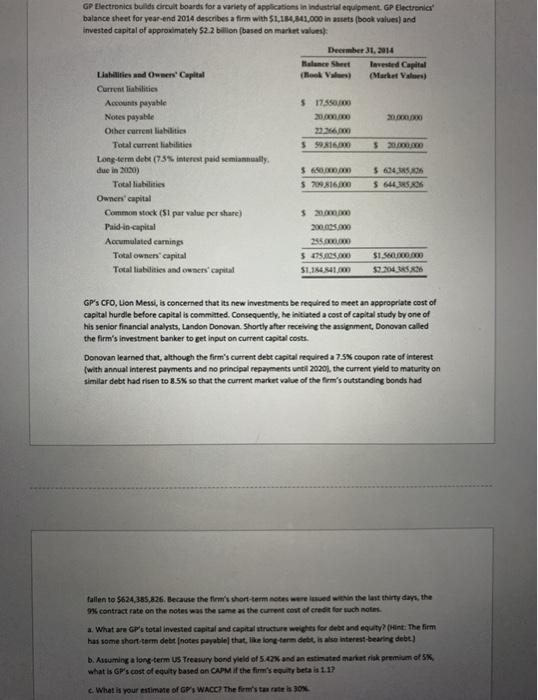

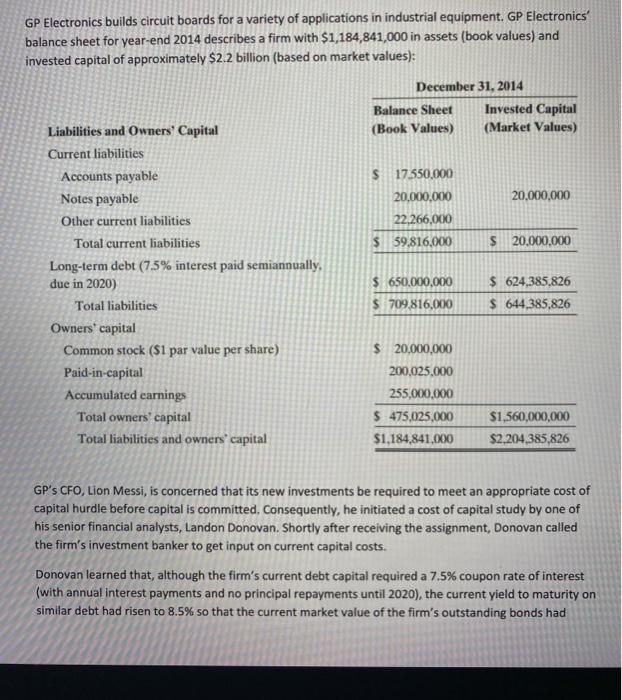

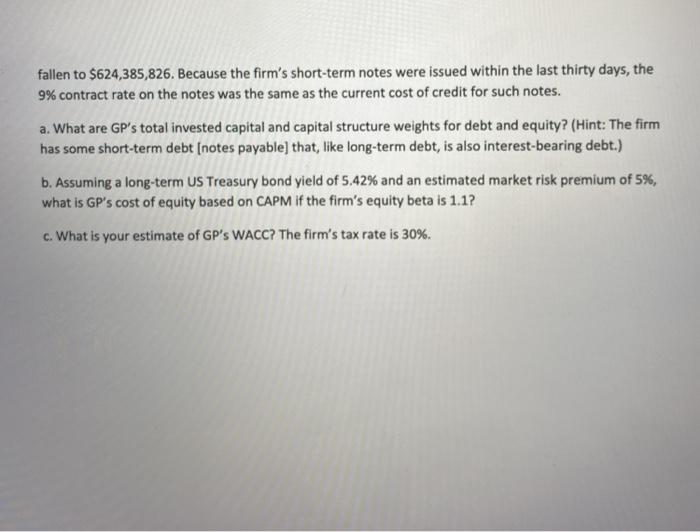

GP Electronics builds circuit boards for a variety of applications in industrial equipment. GP Electronic balance sheet for year-end 2014 describes a firm with $1,164,841.000 insets book values and invested capital of approximately $2.2 billion based on market values December 31, 2014 Malance Sheet levested Capital Liabilities and Owners Capital V (Market Var Current liabilities Accounts payable $17.50 100 Notes payable Other current liabilities 226,000 Total current liabilities $ 9916 $ Long-term debt (735 nerespaid remiannually due in 2000) $ 0.00 56246 Total liabilities 5209816.800 $ 64435.0 Owners' capital Common stock (51 par value per share) S DOO Paid-in-capital 200.025.000 Accumulated earning 285.000 Total owners capital 5.3.0 $1.500 Total liabilities and owners capital SLISS11.00 $9.304 GP's CFO, Lion Messi, is concerned that its new investments be required to meet an appropriate cost of capital hurdle before capital is committed. Consequently, he initiated a cost of capital study by one of his senior financial analysts, Landon Donovan Shortly after receiving the assignment, Donovan called the firm's investment banker to get input on current capital costs Donovan learned that, although the firm's current debt capital required a 75% coupon rate of interest (with annual interest payments and no principal repayments until 2020. the current yield to maturity on similar debt had risen to 8.5% so that the current market value of the firm's outstanding bonds had tallen to $624,385,826. Because the firm's short-term te wereld in the last thirty days, the 9% contract rate on the notes was the same as the current cost of credit for such notes a. What are GP's total invested capital and capital structure for det and equity? Hint: The firm has some short-term debet notes payable that like long-term det, is also interest-bearing debt) b. Assuming a long-term US Treewry bond yield of 5.42% and an estimated maitrisk premium of 5% what is GP's cost of equity based on mit the firm's quity betais 1.1? c. What is your estimate of GP's WACC The firm's tastes 30% GP Electronics builds circuit