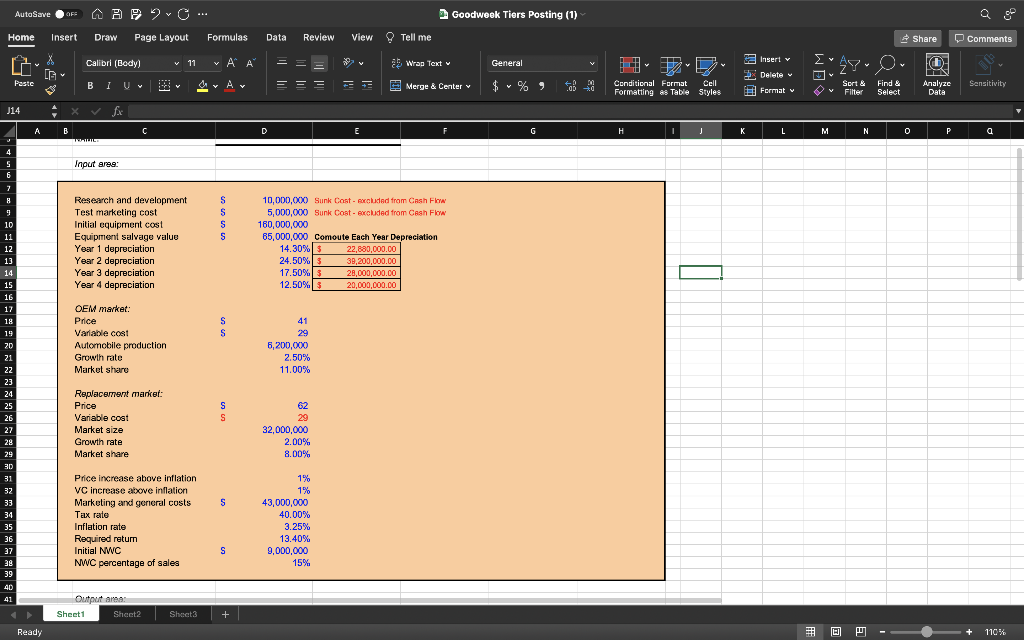

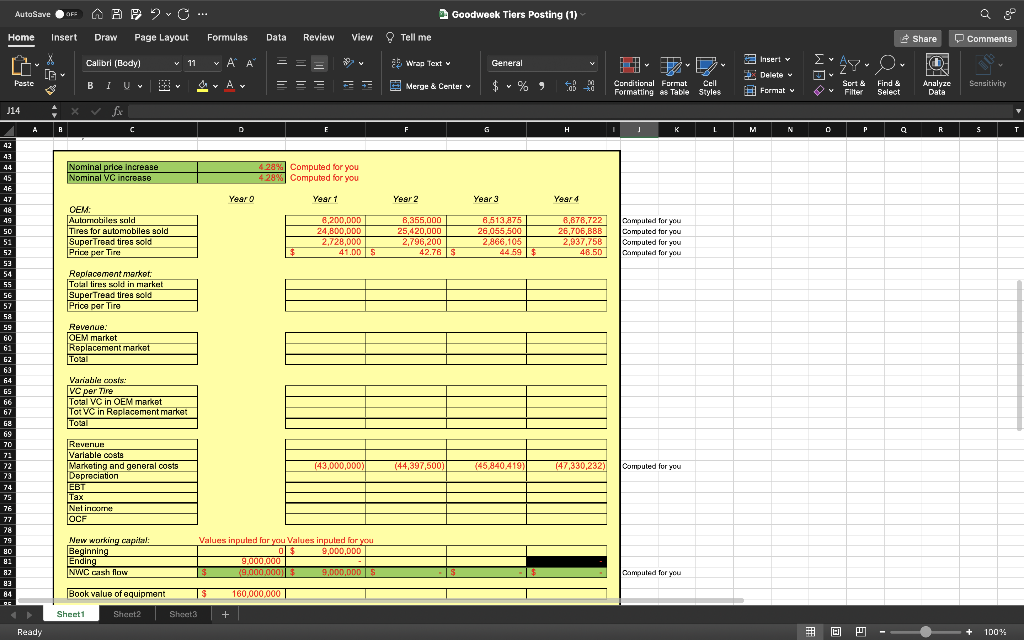

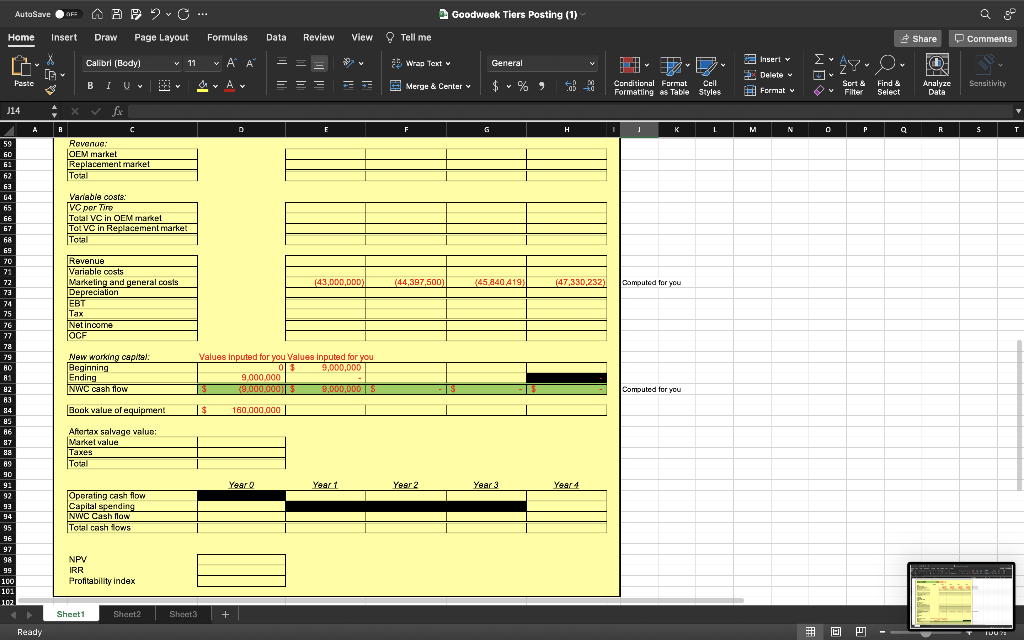

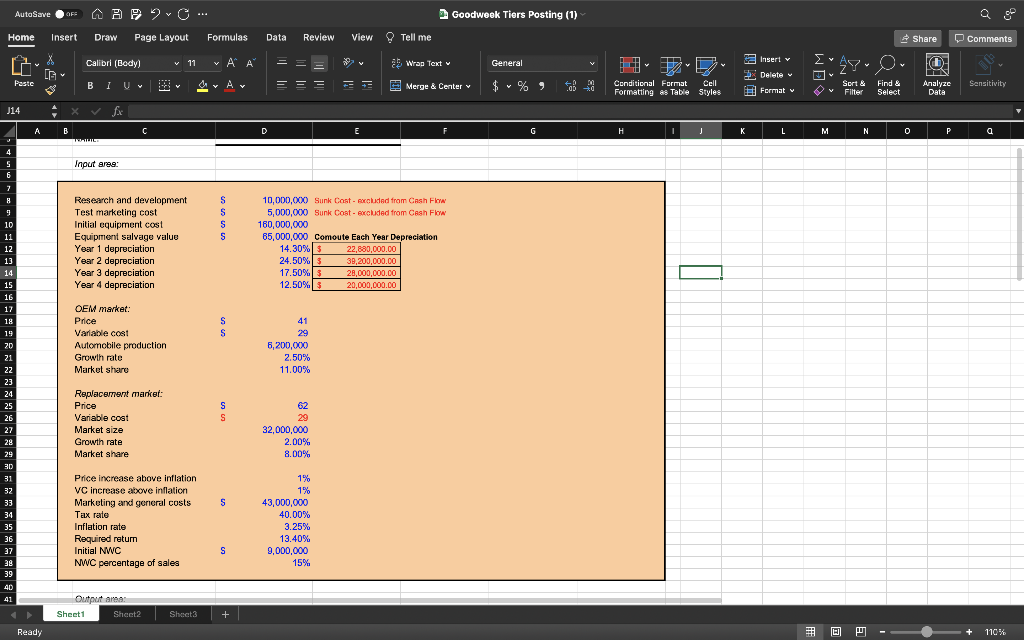

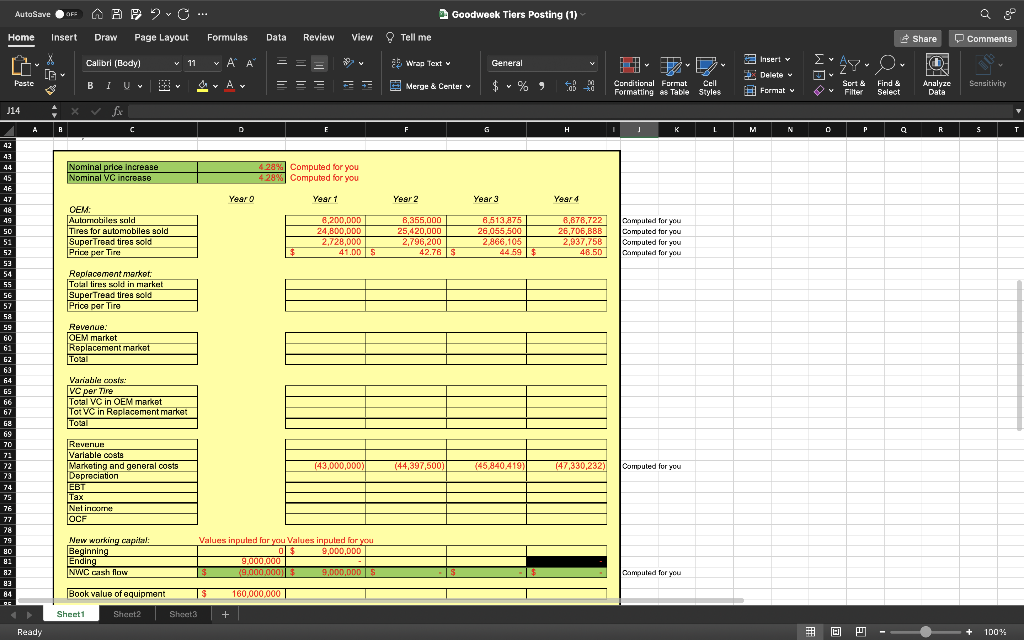

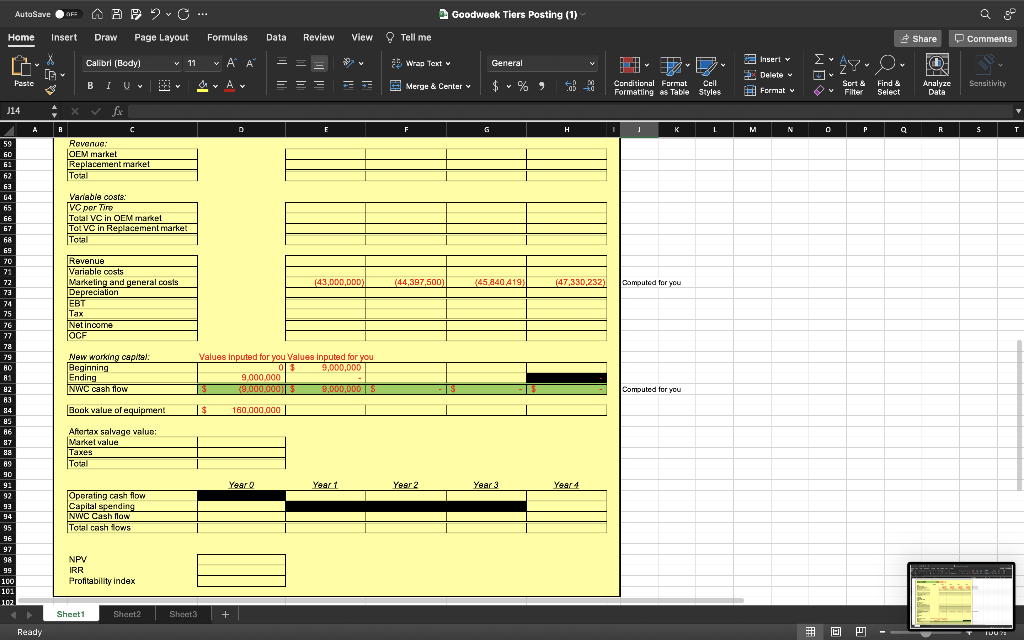

GOODWEEK TIRES, INC. After extensive research and development, Goodweek Tires, Inc., has recently developed a new tire, the Super Tread, and must decide whether to make the investment necessary to produce and market it. The tire would be ideal for drivers doing a large amount of wet weather and off-road driving in addition to normal freeway usage. The research and development costs so far have totaled about $10 million. The Super Tread would be put on the market beginning this year, and Goodweek expects it to stay on the market for a total of four years. Test marketing costing $5 million has shown that there is a significant market for a Super Tread-type tire. As a financial analyst at Goodweek Tires, you have been asked by your CFO, Adam Smith, to eval- uate the SuperTread project and provide a recommendation on whether to go ahead with the invest- ment. Except for the initial investment that will occur immediately, assume all cash flows will occur at year-end. Goodweek must initially invest $120 million in production equipment to make the Super Tread. This equipment can be sold for $51 million at the end of four years. Goodweek intends to sell the SuperTread to two distinct markets: 1. The Original Equipment Manufacturer (OEM)Market The OEM market consists primar- ily of the large automobile companies (e.g., General Motors) who buy tires for new cars. In the OEM market, the Super Tread is expected to sell for $36 per tire. The variable cost to produce each tire is $18. 2. The Replacement Market The replacement market consists of all tires purchased after the automobile has left the factory. This market allows higher margins and Goodweek expects to sell the SuperTread for $59 per tire there. Variable costs are the same as in the OEM market. 