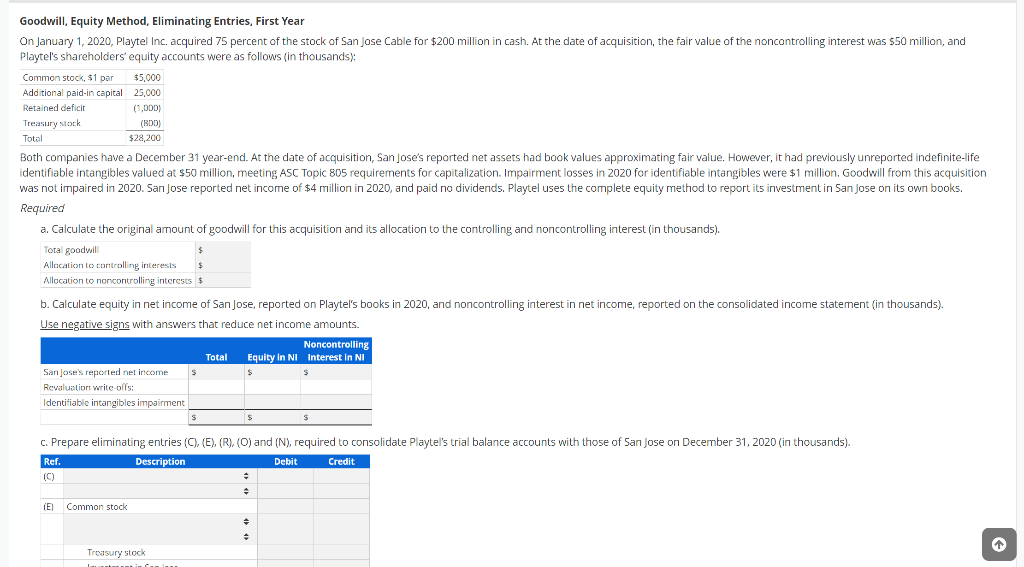

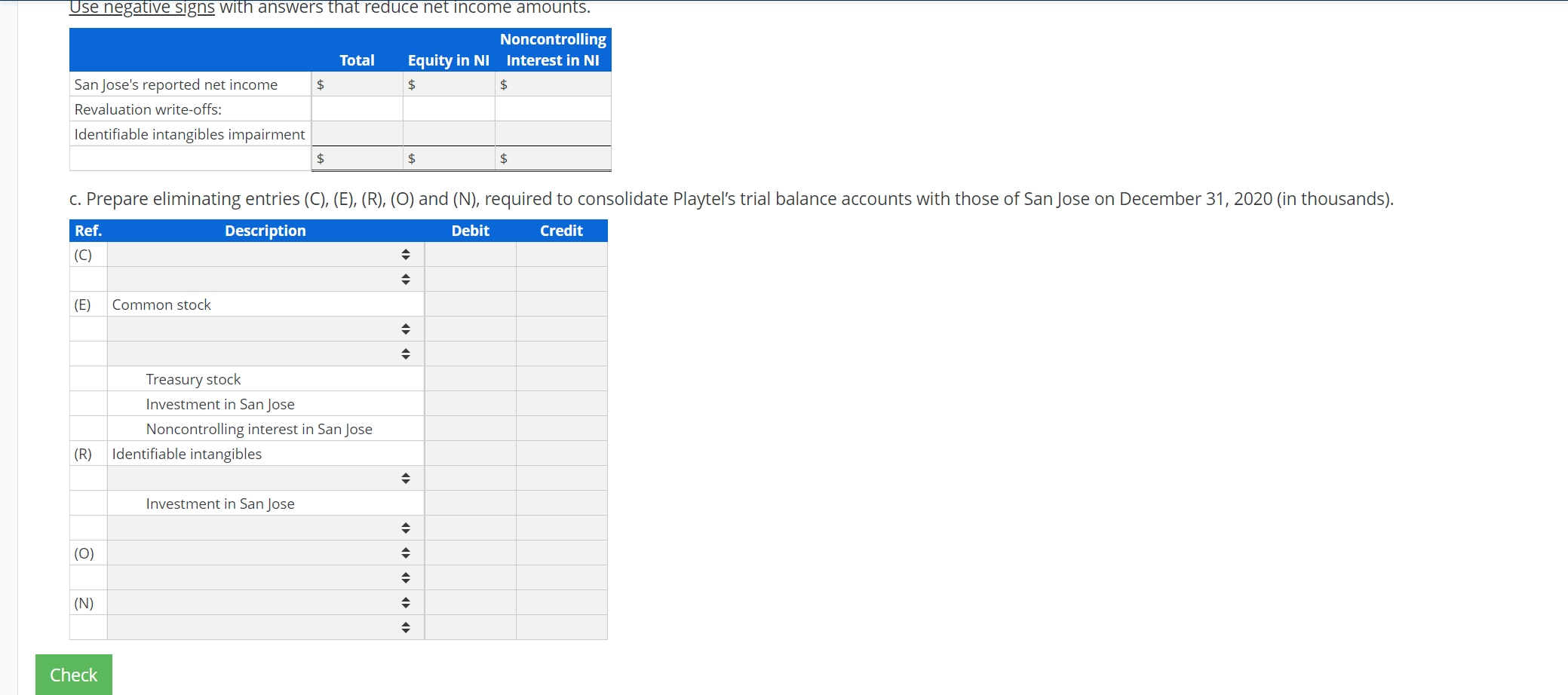

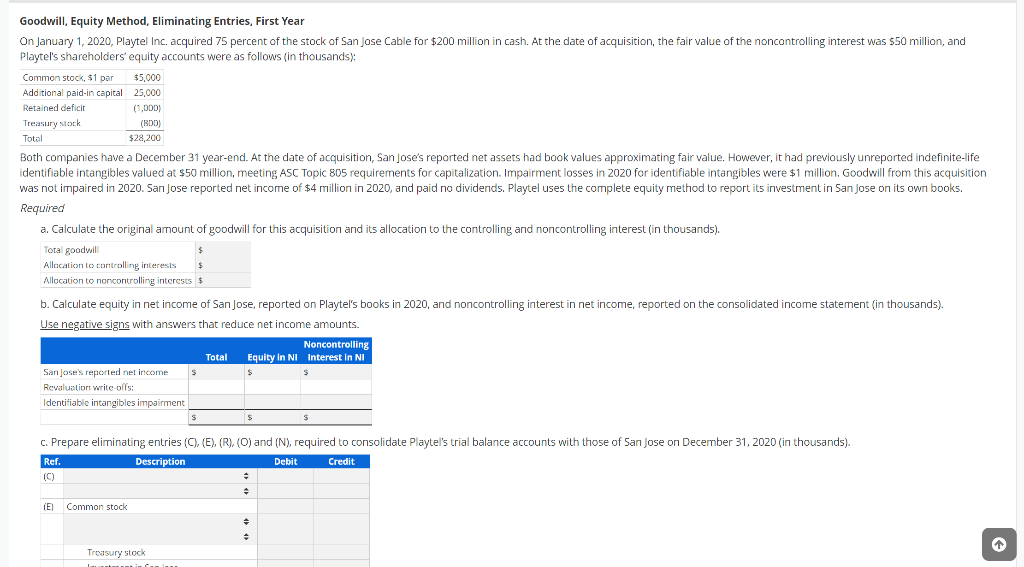

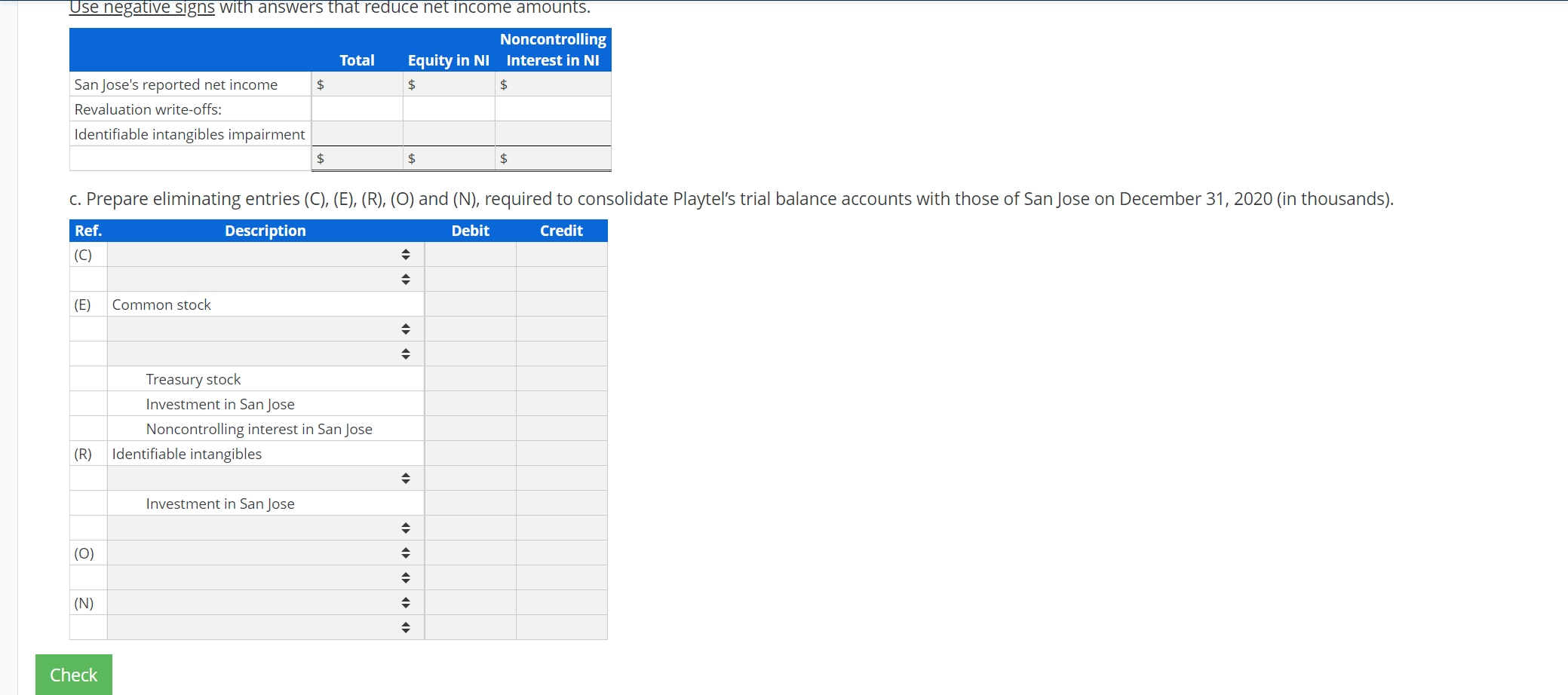

Goodwill, Equity Method, Eliminating Entries, First Year On January 1, 2020, Playtel Inc. acquired 75 percent of the stock of San Jose Cable for $200 million in cash. At the date of acquisition, the fair value of the noncontrolling interest was 550 million, and Playtel's shareholders' equity accounts were as follows (in thousands): Common stock, $1 par $5,000 Additional paid-in capital 25,000 Retained deficit (1,000) Treasury stock (RDD) Total $28,200 Both companies have a December 31 year-end. At the date of acquisition, San Jose's reported net assets had book values approximating fair value. However, it had previously unreported indefinite-life identifiable intangibles valued at $50 million, meeting ASC Topic 805 requirements