Govermental Accounting

please I want a right answer

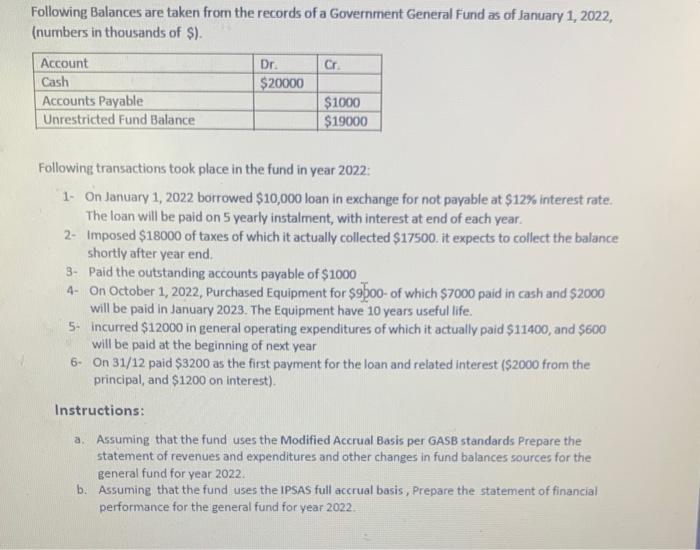

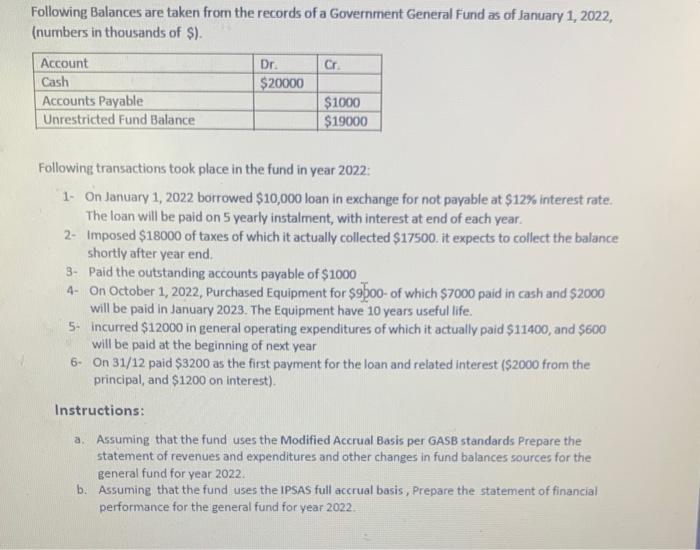

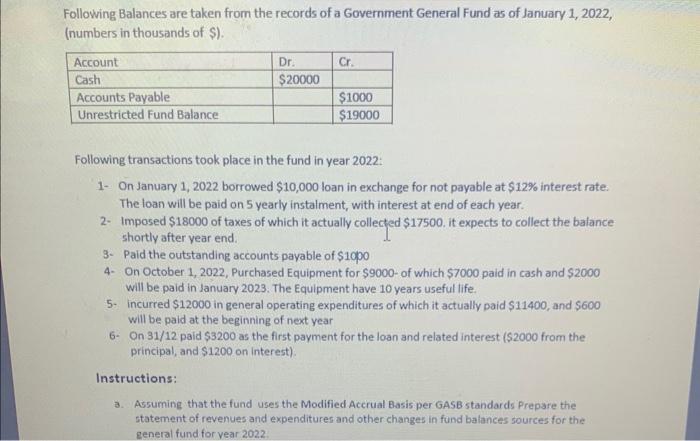

Following Balances are taken from the records of a Government General Fund as of January 1, 2022, (numbers in thousands of \$). Following transactions took place in the fund in year 2022 : 1- On January 1, 2022 borrowed $10,000 loan in exchange for not payable at $12% interest rate. The loan will be paid on 5 yearly instalment, with interest at end of each year. 2- Imposed $18000 of taxes of which it actually collected $17500. it expects to collect the balance shortly after year end. 3. Paid the outstanding accounts payable of $1000 4- On October 1, 2022, Purchased Equipment for $9500 - of which $7000 paid in cash and $2000 will be paid in January 2023. The Equipment have 10 years useful life. 5. incurred $12000 in general operating expenditures of which it actually paid $11400, and $600 will be paid at the beginning of next year 6. On 31/12 paid $3200 as the first payment for the loan and related interest ( $2000 from the principal, and $1200 on interest). Instructions: a. Assuming that the fund uses the Modified Accrual Basis per GASB standards Prepare the statement of revenues and expenditures and other changes in fund balances sources for the general fund for year 2022 . b. Assuming that the fund uses the IPSAS full accrual basis, Prepare the statement of financial performance for the general fund for year 2022. Following Balances are taken from the records of a Government General Fund as of January 1, 2022, (numbers in thousands of \$). Following transactions took place in the fund in year 2022 : 1- On January 1, 2022 borrowed $10,000 loan in exchange for not payable at $12% interest rate. The loan will be paid on 5 yearly instalment, with interest at end of each year. 2. Imposed $18000 of taxes of which it actually collected $17500. it expects to collect the balance shortly after year end. 3. Paid the outstanding accounts payable of $10p0 4- On October 1, 2022, Purchased Equipment for $9000 - of which $7000 paid in cash and $2000 will be paid in January 2023 . The Equipment have 10 years useful life. 5. incurred $12000 in general operating expenditures of which it actually paid $11400, and $600 will be paid at the beginning of next year 6. On 31/12 paid $3200 as the first payment for the loan and related interest ( $2000 from the principal, and $1200 on interest). Instructions: 3. Assuming that the fund uses the Modified Acerual Basis per GASB standards Prepare the statement of revenues and expenditures and other changes in fund balances sources for the general fund for vear 2022