Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Goodwill constructions LLC is considering allocating a limited amount of capital investment funds among three proposals. The amount of proposed investment, and net cash

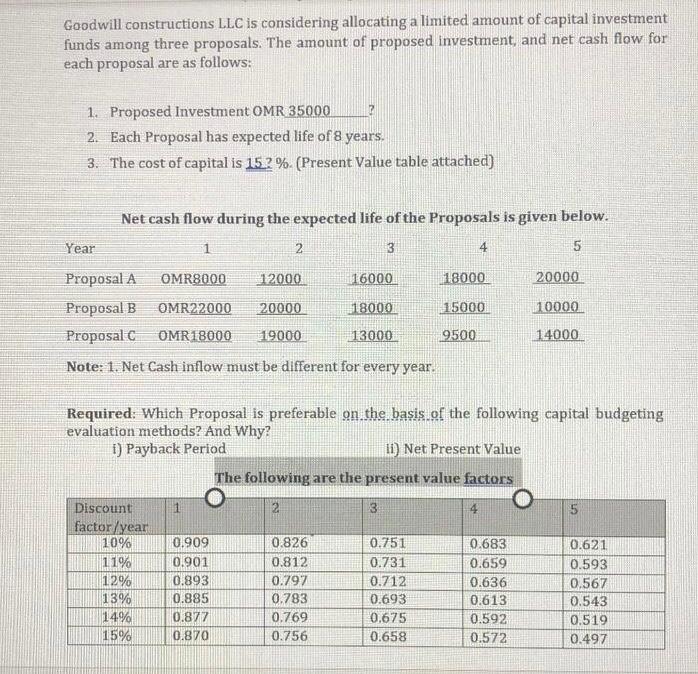

Goodwill constructions LLC is considering allocating a limited amount of capital investment funds among three proposals. The amount of proposed investment, and net cash flow for each proposal are as follows: 1. Proposed Investment OMR 35000 2. Each Proposal has expected life of 8 years. 3. The cost of capital is 152 %. (Present Value table attached) Net cash flow during the expected life of the Proposals is given below. Year 2 3 4 Proposal A OMR8000 12000 16000 18000 20000 Proposal B OMR22000 20000 18000 15000 10000 Proposal C OMR18000 19000 13000 9500 |14000 Note: 1. Net Cash inflow must be different for every year. Required: Which Proposal is preferable on the basis of the following capital budgeting evaluation methods? And Why? i) Payback Period li) Net Present Value The following are the present value factors 2 Discount factor/year 10% 1 4 0.909 0.826 0.751 0.683 0.621 11% 12% 13% 14% 15% 0.901 0.812 0.731 0.659 0.593 0.893 0.797 0.712 0.636 0,567 0.885 0.783 0.693 0.613 0.543 0.877 0.769 0.675 0.592 0.519 0.870 0.756 0.658 0.572 0.497

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculation of NPV of proposals are as follows Tabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started