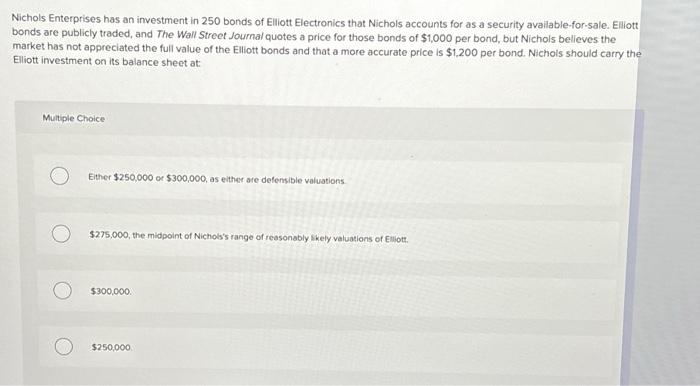

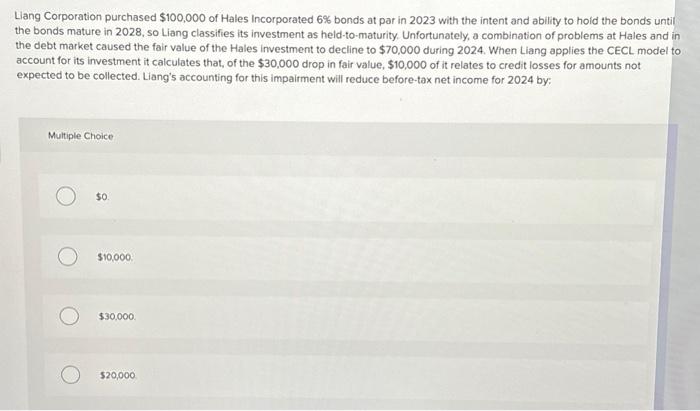

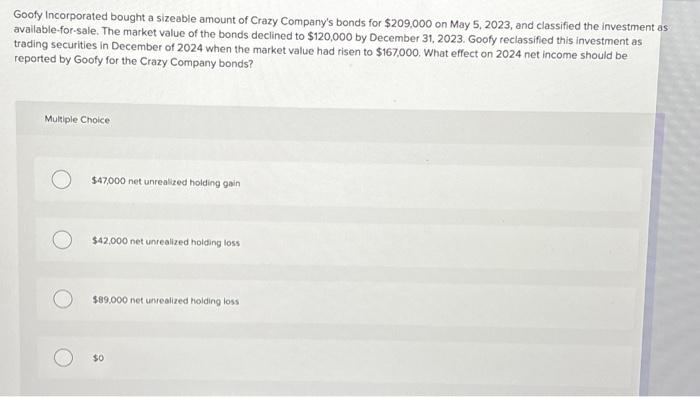

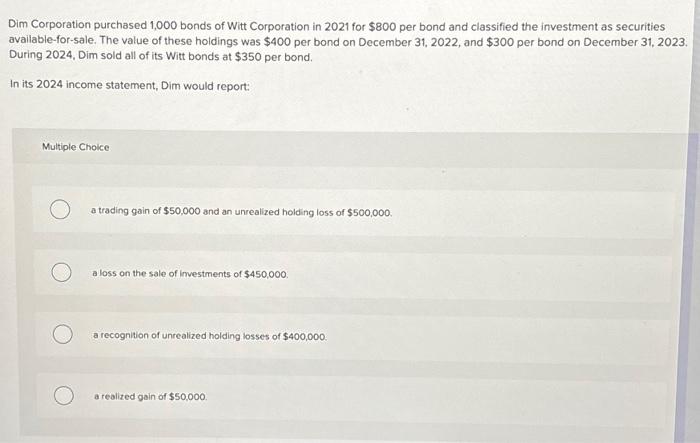

Goofy Incorporated bought a sizeable amount of Crazy Company's bonds for $209,000 on May 5, 2023, and classified the investment avaliable-for-sale. The market value of the bonds declined to $120,000 by December 31, 2023. Goofy reclassified this investment as trading securities in December of 2024 when the market value had risen to $167,000. What effect on 2024 net income should be reported by Goofy for the Crazy Company bonds? Muliple Choice $47,000 net unrealized holding gain $42,000 net unrealized holding loss $89.000 net unrealized hoiding loss $0 Llang Corporation purchased $100,000 of Hales Incorporated 6% bonds at par in 2023 with the intent and ability to hoid the bonds until the bonds mature in 2028, so Liang classifies its investment as held-to-maturity. Unfortunately, a combination of problems at Hales and the debt market caused the fair value of the Hales investment to decline to $70,000 during 2024. When Liang applies the CECL model account for its investment it calculates that, of the $30,000 drop in fair value, $10,000 of it relates to credit losses for amounts not expected to be collected. Liang's accounting for this impairment will reduce before-tax net income for 2024 by: Multiple Choice 50. $10,000. $30,000 520,000 Dim Corporation purchased 1,000 bonds of Witt Corporation in 2021 for $800 per bond and classified the investment as securities available-for-sale. The value of these holdings was $400 per bond on December 31, 2022, and $300 per bond on December 31,2023 . During 2024, Dim sold all of its Witt bonds at $350 per bond. In its 2024 income statement, Dim would report: Multiple Choice a trading gain of $50,000 and an unrealized holding loss of $500,000. a loss on the sale of imvestments of $450,000. a recognition of unrealized holding losses of $400,000. a realized gain of $50,000. Nichols Enterprises has an investment in 250 bonds of Elliott Electronics that Nichols accounts for as a security available-for-sale. Elliott bonds are publicly traded, and The Wall Street Joumal quotes a price for those bonds of $1,000 per bond, but Nichols belleves the market has not appreciated the full value of the Elliott bonds and that a more accurate price is $1,200 per bond. Nichols should carry the Elliott investment on its balance sheet at: Multiple Choice Either $250,000 or $300,000, as elther are defensible valuations $275,000, the midpoint of Nichols's range of reasonably Skely valuations of Elliott. $300,000 $250,000