boards for a variety of applications in industrial equipment. GP Electronics balance sheet for year-end 2014 describes a firm with $1,184,841,000 in assets (book values) and invested capital of approximately $2.2 billion (based on market values): December 31, 2014 Balance Sheet Invested Capital (Book Values) (Market Values) 20,000,000 $ 17.550,000 20,000,000 22,266,000 $ 59,816,000 $ 20,000,000 Liabilities and Owners' Capital Current liabilities Accounts payable Notes payable Other current liabilities Total current liabilities Long-term debt (7.5% interest paid semiannually. due in 2020) Total liabilities Owners' capital Common stock (S1 par value per share) Paid-in-capital Accumulated earnings Total owners' capital Total liabilities and owners' capital $ 650,000,000 S 709.816,000 $ 624,385.826 $ 644,385,826 $ 20,000,000 200,025,000 255,000,000 $475,025,000 $1,184,841.000 $1,560,000,000 $2,204,385,826 GP's CFO, Lion Messi, is concerned that its new investments be required to meet an appropriate cost of capital hurdle before capital is committed. Consequently, he initiated a cost of capital study by one of his senior financial analysts, Landon Donovan. Shortly after receiving the assignment, Donovan called the firm's investment banker to get input on current capital costs. Donovan learned that, although the firm's current debt capital required a 7.5% coupon rate of interest (with annual interest payments and no principal repayments until 2020), the current yield to maturity on similar debt had risen to 8.5% so that the current market value of the firm's outstanding bonds had fallen to $624,385,826. Because the firm's short-term notes were issued within the last thirty days, the 9% contract rate on the notes was the same as the current cost of credit for such notes. a. What are GP's total invested capital and capital structure weights for debt and equity? (Hint: The firm has some short-term debt (notes payable) that, like long-term debt, is also interest-bearing debt.) b. Assuming a long-term US Treasury bond yield of 5,42% and an estimated market risk premium of 5%, what is GP's cost of equity based on CAPM if the firm's equity beta is 1.1? c. What is your estimate of GP's WACC? The firm's tax rate is 30%