goodday at the end of 20X8. Defined benefit obligation Pension plan assets Net defined benefit pension plan liability s Goodday Ltd. has a defined benefit pension plan and a December 31 year-end. The following information relates to the plan: $5,215,000 4.810,000 405,000 cr. 69,200 dr. 8.601,400 r. 4,200,000 cr 601,900 Balances: Defined benefit obligation, end of 20X7 Pension plan assets, fair value, end of 20X7 SFP net defined benefit liability, end of 20X7 SFP accumulated OCI, pension, end of 20X7 Retained earnings, end of 20X7 20X8 earnings, prior to any pension expense Current service cost for 20X8, measured using the projected unit credit method New past service cost granted in 20X8, negative because benefits were reduced and the liability has declined Contributions made to the pension plan assets paid at end of 20X8 Actuarial gain in 20X8, negative because caused by higher anticipated future mortality rates and the liability has declined Actual earnings in the fund, reported by the pension fund trustee, including interest, dividends, and change in fair value Benefits paid to pensioners from Pension fund assets paid at end of 20X8 Interest rate on long-term corporate bonds, end of 20X8 (356,000) 450,000 (106,000) 144.800 67.900 5% Required: Calculate the balances of the defined benefit obligation and the pension plan assets at the end of 20X8. Use these values to calculate the SFP net defined benefit plan element for Goodday at the end of 20X8. Defined benefit obligation Pension plan assets Net defined benefit pension plan liability s