Got stuck on part C, the 6 month Swiss bill rate. Please show the process alongside the answer

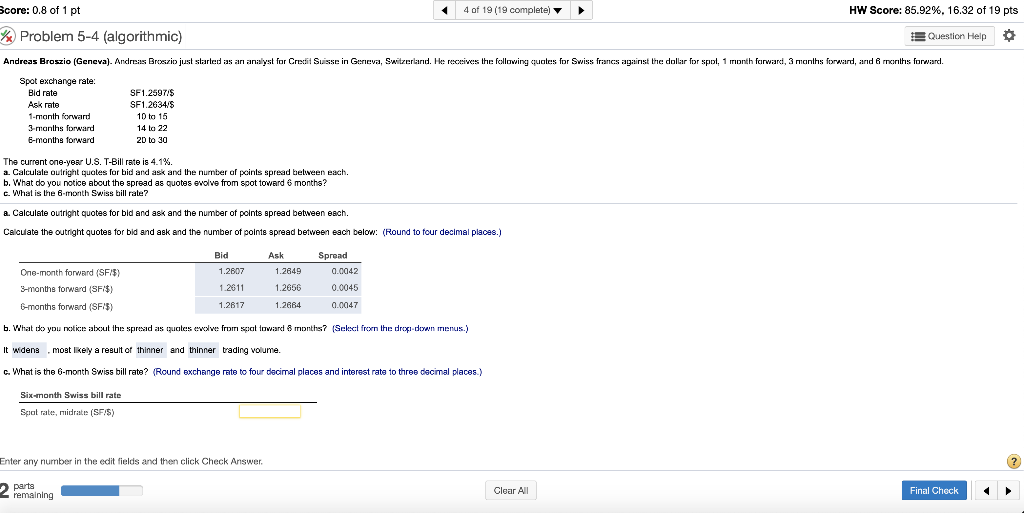

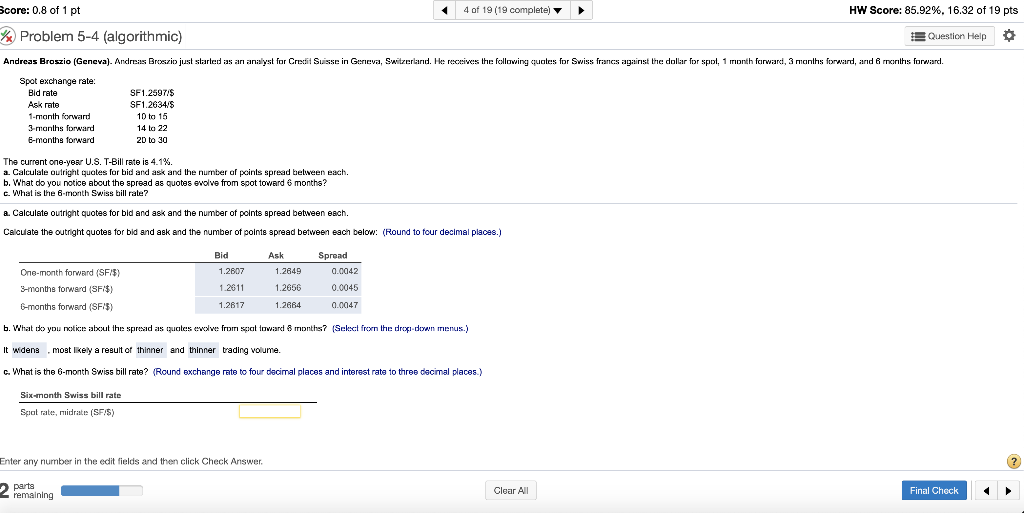

4 of 19 (19 complete) HW Score: 85.92%. 16.32 of 19 pts Score: 0.8 of 1 pt & Problem 5-4 (algorithmic) Question Help Andreas Broszio (Geneva). Andres Broszio just started as an analyst for Credit Suisse in Geneva, Switzerland. He receives the following quotes for Swiss francs against the dollar for spol, 1 month forwarci, 3 months forward, and months forward. Spot exchange rate: Bid rate Ask rate 1-month forward 3-months forward 6-months forward SF1.25971$ SF1.2634/5 10 to 15 14 la 22 20 to 30 The current one-yen U.S. T-Bill rate is 4.1%. a. Calculale outright quotes for bid and ask and the nurnber of poinls spread between each. b. What do you notice about the spread an quotes evolve from spot toward 6 months? c. What is the 6-month Swiss bill rale? a. Calculate outright quotes for bid and ask and the number of points spread between each. Calculate the outright quotes for bid and ask and the number of points spread between each below: (Round to four decimal places.) One-month forward (SF75) 3-months forward (SF$) 6-months forward (SF/5) Bid 1.2807 1.2611 1.2817 Ask 1.2849 1.2656 1.2884 Spread 0.0042 0.0045 0.0947 6. What do you notice about the spread as quates evolve from scallowaard 8 months? (Select from the drop-down menus.) It widens .most likely a result of thinner and thinner trading volume. c. What is the 6-month Swiss bill rate? (Round exchange rate to four decimal places and interest rate to three decimal places) Six-month Swiss bill rate Spot rate, midrate (SFIS) Enter any number in the edit fields and then click Check Answer. 2 parts 2 remaining Clear All Final Check 4 of 19 (19 complete) HW Score: 85.92%. 16.32 of 19 pts Score: 0.8 of 1 pt & Problem 5-4 (algorithmic) Question Help Andreas Broszio (Geneva). Andres Broszio just started as an analyst for Credit Suisse in Geneva, Switzerland. He receives the following quotes for Swiss francs against the dollar for spol, 1 month forwarci, 3 months forward, and months forward. Spot exchange rate: Bid rate Ask rate 1-month forward 3-months forward 6-months forward SF1.25971$ SF1.2634/5 10 to 15 14 la 22 20 to 30 The current one-yen U.S. T-Bill rate is 4.1%. a. Calculale outright quotes for bid and ask and the nurnber of poinls spread between each. b. What do you notice about the spread an quotes evolve from spot toward 6 months? c. What is the 6-month Swiss bill rale? a. Calculate outright quotes for bid and ask and the number of points spread between each. Calculate the outright quotes for bid and ask and the number of points spread between each below: (Round to four decimal places.) One-month forward (SF75) 3-months forward (SF$) 6-months forward (SF/5) Bid 1.2807 1.2611 1.2817 Ask 1.2849 1.2656 1.2884 Spread 0.0042 0.0045 0.0947 6. What do you notice about the spread as quates evolve from scallowaard 8 months? (Select from the drop-down menus.) It widens .most likely a result of thinner and thinner trading volume. c. What is the 6-month Swiss bill rate? (Round exchange rate to four decimal places and interest rate to three decimal places) Six-month Swiss bill rate Spot rate, midrate (SFIS) Enter any number in the edit fields and then click Check Answer. 2 parts 2 remaining Clear All Final Check