GOVERNMENTAL ACCOUNTING

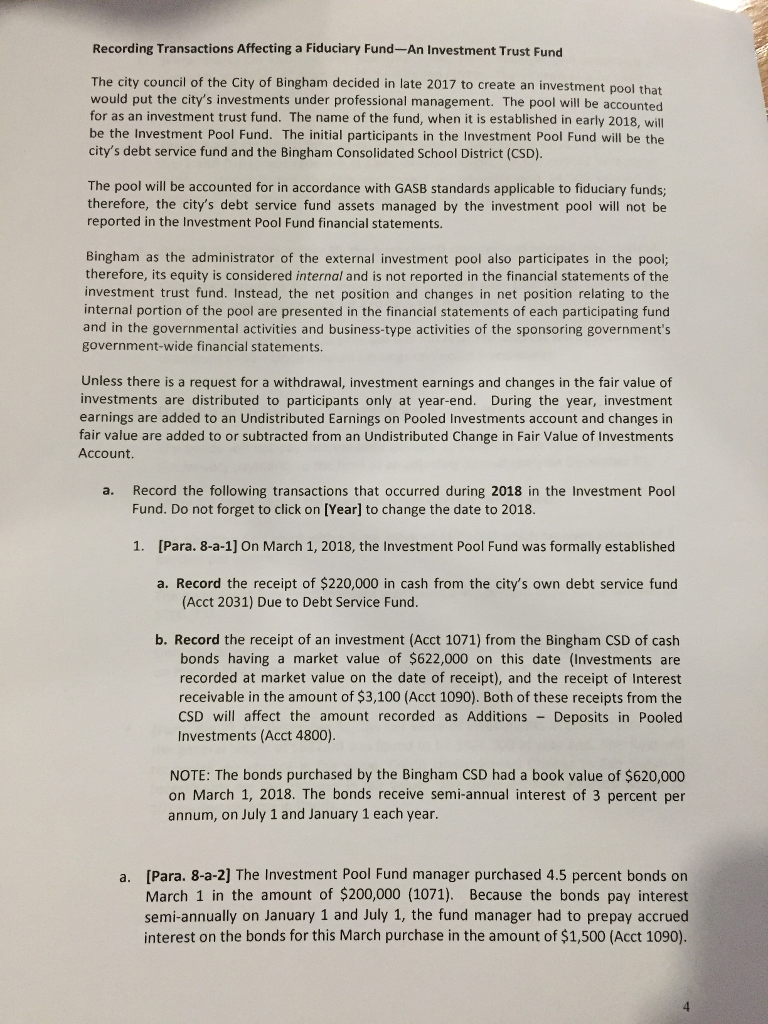

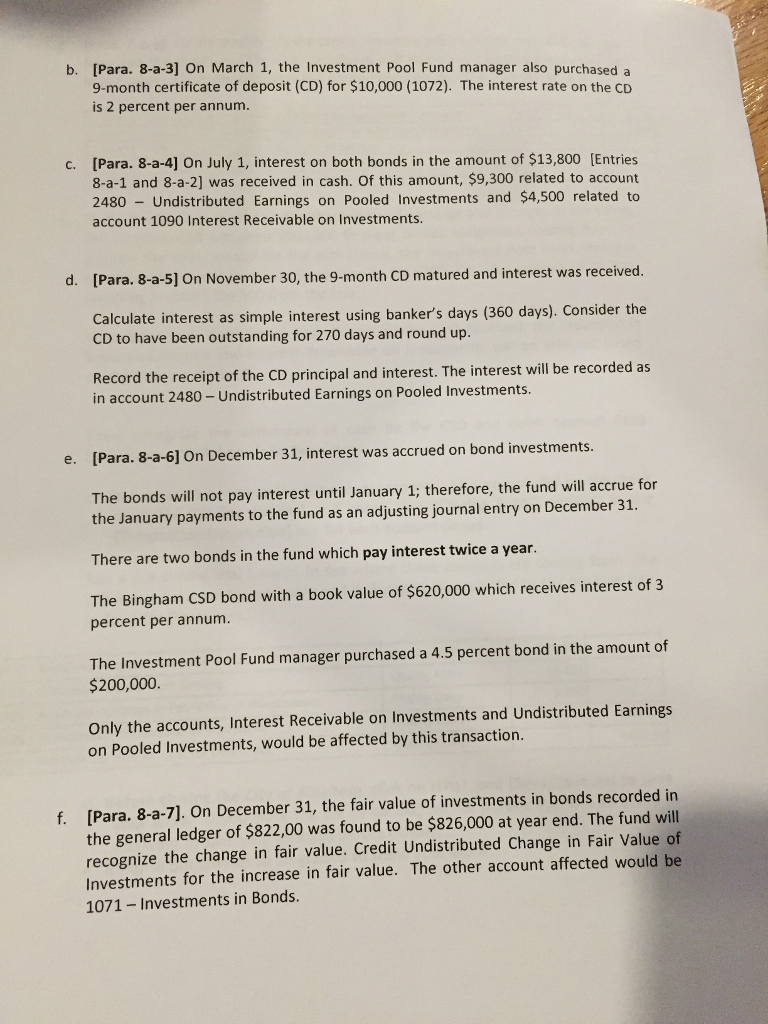

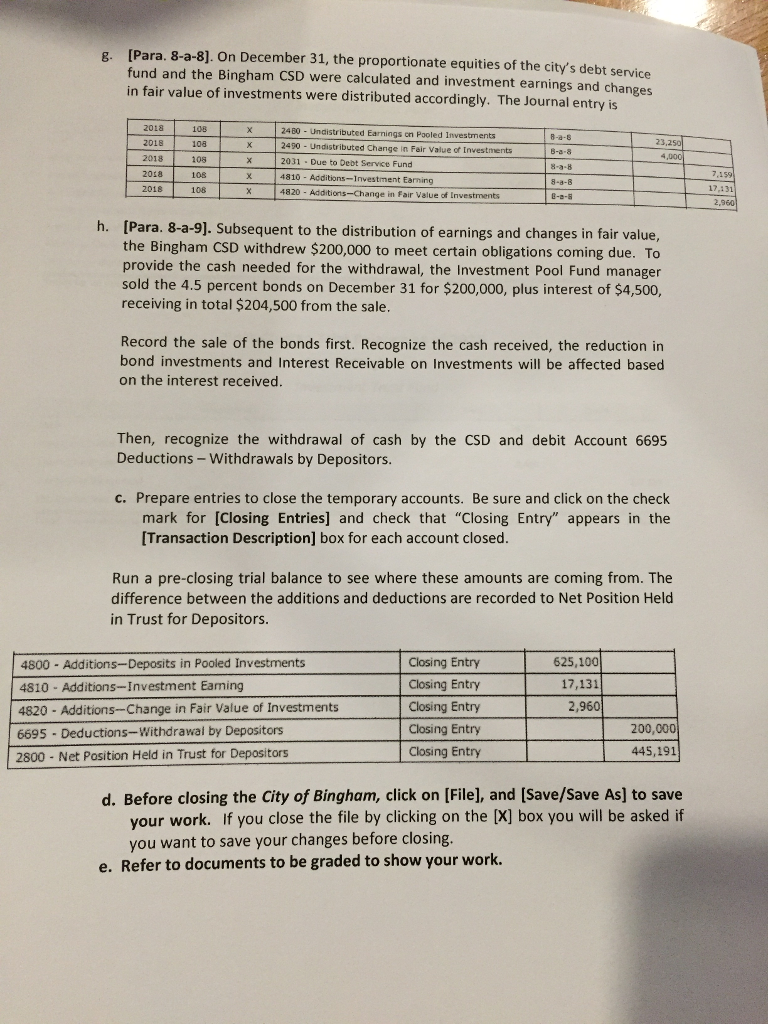

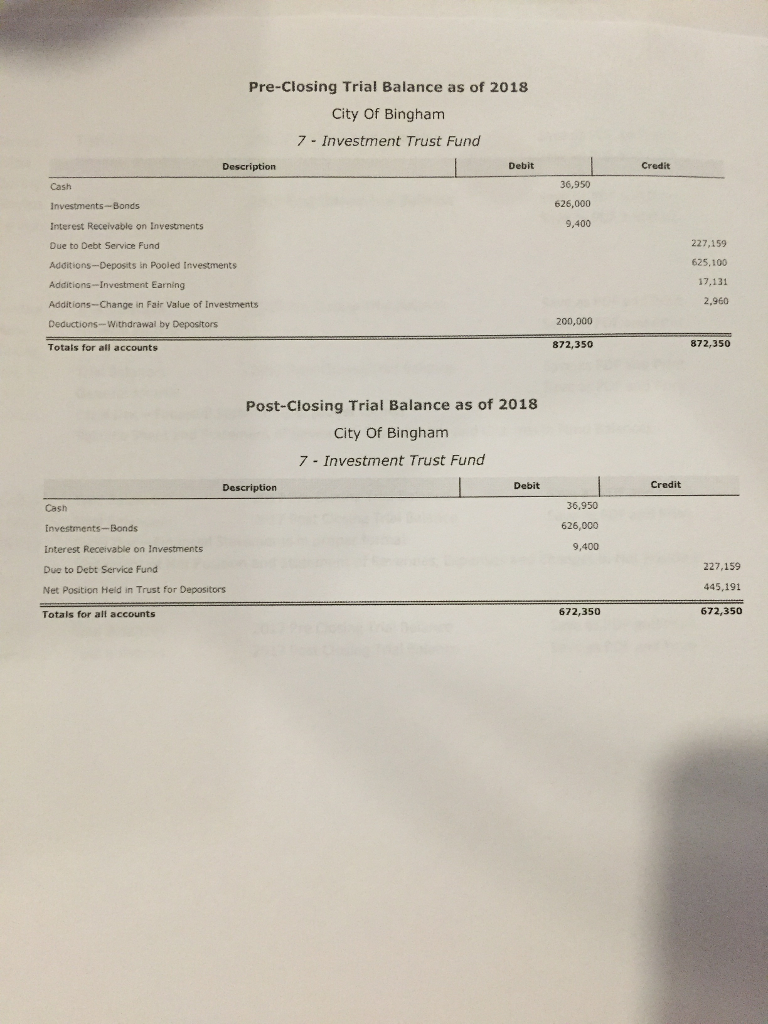

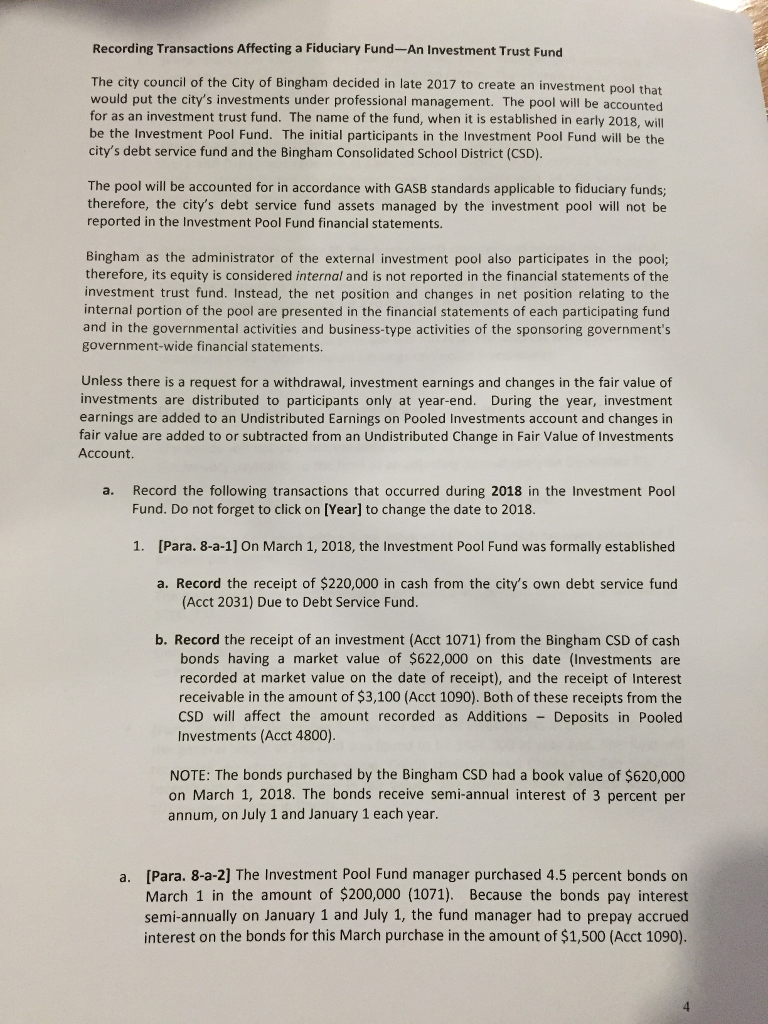

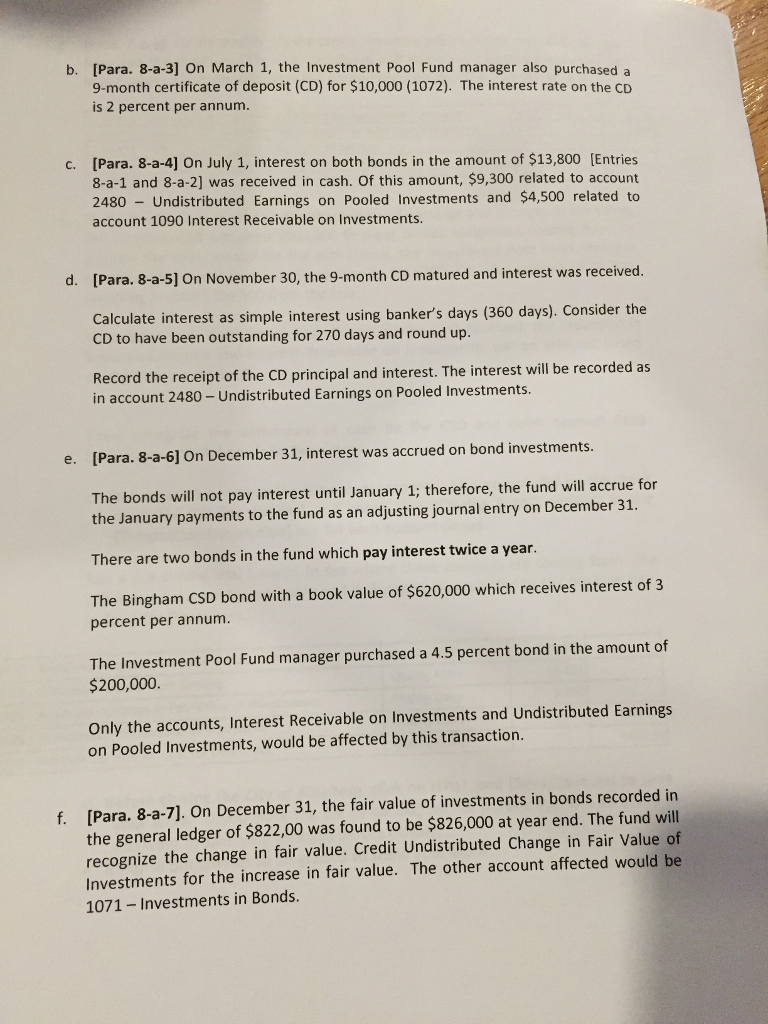

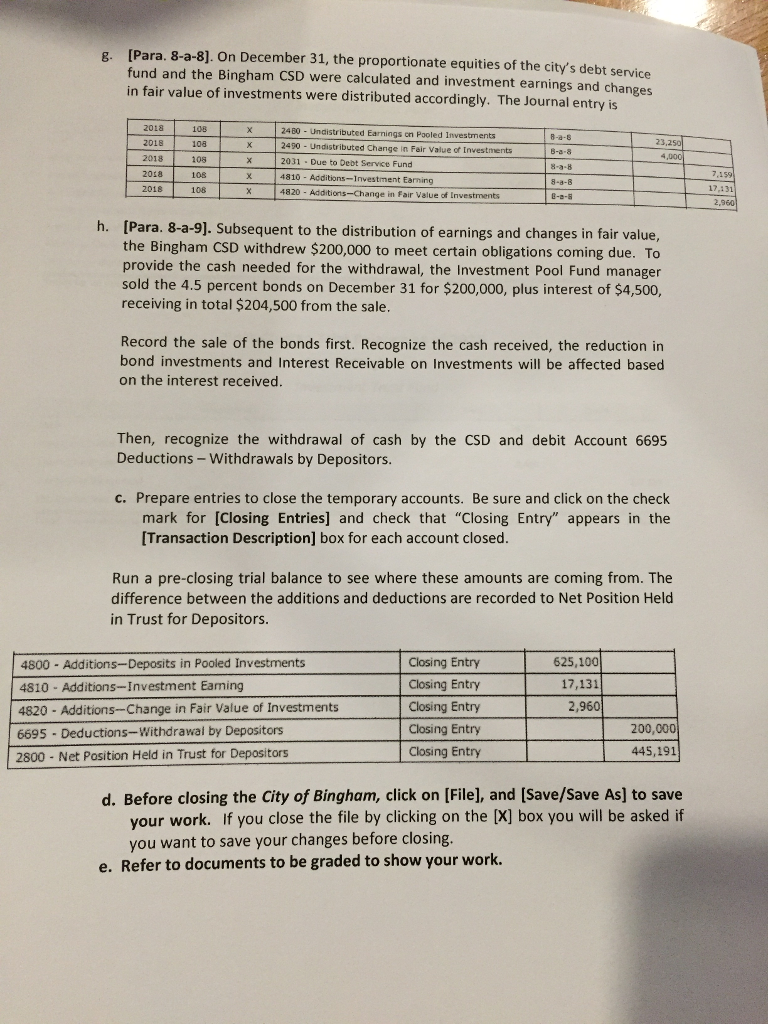

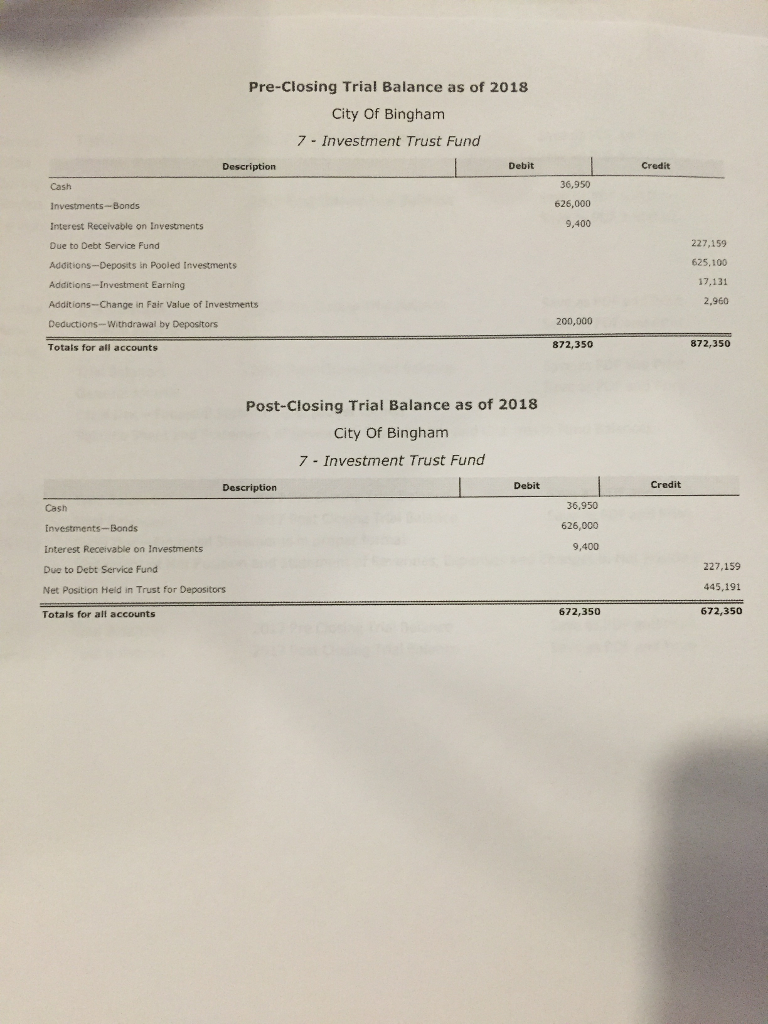

Recording Transactions Affecting a Fiduciary Fund-An Investment Trust Fund The city council of the City of Bingham decided in late 2017 to create an investment pool that would put