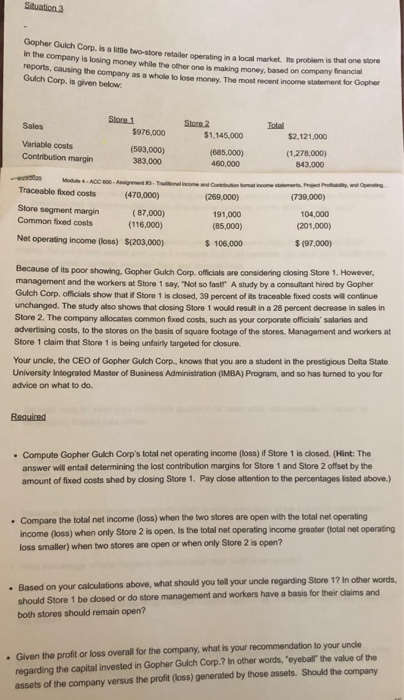

Gopher Guich Corp. is a little two-store retailer operating in a local market. Iis problem is that one store in the company is losing money while the other one is making money, based on company financial reports, causing the company as a whole to lose money. The most recent income statement for Gopher Gulich Corp. is given below. Store 1 Sales Total $2,121,000 Variable costs Contribution margin $976,000 (593,000) 383,000 Store 2 $1,145,000 (685,000) 460,000 (1,278,000) 843.000 Module 4. AC60 Assist Tonal income and Garten met income, Powder Traceable feed costs (470,000) (269,000) (739,000) Store segment margin (87.000) 191,000 104,000 Common faced costs (116,000) (85,000) (201,000) Net operating income (loss) $(203,000) $ 106,000 $(97.000) Because of its poor showing. Gopher Gulch Corp. officials are considering closing Store 1. However, management and the workers at Store 1 say, "Not so fast A study by a consultant hired by Gopher Gulch Corp. officials show that if Store 1 is closed, 39 percent of its traceable fixed costs will continue unchanged. The study also shows that closing Store I would result in a 28 percent decrease in sales in Store 2. The company allocates common fixed costs, such as your corporate officials salaries and advertising costs, to the stores on the basis of square footage of the stores. Management and workers at Store 1 claim that Store 1 is being unfairly targeted for closure Your uncle, the CEO of Gopher Gulch Corp., knows that you are a student in the prestigious Delta State University Integrated Master of Business Administration (MBA) Program, and so has turned to you for advice on what to do. Required Compute Gopher Gulch Corp's total net operating income (loss) if Store 1 is closed. (Hint: The answer will ental determining the lost contribution margins for Store 1 and Store 2 offset by the amount of fixed costs shed by closing Store 1. Pay close attention to the percentages listed above.) . Compare the total net income (loss) when the two stores are open with the total net operating income (loss) when only Store 2 is open, is the total net operating income greater (total net operating loss smaller) when two stores are open or when only Store 2 is open? Based on your calculations above, what should you tell your uncle regarding Store 1? In other words, should Store 1 be closed or do store management and workers have a basis for their claims and both stores should remain open? . Given the profit or loss overall for the company, what is your recommendation to your unde regarding the capital invested in Gopher Gulch Corp.? In other words, "eyeball" the value of the assets of the company versus the profit (loss) generated by those assets. Should the company