269 iloodweek fires intends to ruse prices at percent above Me inflation rate; variable costs will also Increase 1 percent above the inflation rate. In addition, the Super (read project will incur $25 million in marketing and general administration costs the first year. This cost is expected to increase at the inflation rate in the subsequent years. Goodweek's corporate tax rate is 40 percent. Annual inflation is expected to remain constant at 3.25 percent. The company uses a 15.9 percent discount rate to evaluate new product decisions. Automotive industry analysts expect automobile manufacturers to produce 2 million new cars this year and production to grow at 2.5 percent per year thereafter. Each new car needs four tires (the spare tires are undersized and are in a different category). Goodweek Tires expects the SuperTread to capture 11 percent of the OEM market. Industry analysts estimate that the replacement tire market size will be 14 million tires this year and that it will grow at 2 percent annually. Goodweek expects the Super Tread to capture an 8 percent market share. The appropriate depreciation schedule for the equipment is the seven-year MACRS depreciation schedule. The immediate initial working capital requirement is $11 million. Thereafter, the net working capital requirements will be 15 percent of sales. What are the NPV, payback period, discounted pay- back period, AAR. IRE, and Pl on this project? AutoSave OF A APO". Goodweek Tiers Posting (1) Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calibri (Body) v 11 v A A X G ab Wrap Text General Insert v ' , 0 v Delete v Paste ~ Ar Y = = = Merge & Center $ Conditional Format Cell Formatting es Table Styles Y Sort & Filter Sensitivity # Format Find & Select Analyze Data V J14 X fx A B C E G . I T J K L M N 0 P a Input ares: 4 S 6 7 8 S S S S 10 11 12 13 14 15 16 17 18 18 19 Research and development Test marketing cost Initial equipment cost Equipment salvage value Year 1 depreciation Year 2 depreciation Year 3 depreciation Year 4 depreciation 10,000,000 Sunk Costeoxoluded from Cash Flow 5,000,000 Sunk Cost-excluded from Cash Flow 180,000,000 85.000.000 Comoute Each Year Depreciation 14.30% 3 22,880,000.00 24.50% $ 