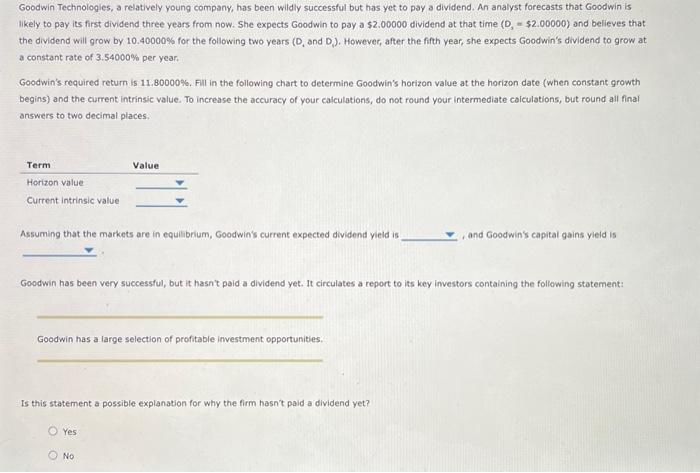

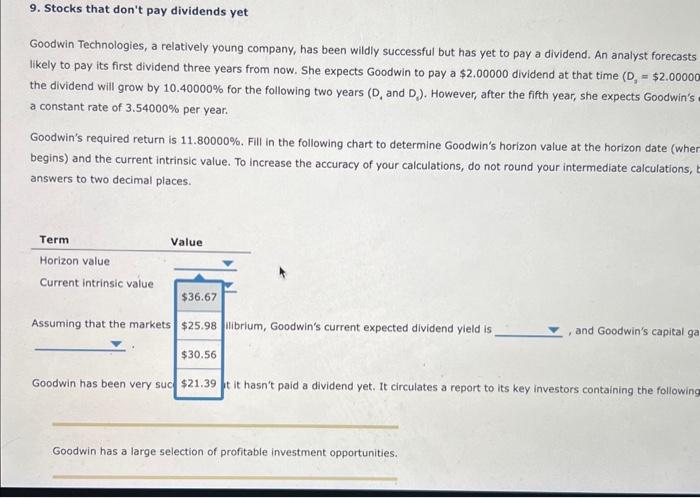

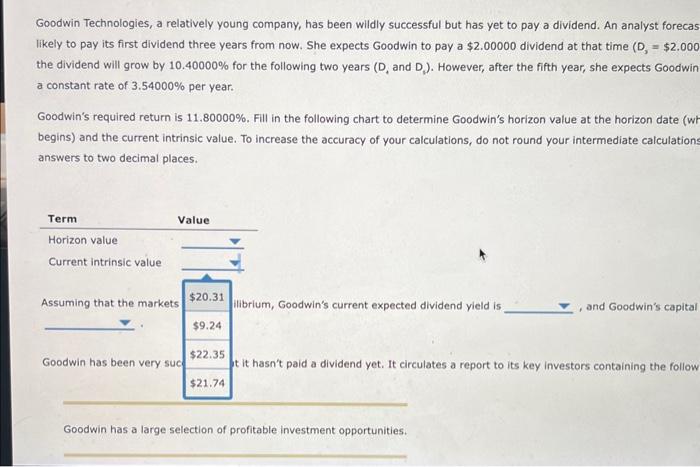

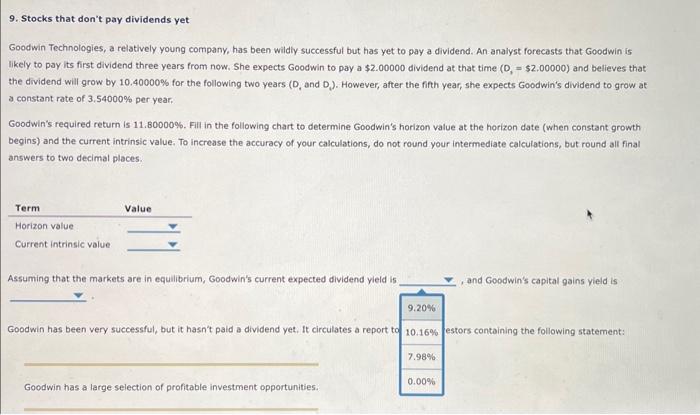

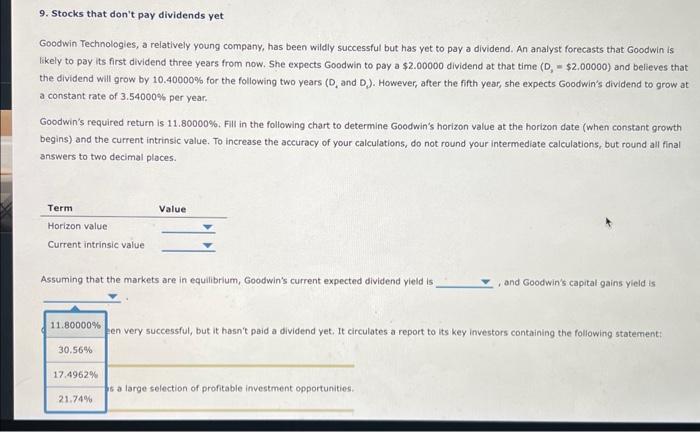

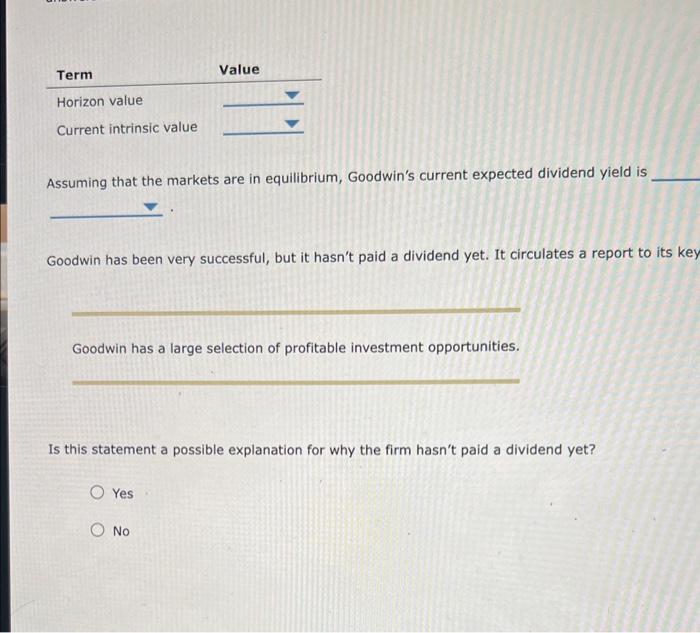

Goodwin Technologies, a relatively young company, has been wildly successful but has yet to pay a dividend. An analyst forecas likely to pay its first dividend three years from now. She expects Goodwin to pay a $2.00000 dividend at that time (D3=$2.000 the dividend will grow by 10.40000% for the following two years (D,andD1). However, after the fifth year, she expects Goodwin a constant rate of 3.54000% per year. Goodwin's required return is 11.80000%. Fill in the following chart to determine Goodwin's horizon value at the horizon date (wh begins) and the current intrinsic value. To increase the accuracy of your calculations, do not round your intermediate calculations answers to two decimal places. Goodwin has a large selection of profitable investment opportunities. 9. Stocks that don't pay dividends yet Goodwin Technologies, a relatively young company, has been wildly successful but has yet to pay a dividend. An analyst forecasts likely to pay its first dividend three years from now. She expects Goodwin to pay a $2.00000 dividend at that time (D,=$2.00000 the dividend will grow by 10.40000% for the following two years ( D,andDj). However, after the fifth year, she expects Goodwin's a constant rate of 3.54000% per year. Goodwin's required return is 11.80000%. Fill in the following chart to determine Goodwin's horizon value at the horizon date (wher begins) and the current intrinsic value. To increase the accuracy of your calculations, do not round your intermediate calculations, answers to two decimal places. oodwin's current expected dividend yield is , and Goodwin's capital ga paid a dividend yet. It circulates a report to its key investors containing the following Goodwin has a large selection of profitable investment opportunities. 9. Stocks that don't pay dividends yet Goodwin Technologies, a relatively young company, has been wildly successful but has yet to pay a dividend. An analyst forecasts that Goodwin is likely to pay its first dividend three years from now. She expects Goodwin to pay a $2.00000 dividend at that time (D,=$2,00000) and believes that the dividend will grow by 10.40000% for the following two years (D,andD1). However, after the fifth year, she expects Goodwin's dividend to grow at a constant rate of 3.54000% per year. Goodwin's required return is 11.80000%, Fill in the following chart to determine Goodwin's horizon value at the horizon date (when constant growth begins) and the current intrinsic value. To increase the accuracy of your calculations, do not round your intermediate calculations, but round all final answers to two decimal places. Assuming