Answered step by step

Verified Expert Solution

Question

1 Approved Answer

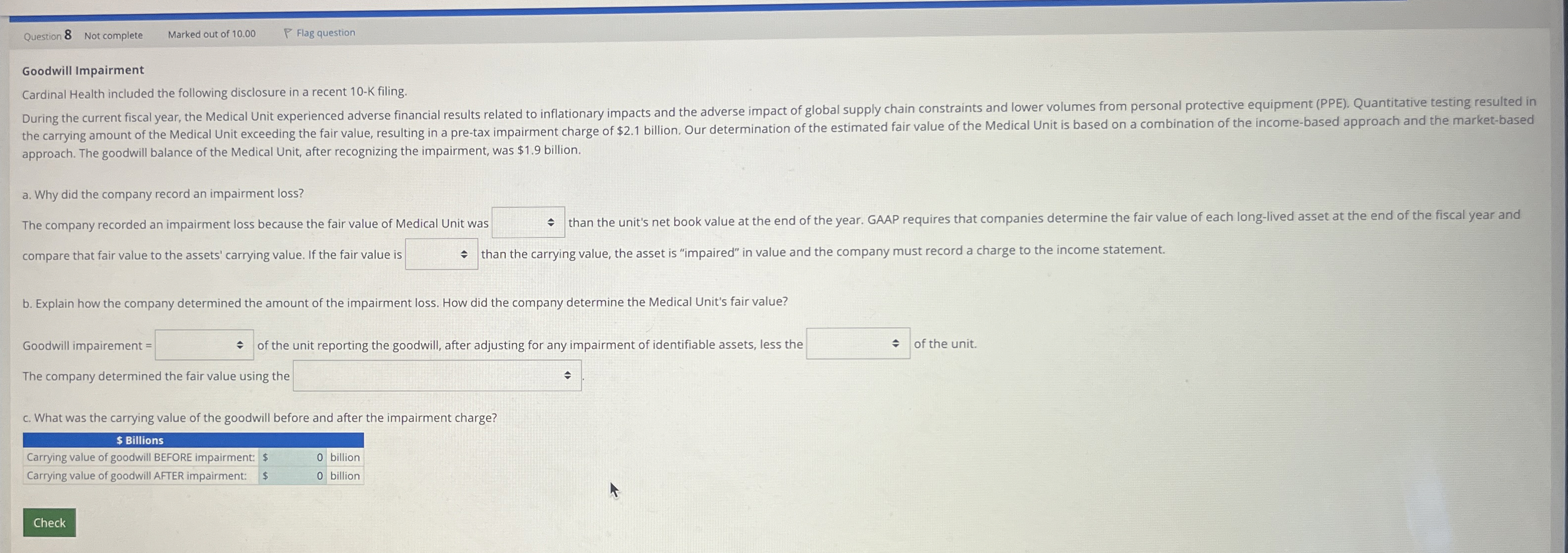

Goodwill Impairment Cardinal Health included the following disclosure in a recent 1 0 - K filing. approach. The goodwill balance of the Medical Unit, after

Goodwill Impairment

Cardinal Health included the following disclosure in a recent filing.

approach. The goodwill balance of the Medical Unit, after recognizing the impairment, was $ billion.

a Why did the company record an impairment loss?

The company recorded an impairment loss because the fair value of Medical Unit wa:

than the unit's net book value at the end of the year. GAAP requires that companies determine the fair value of each longlived asset at the end of the fiscal year and

compare that fair value to the assets' carrying value. If the fair value is

than the carrying value, the asset is "impaired" in value and the company must record a charge to the income statement.

b Explain how the company determined the amount of the impairment loss. How did the company determine the Medical Unit's fair value?

Goodwill impairement

of the unit reporting the goodwill, after adjusting for any impairment of identifiable assets, less the

of the unit.

The company determined the fair value using the

c What was the carrying value of the goodwill before and after the impairment charge?Goodwill Impairment

Cardinal Health included the following disclosure in a recent filing.

approach. The goodwill balance of the Medical Unit, after recognizing the impairment, was $ billion.

a Why did the company record an impairment loss?

The company recorded an impairment loss because the fair value of Medical Unit wa:

than the unit's net book value at the end of the year. GAAP requires that companies determine the fair value of each longlived asset at the end of the fiscal year and

compare that fair value to the assets' carrying value. If the fair value is

than the carrying value, the asset is "impaired" in value and the company must record a charge to the income statement.

b Explain how the company determined the amount of the impairment loss. How did the company determine the Medical Unit's fair value?

Goodwill impairement

of the unit reporting the goodwill, after adjusting for any impairment of identifiable assets, less the

of the unit.

The company determined the fair value using the

c What was the carrying value of the goodwill before and after the impairment charge?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started