government accounting help?

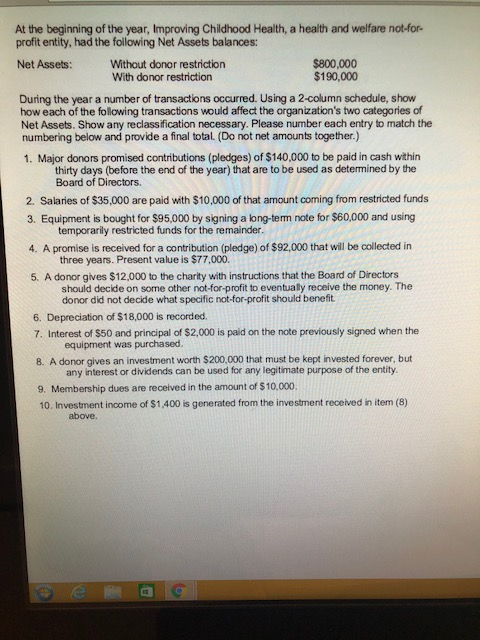

At the beginning of the year, Improving Childhood Health, a health and welfare not-for- profit entity, had the following Net Assets balances: Without donor restriction With donor restriction $800,000 $190,000 Net Assets: During the year a number of transactions occurred. Using a 2-column schedule, show how each of the following transactions would affect the organization's two categories of Net Assets. Show any reclassification necessary. Please number each entry to match the numbering below and provide a final total. (Do not net amounts together.) 1. Major donors promised contributions (pledges) of $140,000 to be paid in cash within thirty days (before the end of the year) that are to be used as determined by the Board of Directors. 2. Salaries of $35,000 are paid with $10,000 of that amount coming from restricted funds 3. Equipment is bought for $95,000 by signing a ong-term note for $60,000 and using 4. A promise is received for a contribution (pledge) of $92,000 that will be collected in 5. A donor gives $12,000 to the charity with instructions that the Board of Directors temporarily restricted funds for the remainder. three years. Present value is $77,000. should decide on some other not-for-profit to eventualy receive the money. The donor did not decide what specific not-for-profit should benefit 6. Depreciation of $18,000 is recorded. 7. Interest of $50 and principal of $2,000 is paid on the note previously signed when the 8. A donor gives an investment worth $200,000 that must be kept invested forever, but 9. Membership dues are received in the amount of $10,000. equipment was purchased. any interest or dividends can be used for any legitimate purpose of the entity 10. Investment income of $1,400 is generated from the investment received in item (8) above. 3 At the beginning of the year, Improving Childhood Health, a health and welfare not-for- profit entity, had the following Net Assets balances: Without donor restriction With donor restriction $800,000 $190,000 Net Assets: During the year a number of transactions occurred. Using a 2-column schedule, show how each of the following transactions would affect the organization's two categories of Net Assets. Show any reclassification necessary. Please number each entry to match the numbering below and provide a final total. (Do not net amounts together.) 1. Major donors promised contributions (pledges) of $140,000 to be paid in cash within thirty days (before the end of the year) that are to be used as determined by the Board of Directors. 2. Salaries of $35,000 are paid with $10,000 of that amount coming from restricted funds 3. Equipment is bought for $95,000 by signing a ong-term note for $60,000 and using 4. A promise is received for a contribution (pledge) of $92,000 that will be collected in 5. A donor gives $12,000 to the charity with instructions that the Board of Directors temporarily restricted funds for the remainder. three years. Present value is $77,000. should decide on some other not-for-profit to eventualy receive the money. The donor did not decide what specific not-for-profit should benefit 6. Depreciation of $18,000 is recorded. 7. Interest of $50 and principal of $2,000 is paid on the note previously signed when the 8. A donor gives an investment worth $200,000 that must be kept invested forever, but 9. Membership dues are received in the amount of $10,000. equipment was purchased. any interest or dividends can be used for any legitimate purpose of the entity 10. Investment income of $1,400 is generated from the investment received in item (8) above. 3