Answered step by step

Verified Expert Solution

Question

1 Approved Answer

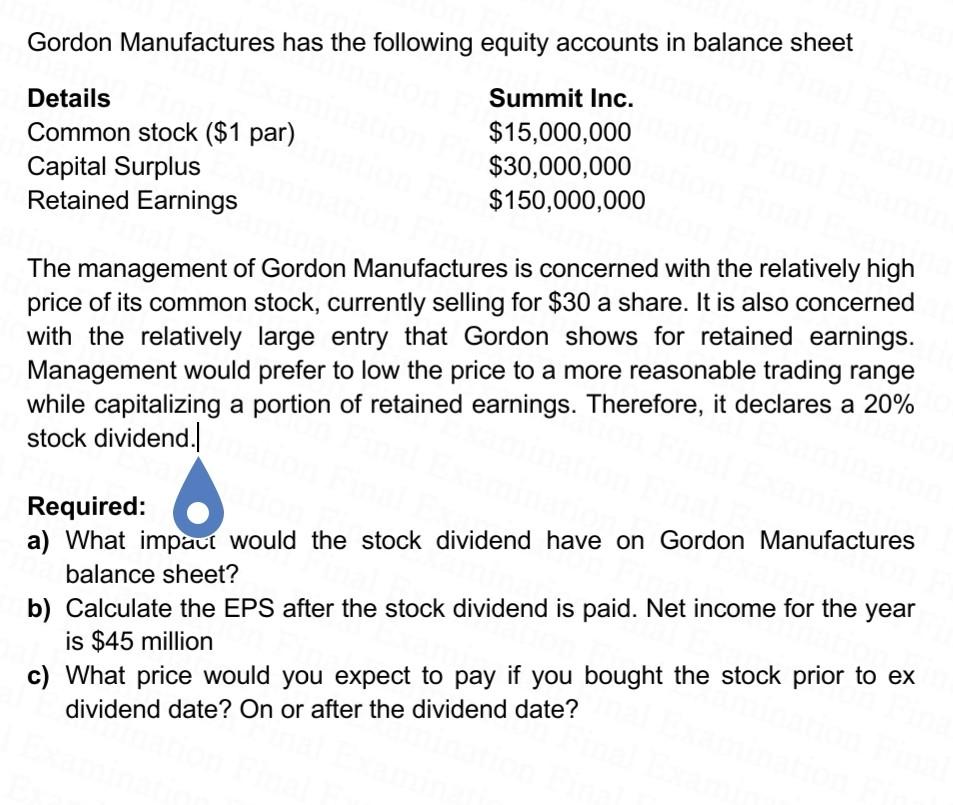

Gordon Manufactures has the following equity accounts in balance sheet Details Common stock ($1 par) Capital Surplus Retained Earnings Summit Inc. $15,000,000 $30,000,000 $150,000,000 The

Gordon Manufactures has the following equity accounts in balance sheet Details Common stock ($1 par) Capital Surplus Retained Earnings Summit Inc. $15,000,000 $30,000,000 $150,000,000 The management of Gordon Manufactures is concerned with the relatively high price of its common stock, currently selling for $30 a share. It is also concerned with the relatively large entry that Gordon shows for retained earnings. Management would prefer to low the price to a more reasonable trading range while capitalizing a portion of retained earnings. Therefore, it declares a 20% stock dividend. Required: a) What impact would the stock dividend have on Gordon Manufactures balance sheet? b) Calculate the EPS after the stock dividend is paid. Net income for the year is $45 million c) What price would you expect to pay if you bought the stock prior to ex dividend date? On or after the dividend date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started