Question

Goshford Company produces a single product and has capacity to produce 120,000 units per month. Costs to produce its current sales of 96,000 units follow.

Goshford Company produces a single product and has capacity to produce 120,000 units per month. Costs to produce its current sales of 96,000 units follow. The regular selling price of the product is $140 per unit. Management is approached by a new customer who wants to purchase 24,000 units of the product for $74.70 per unit. If the order is accepted, there will be no additional fixed manufacturing overhead and no additional fixed selling and administrative expenses. The customer is not in the companys regular selling territory, so there will be a $6.60 per unit shipping expense in addition to the regular variable selling and administrative expenses.

| Per Unit | Costs at 96,000 Units | |||||||

| Direct materials | $ | 12.50 | $ | 1,200,000 | ||||

| Direct labor | 15.00 | 1,440,000 | ||||||

| Variable manufacturing overhead | 11.00 | 1,056,000 | ||||||

| Fixed manufacturing overhead | 17.50 | 1,680,000 | ||||||

| Variable selling and administrative expenses | 14.00 | 1,344,000 | ||||||

| Fixed selling and administrative expenses | 13.00 | 1,248,000 | ||||||

| Totals | $ | 83.00 | $ | 7,968,000 | ||||

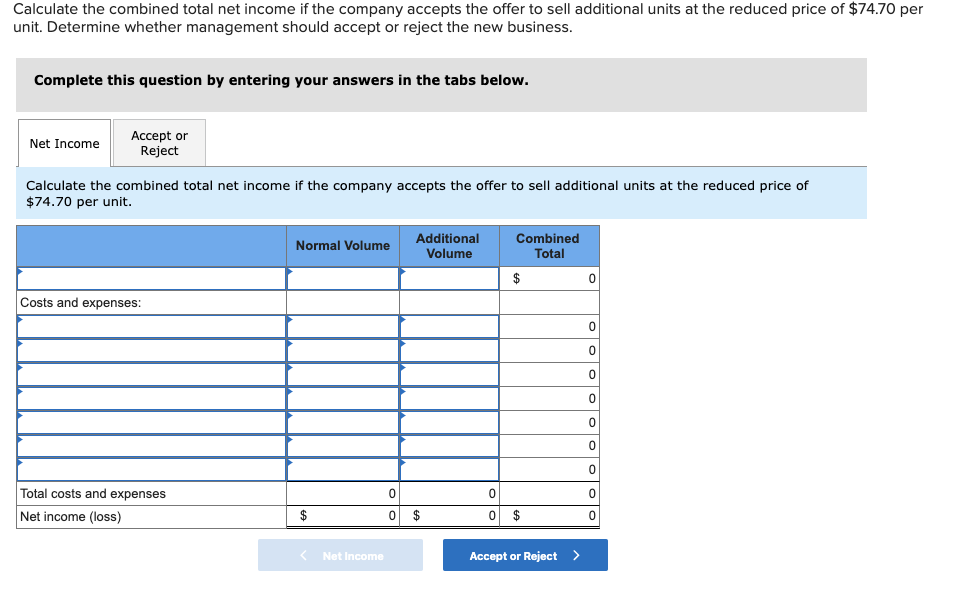

Calculate the combined total net income if the company accepts the offer to sell additional units at the reduced price of $74.70 per unit. Determine whether management should accept or reject the new business.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started