Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Google Excel: https://docs.google.com/spreadsheets/d/17UXg_XHPtx2tU6a32IygCnr9n17cHPSRIYIvmFcN48I/edit?usp=sharing CompTech IBN Liquidity Measures 1 Current Ratio 2 Quick Ratio 3 Cash Ratio Long-Term Solvency Measures 4 Total Debt Ratio 5 Times

Google Excel: https://docs.google.com/spreadsheets/d/17UXg_XHPtx2tU6a32IygCnr9n17cHPSRIYIvmFcN48I/edit?usp=sharing

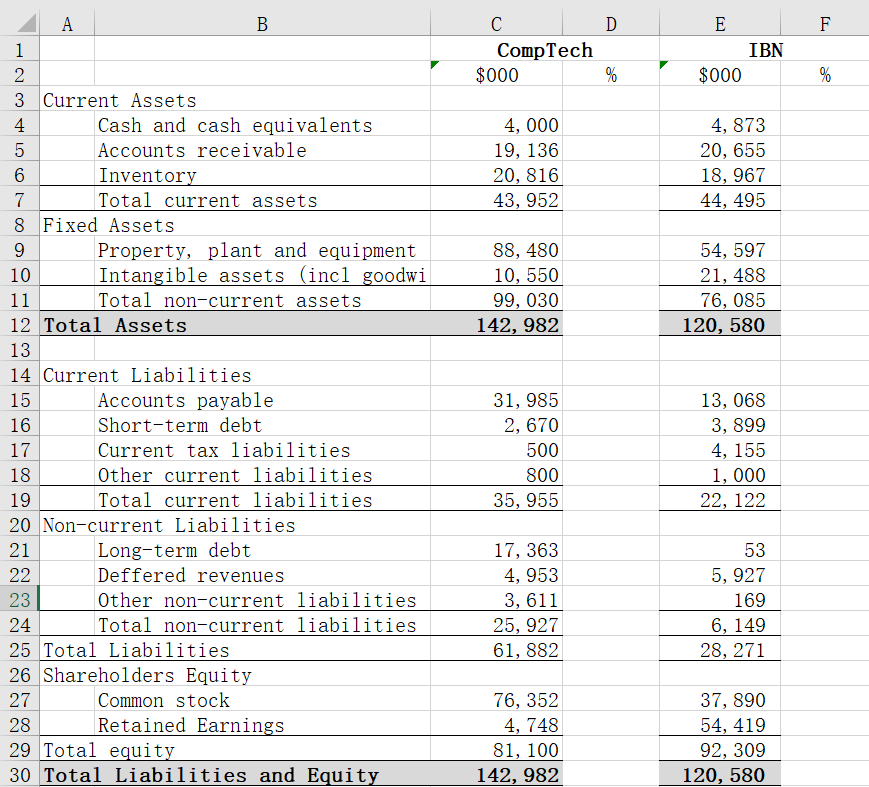

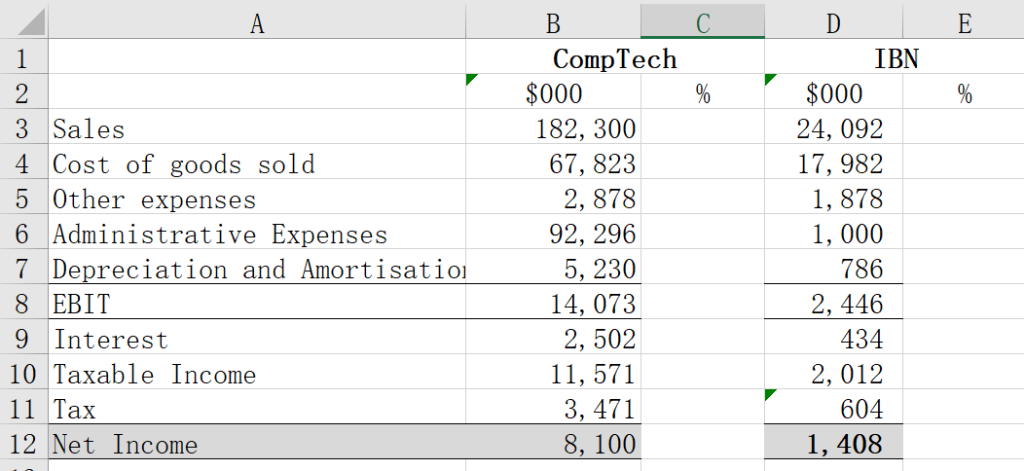

| CompTech | IBN | ||

| Liquidity Measures | |||

| 1 | Current Ratio | ||

| 2 | Quick Ratio | ||

| 3 | Cash Ratio | ||

| Long-Term Solvency Measures | |||

| 4 | Total Debt Ratio | ||

| 5 | Times Interest Earned Ratio | ||

| 6 | Cash Coverage Ratio | ||

| Cash and Asset Management Measures | |||

| 7 | Inventory Turnover | ||

| 8 | Inventory Period (days) | ||

| 9 | Receivables Turnover | ||

| 10 | Receivables Period (days) | ||

| 11 | Payables Turnover | ||

| 12 | Payables Period (days) | ||

| 13 | Cash Cycle (days) | ||

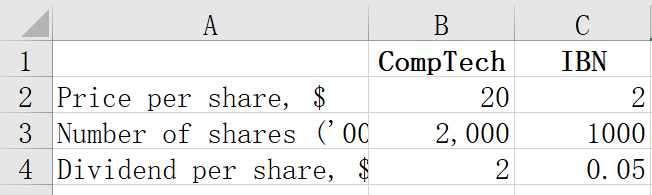

| Market Value Measures | |||

| 14 | Price Earnings Ratio | ||

| 15 | Market to Book ratio | ||

| 16 | Enterprise Value ($000) | ||

| 17 | EBITDA ratio | ||

| DuPont Analysis | |||

| 18 | Return on Equity | ||

| 19 | Return on Assets | ||

| 20 | Profit Margin | ||

| 21 | Total Asset Turnover | ||

| 22 | Equity Multiplier | ||

| 23 | Debt Equity Ratio | ||

| Internal and Sustainable Growth | |||

| 24 | Dividend Payout Ratio | ||

| 25 | Retention Ratio | ||

| 26 | Internal Growth Rate | ||

| 27 | Sustainable Growth Rate | ||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started