the city's investments under professional management. The pool will be accounte for as an investment trust fund. The name of the fund, when it is established in early 2018, will be the Investment Pool Fund. The initial participants in the Investment Pool Fund will be the city's debt service fund and the Bingham Consolidated School District (CSD) The pool will be accounted for in acc cable to fiduciary funds; erefore, the city's debt service fund assets managed by the investment pool will not be reported in the Investment Pool Fund financial statements. Bingham as the administrator of the external investment pool also participates in the pool; therefore, its equity is considered internal and is not reported in the financial statements of the investment trust fund. Instead, the net position and changes in net position relating to the internal portion of the pool are presented in the financial statements of each participating fund and in the governmental activities and business-type activities of the sponsoring government's government-wide financial statements. Unless there is a request for a withdrawal, investment earnings and changes in the fair value of investments are distributed to participants only at year-end. During the year, investment earnings are added to an Undistributed Earnings on Pooled Investments account and changes in fair value are added to or subtracted from an Undistributed Change in Fair Value of Investments Account Record the following transactions that occurred during 2018 in the Investment Pool Fund. Do not forget to click on [Year] to change the date to 2018. a. 1. [Para. 8-a-1] On March 1, 2018, the Investment Pool Fund was formally established a. Record the receipt of $220,000 in cash from the city's own debt service fund (Acct 2031) Due to Debt Service Fund b. Record the receipt of an investment (Acct 1071) from the Bingham CSD of cash bonds having a market value of $622,000 on this date (Investments are recorded at market value on the date of receipt), and the receipt of Interest receivable in the amount of $3,100 (Acct 1090). Both of these receipts from the CSD will affect the amount recorded as Additions Deposits in Pooled Investments (Acct 4800) NOTE: The bonds purchased by the Bingham CSD had a book value of $620,000 on March 1, 2018. The bonds receive semi-annual interest of 3 percent per annum, on July 1 and January 1 each year a. [Para. 8-a-2] The Investment Pool Fund manager purchased 4.5 percent bonds on March 1 in the amount of $200,000 (1071). Because the bonds pay interest semi-annually on January 1 and July 1, the fund manager had to prepay accrued interest on the bonds for this March purchase in the amount of $1,500 (Acct 1090)