39.200.000,00 17.50% 3 28,000,000.00 12.50% 20,000,000.00 S S OEM market: Price Variable cost Automobile production Growth rate Market share 41 29 6,200,000 2.50% 11.00% S S Replacement market: Price Variable cost Market size Growth rate Market share 32,000,000 2.00% 8.00% 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 S Price increase above inflation VC increase above inflation Marketing and general costs Tax rate Inflation rate Required return Initial NWC NWC percentage of sales 1% 1% 43,000,000 40.00% 3.25% 13.40% 9,000,000 15% S Output: Sheet1 Sheet2 Sheet3 + + Ready + 110% AutoSave OF A APO". Goodweek Tiers Posting (1) Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calibri (Body) v 11 v A A X G 5 Wrap Text General 2 Insert v 0 v Delete v Paste ~ Ar Y = = = - Merge & Center v Conditional Format Cell Formatting es Table Styles Sensitivity Sort & Filter Format v Find & Select Analyze Data V J14 fx . B C G H J K L M N o P Q R S Nominal price increase Nominal VC increase 4 28% Computed for you 428% Computed for you Year o Year 1 Year 2 Year 3 Year 1 OEM Automatiiles sold Tires for automobiles sold SuperTread tires sold Cunod Price per Tiret 8,200,000 24,800,00D 2,728,000 41.DDS 8,355,000 25,420,000 6,513 875 26.055,500 2,866,105 44.59 $ 2,796 200 8,878,722 26,706,8BB 2,937,758 48.50 Computed for you Domputed for you Computed for you Computed for you 42.78S Replacement market: Total tires sild in market Pepe SuperTread tires sold Price per Tire Revenue: OEM market Replacement market Total 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 GS 66 67 G2 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 DE Variable costs: VC per Tire Total VC in OEM market Tor VC in Replacement market Total (43,000,000) (44,397,500) (45,840,41991 (47,330,232) Computed for you Revenue Variable costs Marketing and general costs Depreciation | Net income OCF Now working capital Beginning Ending NWC cash flow Values inpuled for you Values inpuled for you 0 $ 9,000,0DD 9.000.000 $ (9.000.000) 9,000,000 S Computed for you Book value of oquipment IS 160,000,000 Sheet1 Sheet2 Sheet3 + Ready + 