Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Goodwill Method Wednesday, July 3, Year 5, 9:32 a.m. Reynolds, Kevin Assets To: Lewis, Rachel; Sandford, George Rachel/George, As we have discussed, please use this

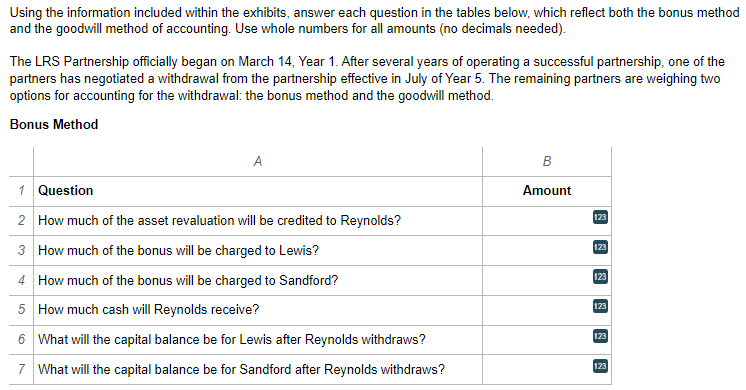

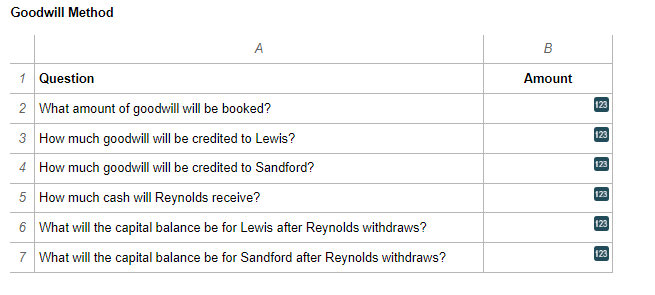

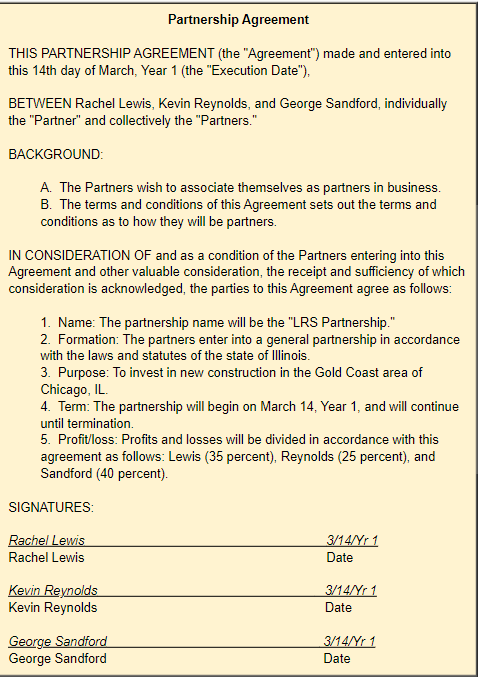

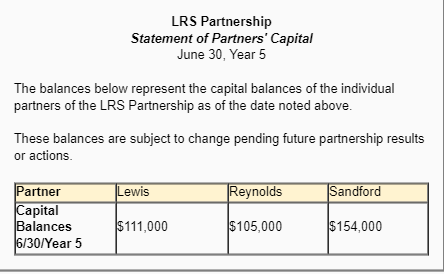

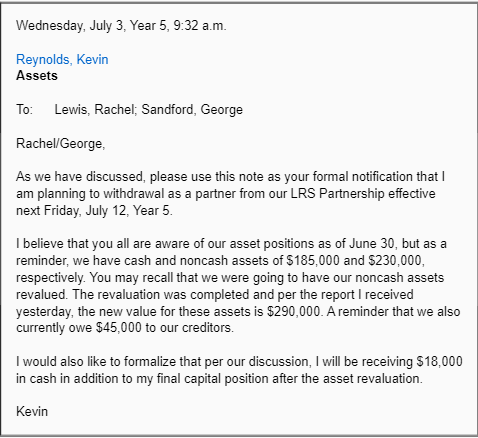

Goodwill Method Wednesday, July 3, Year 5, 9:32 a.m. Reynolds, Kevin Assets To: Lewis, Rachel; Sandford, George Rachel/George, As we have discussed, please use this note as your formal notification that I am planning to withdrawal as a partner from our LRS Partnership effective next Friday, July 12, Year 5. I believe that you all are aware of our asset positions as of June 30 , but as a reminder, we have cash and noncash assets of \\( \\$ 185,000 \\) and \\( \\$ 230,000 \\), respectively. You may recall that we were going to have our noncash assets revalued. The revaluation was completed and per the report I received yesterday, the new value for these assets is \\( \\$ 290,000 \\). A reminder that we also currently owe \\( \\$ 45,000 \\) to our creditors. I would also like to formalize that per our discussion, I will be receiving \\( \\$ 18,000 \\) in cash in addition to my final capital position after the asset revaluation. Kevin THIS PARTNERSHIP AGREEMENT (the \"Agreement\") made and entered into this 14th day of March, Year 1 (the \"Execution Date\"), BETWEEN Rachel Lewis, Kevin Reynolds, and George Sandford, individually the \"Partner\" and collectively the \"Partners.\" BACKGROUND: A. The Partners wish to associate themselves as partners in business. \\( B \\). The terms and conditions of this Agreement sets out the terms and conditions as to how they will be partners. IN CONSIDERATION OF and as a condition of the Partners entering into this Agreement and other valuable consideration, the receipt and sufficiency of which consideration is acknowledged, the parties to this Agreement agree as follows: 1. Name: The partnership name will be the \"LRS Partnership.\" 2. Formation: The partners enter into a general partnership in accordance with the laws and statutes of the state of Illinois. 3. Purpose: To invest in new construction in the Gold Coast area of Chicago, IL. 4. Term: The partnership will begin on March 14, Year 1, and will continue until termination. 5. Profit/loss: Profits and losses will be divided in accordance with this agreement as follows: Lewis ( 35 percent), Reynolds ( 25 percent), and Sandford (40 percent). SIGNATURES: LRS Partnership Statement of Partners' Capital June 30 , Year 5 The balances below represent the capital balances of the individual partners of the LRS Partnership as of the date noted above. These balances are subject to change pending future partnership results or actions. Using the information included within the exhibits, answer each question in the tables below, which reflect both the bonus method and the goodwill method of accounting. Use whole numbers for all amounts (no decimals needed). The LRS Partnership officially began on March 14, Year 1. After several years of operating a successful partnership, one of the partners has negotiated a withdrawal from the partnership effective in July of Year 5. The remaining partners are weighing two options for accounting for the withdrawal: the bonus method and the goodwill method. Bonus Method

