Gordon Walker is recently single and lives on his own in Toronto. He has two adult sons with his wife from whom he recently separated.

Gordon Walker is recently single and lives on his own in Toronto. He has two adult sons with his wife from whom he recently separated. He drew up a will years ago. In it, he names his wife as the sole beneficiary of his estate. Now that he is separated, he knows he should revise the will but he hasn't gotten around to it. Gordon is proud of himself: at age 53, his assets total $1 Million.

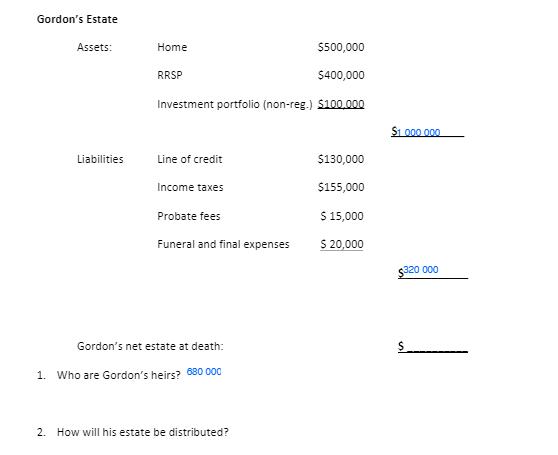

Gordon's Estate Assets: Liabilities Home $500,000 $400,000 Investment portfolio (non-reg.) $100,000 RRSP Line of credit Income taxes Probate fees Funeral and final expenses Gordon's net estate at death: 1. Who are Gordon's heirs? 680 000 2. How will his estate be distributed? $130,000 $155,000 $ 15,000 $ 20,000 $1.000 000 $320 000

Step by Step Solution

3.44 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

Gordons Net Estate at Death To calculate Gordons net estate at the time of his death you subtract hi...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started