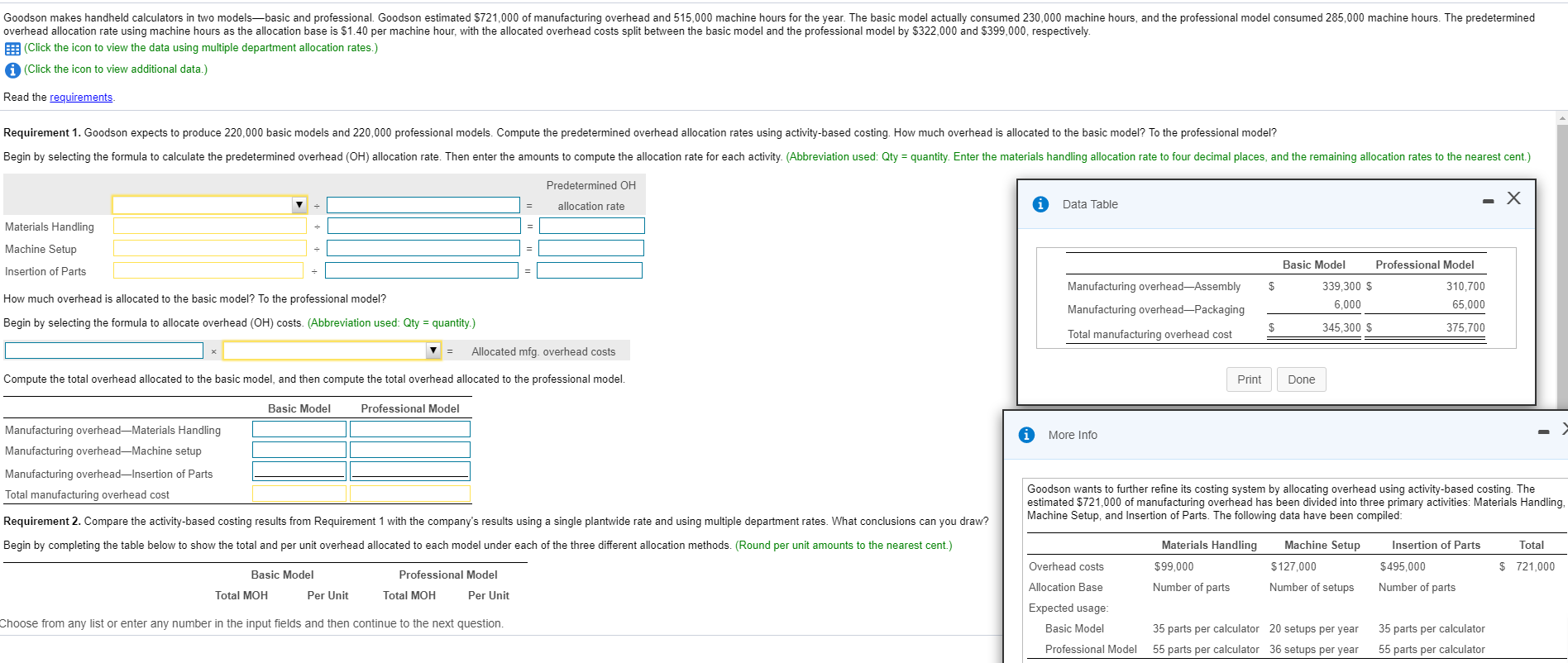

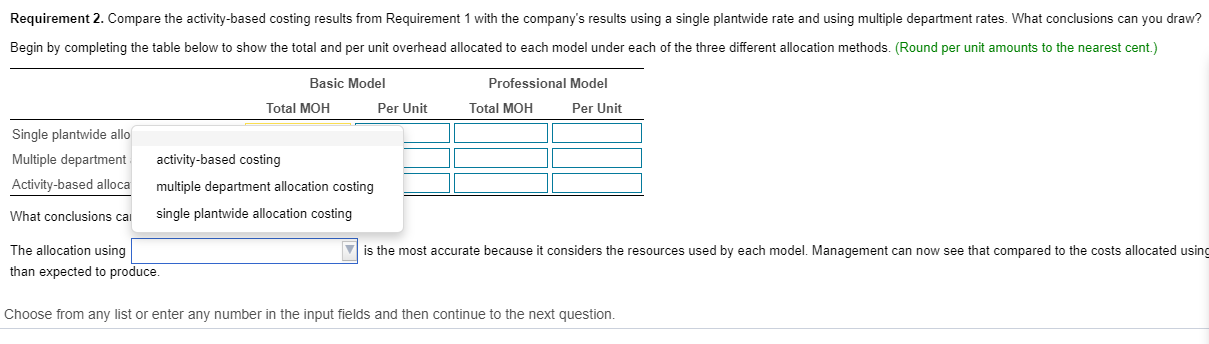

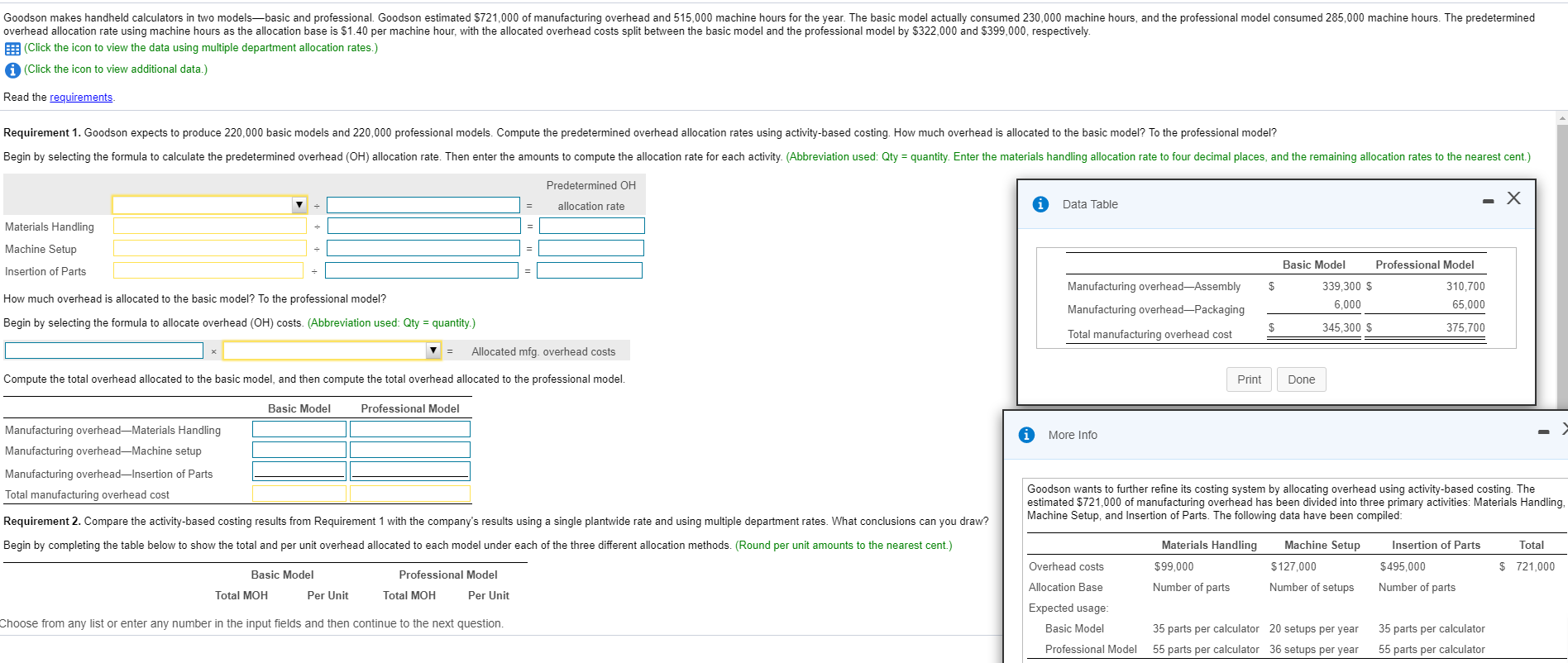

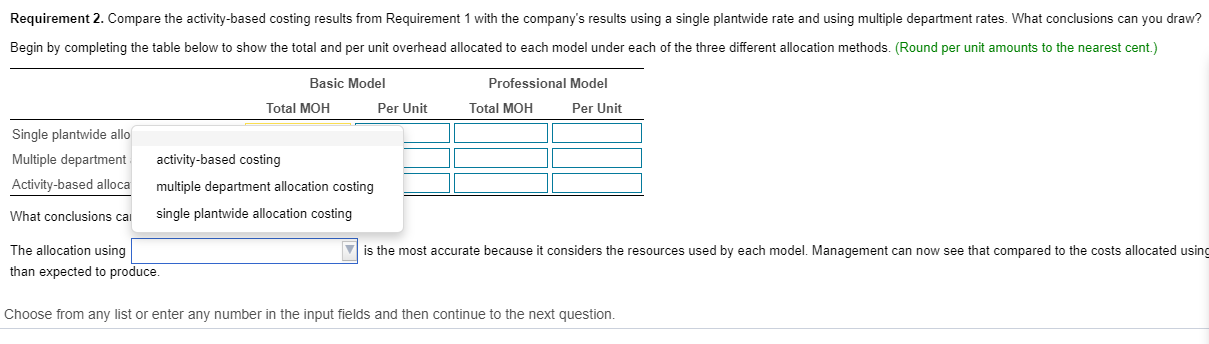

Goodson makes handheld calculators in two modelsbasic and professional. Goodson estimated $721,000 of manufacturing overhead and 515,000 machine hours for the year. The basic model actually consumed 230,000 machine hours, and the professional model consumed 285,000 machine hours. The predetermined overhead allocation rate using machine hours as the allocation base is $1.40 per machine hour, with the allocated overhead costs split between the basic model and the professional model by $322,000 and $399,000, respectively. (Click the icon to view the data using multiple department allocation rates.) (Click the icon to view additional data.) Read the requirements. Requirement 1. Goodson expects to produce 220,000 basic models and 220,000 professional models. Compute the predetermined overhead allocation rates using activity-based costing. How much overhead is allocated to the basic model? To the professional model? Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation rate for each activity. (Abbreviation used: Qty = quantity. Enter the materials handling allocation rate to four decimal places, and the remaining allocation rates to the nearest cent.) Predetermined OH allocation rate = - X Data Table Materials Handling Machine Setup Insertion of Parts $ How