Got the first one need help with the rest

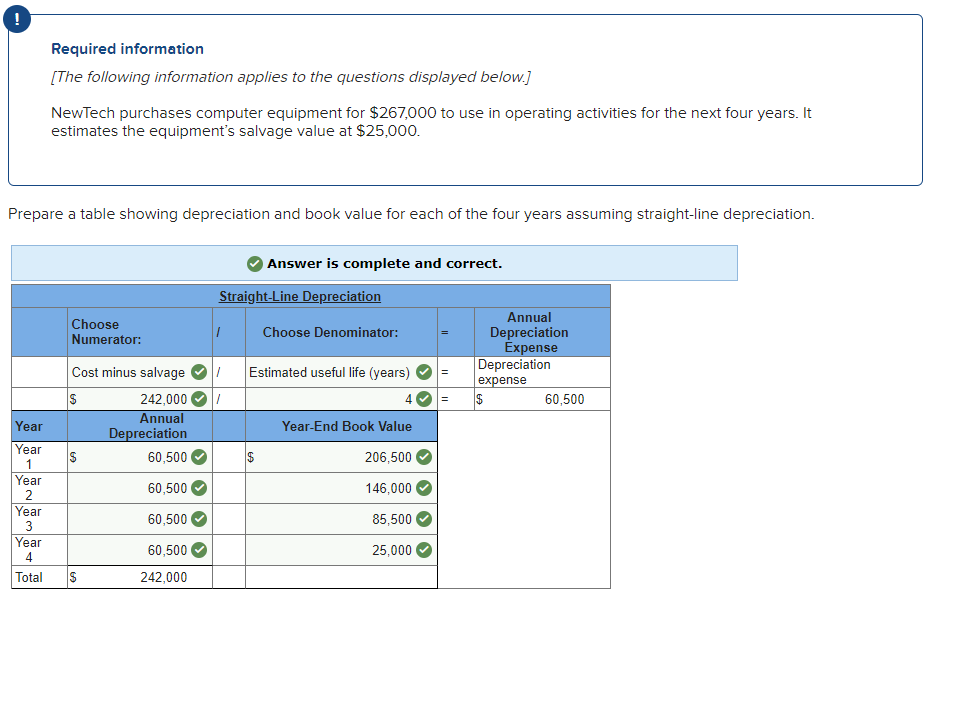

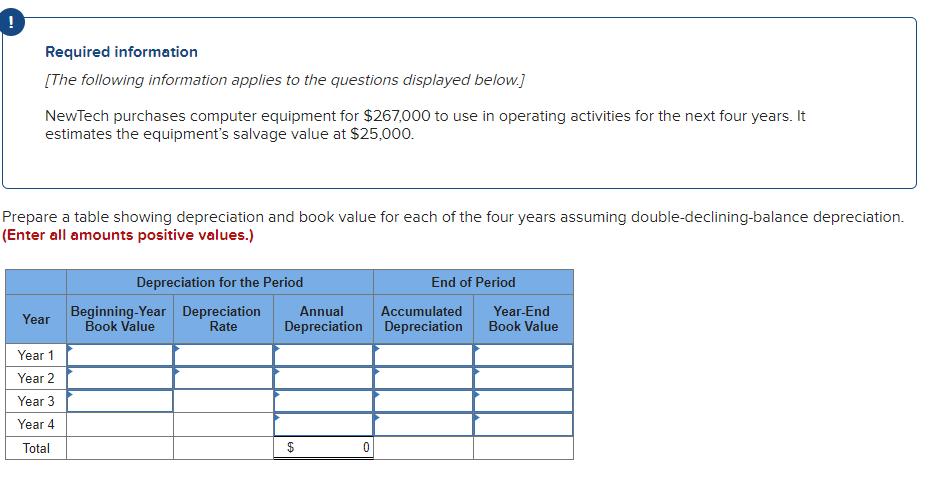

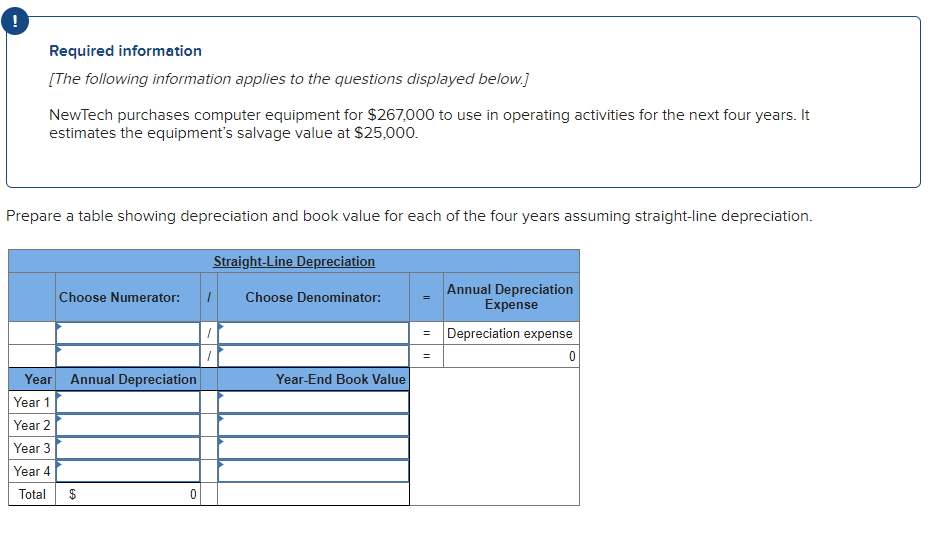

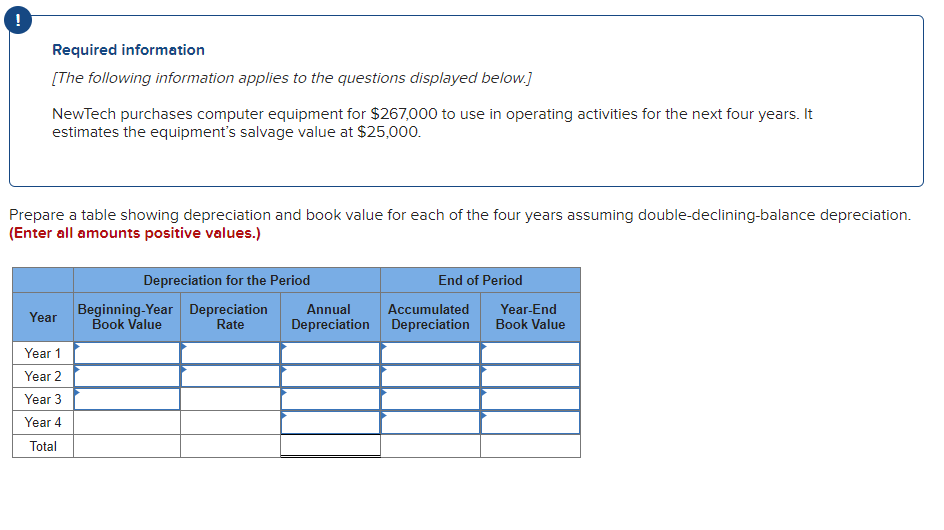

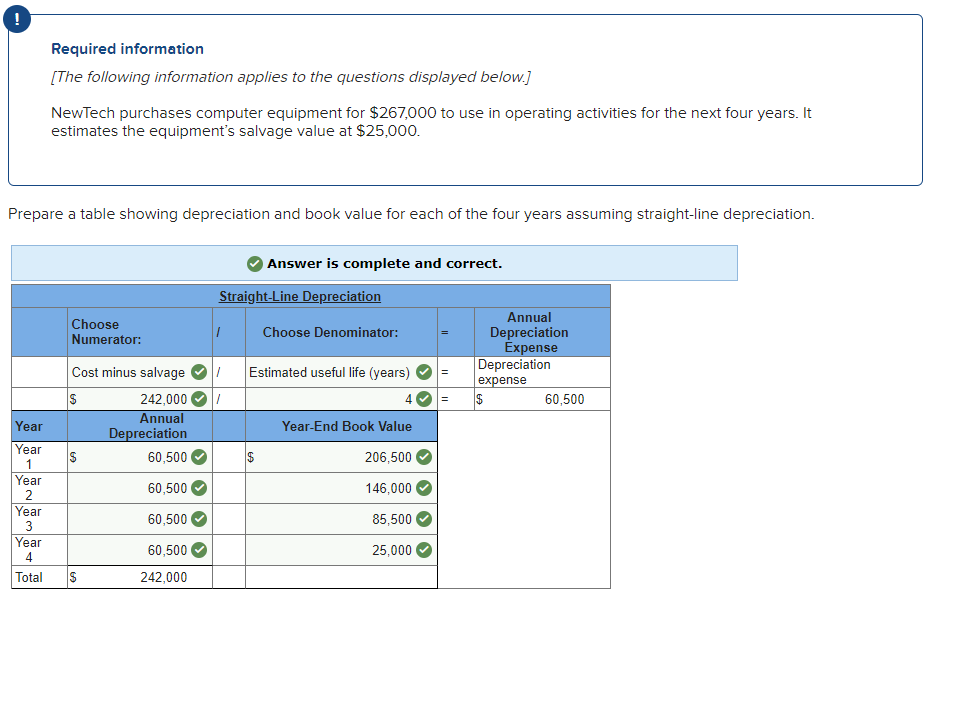

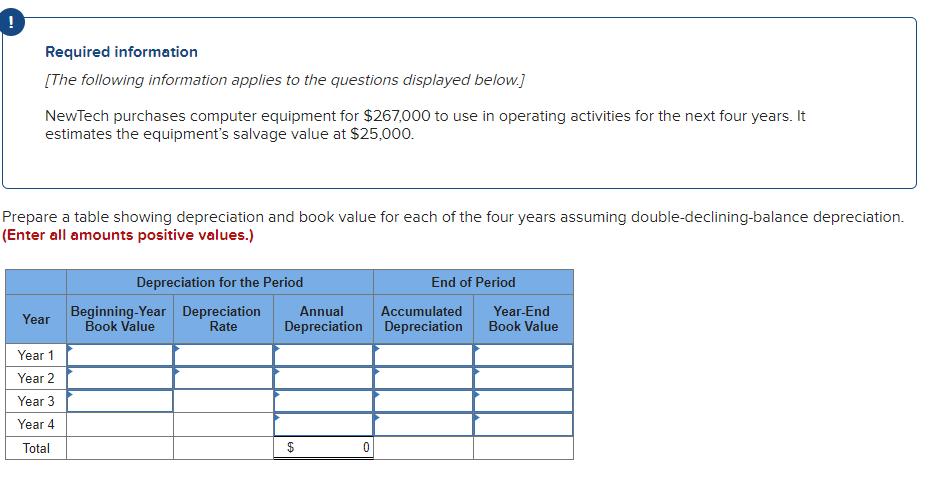

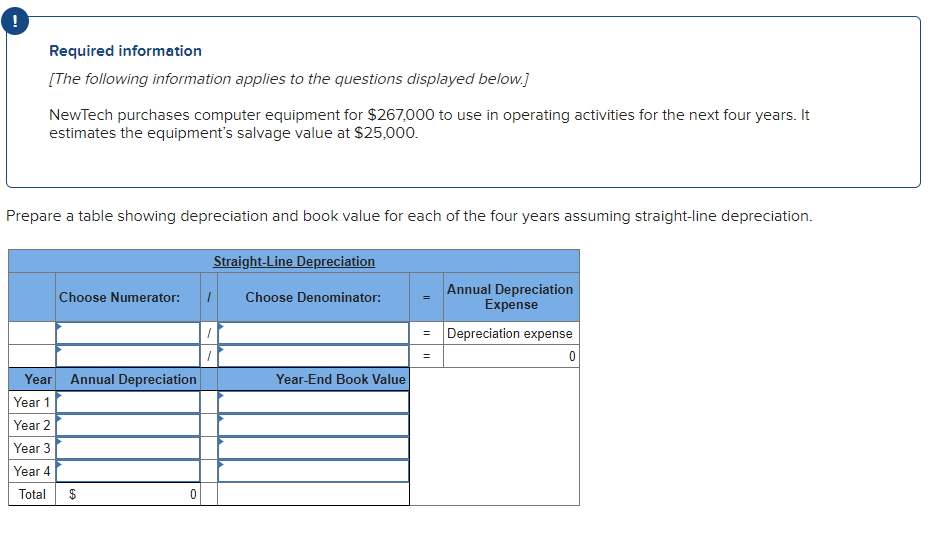

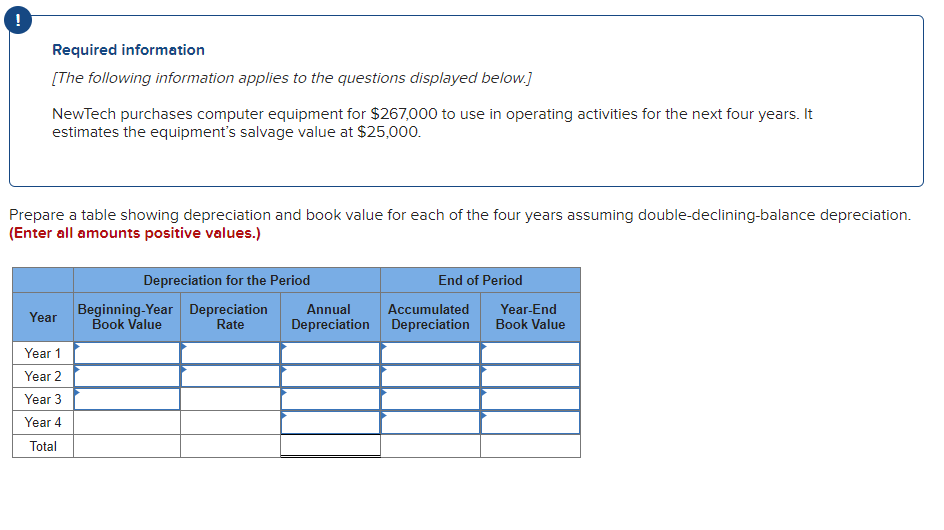

Required information [The following information applies to the questions displayed below.] NewTech purchases computer equipment for $267,000 to use in operating activities for the next four years. It estimates the equipment's salvage value at $25,000. Prepare a table showing depreciation and book value for each of the four years assuming straight-line