Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Goodwill constructions LLC is considering allocating a limited amount of capital investment funds among three proposals. The amount of proposed investment, and net cash flow

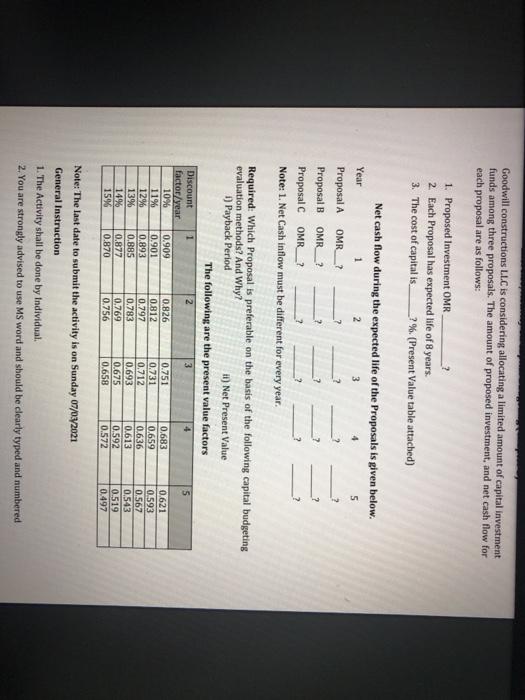

Goodwill constructions LLC is considering allocating a limited amount of capital investment funds among three proposals. The amount of proposed investment, and net cash flow for each proposal are as follows:

1. Proposed Investment OMR ______________?

2. Each Proposal has expected life of 8 years.

3. The cost of capital is_________? %. (Present Value table attached)

Net cash flow during the expected life of the Proposals is given below:

Proposal A for year 1,2,3,4 and 5

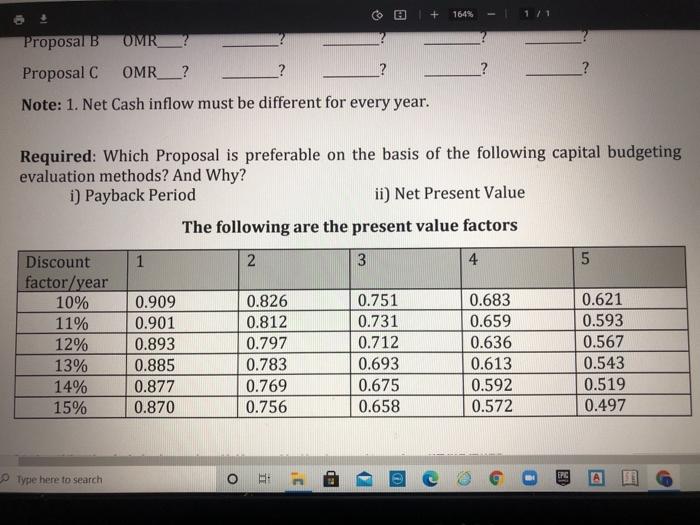

Proposal B for year 1,2,3,4 and 5

Proposal C for year 1,2,3,4 and 5

( Choose Random amount (OMR) for each year in each proposal )

Note: 1. Net Cash inflow must be different for every year.

Required: Which Proposal is preferable on the basis of the following capital budgeting evaluation methods? And Why?

i) Payback Period ii) Net Present Value

The following are the present value factors

( this will be Schedule here , i will take a photo for this Schedule)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started