100% AutoSave OF AA2... Goodweek Tiers Posting (1) Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calibri (Body) v 11 X G v A A General 5 Wrap Text 0 0 2 Insert v Delete Format v v v Paste Y ~ Ar = = = Merge & Center v Y 4 Conditional Format Cell Formatting es Table Styles Sort & Filter Find & Select Analyze Data Sensitivity V J14 X fx A C E G H J K L M N 0 P Q Q R S Revenue OEM market Replacement market Total Variable costs: VC per Tire Total VC in OEM market Tot VC in Replacement market Total Revenue Variable costs (43,000,000) (44,397,500) (45.840419) (47,330,232) Comouted for you Marketing and general casis Depreciation EBT Tax Net Income OCF 59 60 61 62 63 G4 65 GE 67 68 69 20 71 72 73 74 75 76 77 78 29 AD 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 New working capital: Beginning Ending NWC cash flow Values Inputed for you Values inputed for you 03 9,000,000 9,000,000 3 (9.000.000 9,000,000S Computed for you Book value of equipment $ 160.000.000 Aftertax salvage value: Market value Taxes Total Year Yeart Year 2 Year 3 Year 4 Operating cash flow Capital spending NWC Cash flow Total cash lows NPV IRR Profitability Index Sheet1 Sheet2 Sheet: + Ready TUU? GOODWEEK TIRES, INC. After extensive research and development, Goodweek Tires, Inc., has recently developed a new tire, the Super Tread, and must decide whether to make the investment necessary to produce and market it. The tire would be ideal for drivers doing a large amount of wet weather and off-road driving in addition to normal freeway usage. The research and development costs so far have totaled about $10 million. The Super Tread would be put on the market beginning this year, and Goodweek expects it to stay on the market for a total of four years. Test marketing costing $5 million has shown that there is a significant market for a Super Tread-type tire. As a financial analyst at Goodweek Tires, you have been asked by your CFO, Adam Smith, to eval- uate the SuperTread project and provide a recommendation on whether to go ahead with the invest- ment. Except for the initial investment that will occur immediately, assume