that the markets are in equilibrium, Goodwin's current expected dividend yield is , and Goodwin's capital gains yield is 9. Stocks that don't pay dividends yet Goodwin Technologies, a relatively young company, has been wildiy successful but has yet to pay a dividend. An analyst forecasts that Goodwin is likely to pay its first dividend three years from now, She expects Goodwin to pay a $2.00000 dividend at that time (D,=$2.00000) and believes that the dividend will grow by 10.40000% for the following two years (D, and Df ). However, after the fifth year, she expects Goodwin's dividend to grow at a constant rate of 3.54000% per year. Goodwin's required return is 11.80000%. Fill in the following chart to determine Goodwin's horizon value at the horizon date (when constant growth begins) and the current intrinsic value. To increase the accuracy of your calculations, do not round your intermediate calculations, but round all final answers to two decimal places. Assuming that the markets are in equilibrium, Goodwin's current expected dividend yield is , and Goodwin's capital gains yield is Goodwin has been very successful, but it hasn't paid a dividend yet. It circulates a report to Goodwin has a large selection of profitable investment opportunities. Goodwin Technologies, a relatively young company, has been wildly successful but has yet to pay a dividend. An analyst forecasts that Goodwin is likely to pay its first dividend three years from now. She expects Goodwin to pay a $2.00000 dividend at that time (D3=$2.00000) and believes that the dividend will grow by 10.40000% for the following two years ( D1 and Df). However, after the fifth vear, she expects Goodwin's dividend to grow at a constant rate of 3.54000% per year. Goodwin's required return is 11.80000%. Fill in the following chart to determine Goodwin's horizon value at the horizon date (when constant growth begins) and the current intrinsic value. To increase the accuracy of your caiculations, do not found your intermediate calculations, but round all final answers to two decimal places. Assuming that the markets are in equilibrium, Goodwin's current expected dividend yieid is , and Goodwin's capital gains yield is Goodwin has been very successful, but it hasn't paid a dividend yet. It circulates a report to its key investors containing the following statement: Goodwin has a large selection of profitable investment opportunities. Is this statement a possible explanation for why the firm hasn't paid a dividend yet? Yes No Assuming that the markets are in equilibrium, Goodwin's current expected dividend yield is Goodwin has been very successful, but it hasn't paid a dividend yet. It circulates a report to its ke Goodwin has a large selection of profitable investment opportunities. Is this statement a possible explanation for why the firm hasn't paid a dividend yet? Yes No