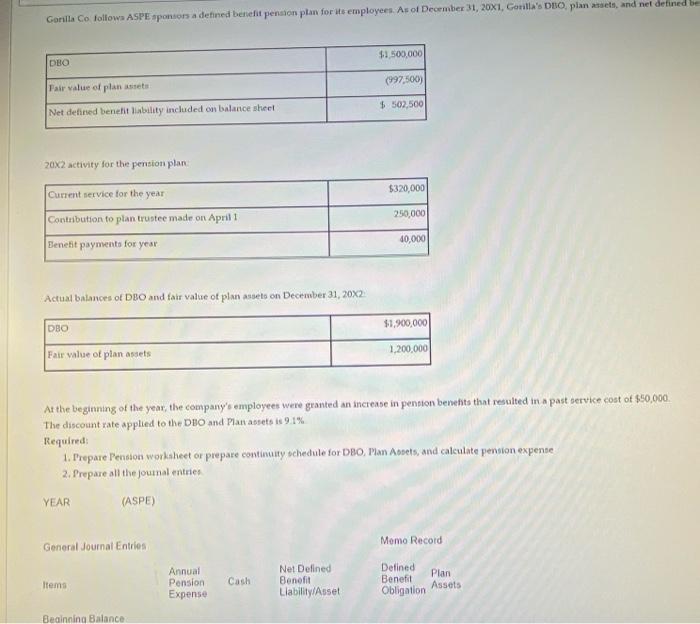

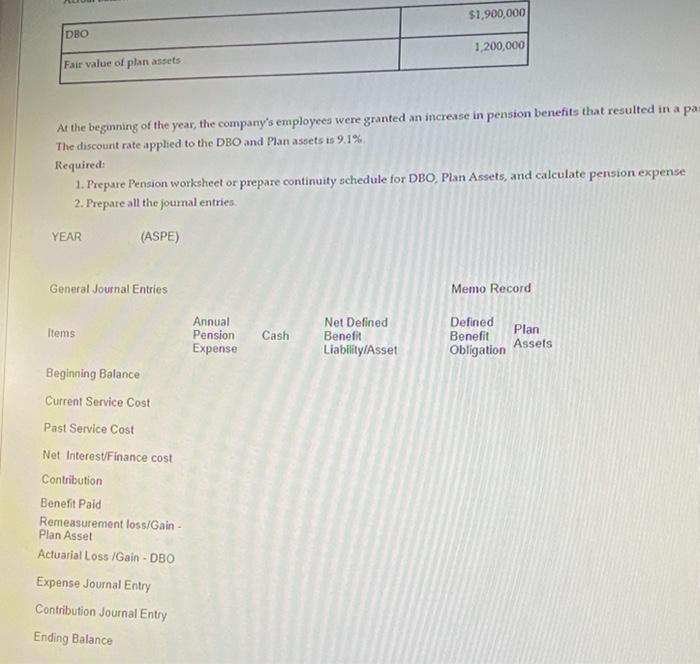

Gorilla Co follows ASPE sponsors a defined benefit pension plan for its employees. As of December 31, 20X1, Conilla's DB, plan assets and net defined be $1,500,000 DBO (997,500) Fair value of plan assets $ 502,500 Net defined benefit liability included on balance sheet 20x2 activity for the pension plan $320,000 Current service for the year 250,000 Contribution to plan trustee made on April 40,000 Benefit payments for year Actual balances of DBO and fair value of plan assets on December 31, 20X2 DBO $1,900,000 1.200.000 Fair value of plan assets At the beginning of the year, the company's employees were granted an increase in pension benefits that resulted in a past service cost of $50,000 The discount rate applied to the DNO and Planassets : 9.1% Required: 1. Prepare Pension worksheet or prepare continuity chedule for DBO, Plan Asets, and calentate pension expense 2. Prepare all the journal entries YEAR (ASPE) Momo Record General Journal Entries Annual Pension Expense Items Cash Net Defined Benefit Liability/Asset Defined Benefit Obligation Plan Assets Beginning Balance $1,900,000 DBO 1,200,000 Fair value of plan assets At the beginning of the year, the company's employees were granted an increase in pension benefits that resulted in a pas The discount rate applied to the DBO and Plan assets is 9.1% Required: 1. Prepare Pension worksheet or prepare continuity schedule for DBO, Plan Assets, and calculate pension expense 2. Prepare all the journal entries YEAR (ASPE) General Journal Entries Memo Record Items Annual Pension Expense Cash Net Defined Benefit Liability/Asset Defined Benefit Plan Obligation Assets Beginning Balance Current Service Cost Past Service Cost Net Interest/Finance cost Contribution Benefit Paid Remeasurement loss/Gain Plan Asset Actuarial Loss /Gain - DBO Expense Journal Entry Contribution Journal Entry Ending Balance Gorilla Co follows ASPE sponsors a defined benefit pension plan for its employees. As of December 31, 20X1, Conilla's DB, plan assets and net defined be $1,500,000 DBO (997,500) Fair value of plan assets $ 502,500 Net defined benefit liability included on balance sheet 20x2 activity for the pension plan $320,000 Current service for the year 250,000 Contribution to plan trustee made on April 40,000 Benefit payments for year Actual balances of DBO and fair value of plan assets on December 31, 20X2 DBO $1,900,000 1.200.000 Fair value of plan assets At the beginning of the year, the company's employees were granted an increase in pension benefits that resulted in a past service cost of $50,000 The discount rate applied to the DNO and Planassets : 9.1% Required: 1. Prepare Pension worksheet or prepare continuity chedule for DBO, Plan Asets, and calentate pension expense 2. Prepare all the journal entries YEAR (ASPE) Momo Record General Journal Entries Annual Pension Expense Items Cash Net Defined Benefit Liability/Asset Defined Benefit Obligation Plan Assets Beginning Balance $1,900,000 DBO 1,200,000 Fair value of plan assets At the beginning of the year, the company's employees were granted an increase in pension benefits that resulted in a pas The discount rate applied to the DBO and Plan assets is 9.1% Required: 1. Prepare Pension worksheet or prepare continuity schedule for DBO, Plan Assets, and calculate pension expense 2. Prepare all the journal entries YEAR (ASPE) General Journal Entries Memo Record Items Annual Pension Expense Cash Net Defined Benefit Liability/Asset Defined Benefit Plan Obligation Assets Beginning Balance Current Service Cost Past Service Cost Net Interest/Finance cost Contribution Benefit Paid Remeasurement loss/Gain Plan Asset Actuarial Loss /Gain - DBO Expense Journal Entry Contribution Journal Entry Ending Balance