all cash flows will occur at year-end. Goodweek must initially invest $120 million in production equipment to make the Super Tread. This equipment can be sold for $51 million at the end of four years. Goodweek intends to sell the SuperTread to two distinct markets: 1. The Original Equipment Manufacturer (OEM)Market The OEM market consists primar- ily of the large automobile companies (e.g., General Motors) who buy tires for new cars. In the OEM market, the Super Tread is expected to sell for $36 per tire. The variable cost to produce each tire is $18. 2. The Replacement Market The replacement market consists of all tires purchased after the automobile has left the factory. This market allows higher margins and Goodweek expects to sell the SuperTread for $59 per tire there. Variable costs are the same as in the OEM market. 269 iloodweek fires intends to ruse prices at percent above Me inflation rate; variable costs will also Increase 1 percent above the inflation rate. In addition, the Super (read project will incur $25 million in marketing and general administration costs the first year. This cost is expected to increase at the inflation rate in the subsequent years. Goodweek's corporate tax rate is 40 percent. Annual inflation is expected to remain constant at 3.25 percent. The company uses a 15.9 percent discount rate to evaluate new product decisions. Automotive industry analysts expect automobile manufacturers to produce 2 million new cars this year and production to grow at 2.5 percent per year thereafter. Each new car needs four tires (the spare tires are undersized and are in a different category). Goodweek Tires expects the SuperTread to capture 11 percent of the OEM market. Industry analysts estimate that the replacement tire market size will be 14 million tires this year and that it will grow at 2 percent annually. Goodweek expects the Super Tread to capture an 8 percent market share. The appropriate depreciation schedule for the equipment is the seven-year MACRS depreciation schedule. The immediate initial working capital requirement is $11 million. Thereafter, the net