Goodwill Method Wednesday, July 3, Year 5, 9:32 a.m. Reynolds, Kevin Assets To: Lewis, Rachel; Sandford, George Rachel/George, As we have discussed, please use this note as your formal notification that I am planning to withdrawal as a partner from our LRS Partnership effective next Friday, July 12, Year 5. I believe that you all are aware of our asset positions as of June 30 , but as a reminder, we have cash and noncash assets of \\( \\$ 185,000 \\) and \\( \\$ 230,000 \\), respectively. You may recall that we were going to have our noncash assets revalued. The revaluation was completed and per the report I received yesterday, the new value for these assets is \\( \\$ 290,000 \\). A reminder that we also currently owe \\( \\$ 45,000 \\) to our creditors. I would also like to formalize that per our discussion, I will be receiving \\( \\$ 18,000 \\) in cash in addition to my final capital position after the asset revaluation. Kevin THIS PARTNERSHIP AGREEMENT (the \"Agreement\") made and entered into this 14th day of March, Year 1 (the \"Execution Date\"), BETWEEN Rachel Lewis, Kevin Reynolds, and George Sandford, individually the \"Partner\" and collectively the \"Partners.\" BACKGROUND: A. The Partners wish to associate themselves as partners in business. \\( B \\). The terms and conditions of this Agreement sets out the terms and conditions as to how they will be partners. IN CONSIDERATION OF and as a condition of the Partners entering into this Agreement and other valuable consideration, the receipt and sufficiency of which consideration is acknowledged, the parties to this Agreement agree as follows: 1. Name: The partnership name will be the \"LRS Partnership.\" 2. Formation: The partners enter into a general partnership in accordance with the laws and statutes of the state of Illinois. 3. Purpose: To invest in new construction in the Gold Coast area of Chicago, IL. 4. Term: The partnership will begin on March 14, Year 1, and will continue until termination. 5. Profit/loss: Profits and losses will be divided in accordance with this agreement as follows: Lewis ( 35 percent), Reynolds ( 25 percent), and Sandford (40 percent). SIGNATURES: LRS Partnership Statement of Partners' Capital June 30 , Year 5 The balances below represent the capital balances of the individual partners of the LRS Partnership as of the date noted above. These balances are subject to change pending future partnership results or actions. Using the information included within the exhibits, answer each question in the tables below, which reflect both the bonus method and the goodwill method of accounting. Use whole numbers for all amounts (no decimals needed). The LRS Partnership officially began on March 14, Year 1. After several years of operating a successful partnership, one of the partners has negotiated a withdrawal from the partnership effective in July of Year 5. The remaining partners are weighing two options for accounting for the withdrawal: the bonus method and the goodwill method. Bonus Method Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started