depreciation. Answer is complete and correct. Straight-Line Depreciation Choose Numerator: 1 Choose Denominator: Annual Depreciation Expense Depreciation expense $ 60,500 Estimated useful life (years) 1 11 = = Cost minus salvage $ 242,000 Annual Depreciation $ 60,500 Year Year-End Book Value 206,500 Year 1 Year 60,500 146,000 60,500 85,500 Year 3 Year 4 Total 25,000 60,500 242,000 A ! Required information [The following information applies to the questions displayed below.) NewTech purchases computer equipment for $267,000 to use in operating activities for the next four years. It estimates the equipment's salvage value at $25,000. Prepare a table showing depreciation and book value for each of the four years assuming double-declining-balance depreciation. (Enter all amounts positive values.) Depreciation for the Period End of Period Beginning-Year Depreciation Annual Accumulated Year-End Book Value Rate Depreciation Depreciation Book Value Year Year 1 Year 2 Year 3 Year 4 Total 0 Required information [The following information applies to the questions displayed below.) NewTech purchases computer equipment for $267,000 to use in operating activities for the next four years. It estimates the equipment's salvage value at $25,000. Prepare a table showing depreciation and book value for each of the four years assuming straight-line depreciation. Straight-Line Depreciation Choose Numerator: 1 Choose Denominator: = Annual Depreciation Expense Depreciation expense 0 11 11 Year-End Book Value Year Annual Depreciation Year 1 Year 2 Year 3 Year 4 Total $ 0 Required information (The following information applies to the questions displayed below.) NewTech purchases computer equipment for $267,000 to use in operating activities for the next four years. It estimates the equipment's salvage value at $25,000. Prepare a table showing depreciation and book value for each of the four years assuming double-declining-balance depreciation. (Enter all amounts positive values.) Depreciation for the Period Beginning-Year Depreciation Annual Book Value Rate Depreciation End of Period Accumulated Year-End Depreciation Book Value Year Year 1 Year 2 Year 3 Year 4 Total