much overhead is allocated to the basic model? To the professional model? Begin by selecting the formula to allocate overhead (OH) costs. (Abbreviation used: Qty = quantity.) Manufacturing overheadAssembly Manufacturing overhead-Packaging Basic Model Professional Model 339,300 $ 310,700 6,000 65,000 345,300 $ 375.700 $ Total manufacturing overhead cost = Allocated mfg. overhead costs Compute the total overhead allocated to the basic model, and then compute the total overhead allocated to the professional model. Print Done Basic Model Professional Model Manufacturing overhead-Materials Handling Manufacturing overhead-Machine setup i More Info Manufacturing overhead-Insertion of Parts Total manufacturing overhead cost Goodson wants to further refine its costing system by allocating overhead using activity-based costing. The estimated $721,000 of manufacturing overhead has been divided into three primary activities: Materials Handling, Machine Setup, and Insertion of Parts. The following data have been compiled: Requirement 2. Compare the activity-based costing results from Requirement 1 with the company's results using a single plantwide rate and using multiple department rates. What conclusions can you draw? Begin by completing the table below to show the total and per unit overhead allocated to each model under each of the three different allocation methods. (Round per unit amounts to the nearest cent.) Materials Handling $99,000 Number of parts Machine Setup $127,000 Number of setups Insertion of Parts $495,000 Number of parts Total $ 721,000 Basic Model Total MOH Per Unit Professional Model Total MOH Per Unit Overhead costs Allocation Base Expected usage: Basic Model Professional Model Choose from any list or enter any number in the input fields and then continue to the next question. 35 parts per calculator 20 setups per year 55 parts per calculator 36 setups per year 35 parts per calculator 55 parts per calculator Requirement 2. Compare the activity-based costing results from Requirement 1 with the company's results using a single plantwide rate and using multiple department rates. What conclusions can you draw? Begin by completing the table below to show the total and per unit overhead allocated to each model under each of the three different allocation methods. (Round per unit amounts to the nearest cent.) Basic Model Total MOH Per Unit Professional Model Total MOH Per Unit Single plantwide allo Multiple department Activity-based alloca activity-based costing multiple department allocation costing What conclusions cai single plantwide allocation costing is the most accurate because it considers the resources used by each model. Management can now see that compared to the costs allocated using The allocation using than expected to produce. Choose from any list or enter any number in the input fields and then continue to the next