working capital requirements will be 15 percent of sales. What are the NPV, payback period, discounted pay- back period, AAR. IRE, and Pl on this project? AutoSave OF A APO". Goodweek Tiers Posting (1) Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calibri (Body) v 11 v A A X G ab Wrap Text General Insert v ' , 0 v Delete v Paste ~ Ar Y = = = Merge & Center $ Conditional Format Cell Formatting es Table Styles Y Sort & Filter Sensitivity # Format Find & Select Analyze Data V J14 X fx A B C E G . I T J K L M N 0 P a Input ares: 4 S 6 7 8 S S S S 10 11 12 13 14 15 16 17 18 18 19 Research and development Test marketing cost Initial equipment cost Equipment salvage value Year 1 depreciation Year 2 depreciation Year 3 depreciation Year 4 depreciation 10,000,000 Sunk Costeoxoluded from Cash Flow 5,000,000 Sunk Cost-excluded from Cash Flow 180,000,000 85.000.000 Comoute Each Year Depreciation 14.30% 3 22,880,000.00 24.50% $ 39.200.000,00 17.50% 3 28,000,000.00 12.50% 20,000,000.00 S S OEM market: Price Variable cost Automobile production Growth rate Market share 41 29 6,200,000 2.50% 11.00% S S Replacement market: Price Variable cost Market size Growth rate Market share 32,000,000 2.00% 8.00% 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 S Price increase above inflation VC increase above inflation Marketing and general costs Tax rate Inflation rate Required return Initial NWC NWC percentage of sales 1% 1% 43,000,000 40.00% 3.25% 13.40% 9,000,000 15% S Output: Sheet1 Sheet2 Sheet3 + + Ready + 110% AutoSave OF A APO". Goodweek Tiers Posting (1) Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calibri (Body) v 11 v A A X G 5 Wrap Text General 2 Insert v 0 v Delete v Paste ~ Ar Y = = = - Merge & Center v Conditional Format Cell Formatting es Table Styles Sensitivity Sort & Filter Format v Find & Select Analyze Data V J14 fx . B C G H J K L M N o P Q R S Nominal price increase Nominal VC increase 4 28% Computed for you 428% Computed for you Year o Year 1 Year 2 Year 3 Year 1 OEM Automatiiles sold Tires for automobiles sold SuperTread tires sold Cunod Price per Tiret 8,200,000 