for capitalization. Impairment losses in 2020 for identifiable intangibles were $1 million. Goodwill from this acquisition was not impaired in 2020. San Jose reported net income of $4 million in 2020, and paid no dividends. Playtel uses the complete equity method to report its investment in San Jose on its own books. Required a. Calculate the original amount of goodwill for this acquisition and its allocation to the controlling and noncontrolling interest (in thousands). Total goodwill $ Allocation to controlling interests Allocation to noncontrolling interests $ b. Calculate equity in net income of San Jose, reported on Playtel's books in 2020, and noncontrolling interest in net income, reported on the consolidated income statement in thousands). Use negative signs with answers that reduce net income amounts. Noncontrolling Total Equity in NI Interest in NI San Jose's reported net income Revaluation write ols: Identifiable intangibles impairment $ C. Prepare eliminating entries (C). (E). (R), (O) and (N), required to consolidate Playtel's trial balance accounts with those of San Jose on December 31, 2020 (in thousands). . Description Debit (C) $ s $ Ref. Credit . Common stock . Treasury stock Use negative signs with answers that reduce net income amounts. Noncontrolling Total Equity in NI Interest in NI San Jose's reported net income $ $ Revaluation write-offs: Identifiable intangibles impairment $ $ $ C. Prepare eliminating entries (C), (E), (R), (O) and (N), required to consolidate Playtel's trial balance accounts with those of San Jose on December 31, 2020 (in thousands). Ref. Description Debit Credit (C) (E) Common stock - Treasury stock Investment in San Jose Noncontrolling interest in San Jose Identifiable intangibles (R) A Investment in San Jose (0) (N) - Check