24,800,00D 2,728,000 41.DDS 8,355,000 25,420,000 6,513 875 26.055,500 2,866,105 44.59 $ 2,796 200 8,878,722 26,706,8BB 2,937,758 48.50 Computed for you Domputed for you Computed for you Computed for you 42.78S Replacement market: Total tires sild in market Pepe SuperTread tires sold Price per Tire Revenue: OEM market Replacement market Total 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 GS 66 67 G2 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 DE Variable costs: VC per Tire Total VC in OEM market Tor VC in Replacement market Total (43,000,000) (44,397,500) (45,840,41991 (47,330,232) Computed for you Revenue Variable costs Marketing and general costs Depreciation | Net income OCF Now working capital Beginning Ending NWC cash flow Values inpuled for you Values inpuled for you 0 $ 9,000,0DD 9.000.000 $ (9.000.000) 9,000,000 S Computed for you Book value of oquipment IS 160,000,000 Sheet1 Sheet2 Sheet3 + Ready + 100% AutoSave OF AA2... Goodweek Tiers Posting (1) Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calibri (Body) v 11 X G v A A General 5 Wrap Text 0 0 2 Insert v Delete Format v v v Paste Y ~ Ar = = = Merge & Center v Y 4 Conditional Format Cell Formatting es Table Styles Sort & Filter Find & Select Analyze Data Sensitivity V J14 X fx A C E G H J K L M N 0 P Q Q R S Revenue OEM market Replacement market Total Variable costs: VC per Tire Total VC in OEM market Tot VC in Replacement market Total Revenue Variable costs (43,000,000) (44,397,500) (45.840419) (47,330,232) Comouted for you Marketing and general casis Depreciation EBT Tax Net Income OCF 59 60 61 62 63 G4 65 GE 67 68 69 20 71 72 73 74 75 76 77 78 29 AD 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 New working capital: Beginning Ending NWC cash flow Values Inputed for you Values inputed for you 03 9,000,000 9,000,000 3 (9.000.000 9,000,000S Computed for you Book value of equipment $ 160.000.000 Aftertax salvage value: Market value Taxes Total Year Yeart Year 2 Year 3 Year 4 Operating cash flow Capital spending NWC Cash flow Total cash lows NPV IRR Profitability Index Sheet1 Sheet2 Sheet: + Ready TUU