Question

GPK plastics is a company that produces industrial grade trash liners. The liners themselves are a petroleum product and are therefore subject to the dramatic

GPK plastics is a company that produces industrial grade trash liners. The liners themselves are a petroleum product and are therefore subject to the dramatic swings in crude oil prices. Currently oil is at $50/barrel containing 42 gallons of crude each. Each individual bag takes 1/10 of a gallon to produce which costs GPK $0.12/bag or $6/unit (box of 50). Add in $1 for packaging and materials and $2 for labor per unit and GPK has a total production cost of $9/unit. Currently they are selling a box for $12 at a $3 profit. If GPK wanted to secure the right to purchase crude oil in the future within a set window of time at preselected price, what would be their best course of action?

Select one:

a. Put Option

b. Call Option

c. Future Contract

d. Forward Contract

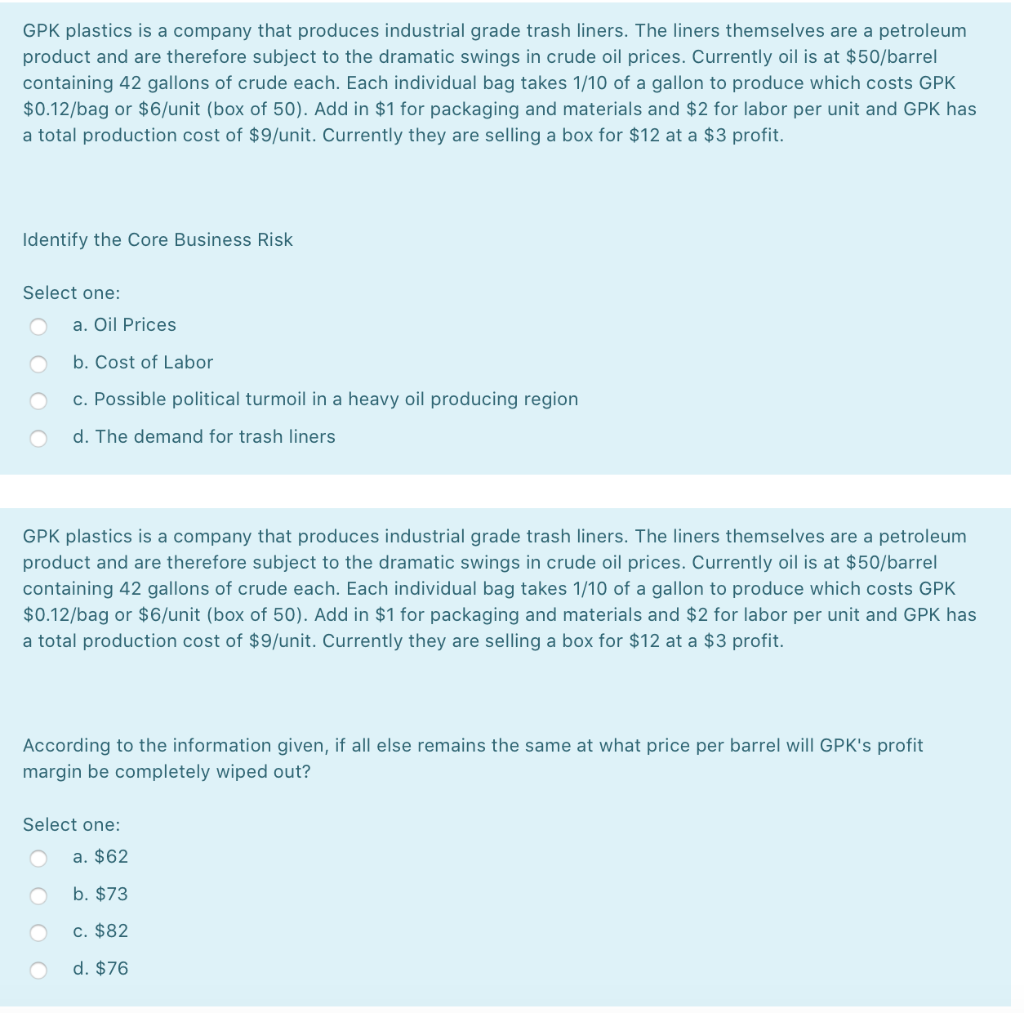

GPK plastics is a company that produces industrial grade trash liners. The liners themselves are a petroleum product and are therefore subject to the dramatic swings in crude oil prices. Currently oil is at $50/barrel containing 42 gallons of crude each. Each individual bag takes 1/10 of a gallon to produce which costs GPK $0.12/bag or $6/unit (box of 50). Add in $1 for packaging and materials and $2 for labor per unit and GPK has a total production cost of $9/unit. Currently they are selling a box for $12 at a $3 profit. Identify the Core Business Risk Select one: O a. Oil Prices b. Cost of Labor O c. Possible political turmoil in a heavy oil producing region O d. The demand for trash liners GPK plastics is a company that produces industrial grade trash liners. The liners themselves are a petroleum product and are therefore subject to the dramatic swings in crude oil prices. Currently oil is at $50/barrel containing 42 gallons of crude each. Each individual bag takes 1/10 of a gallon to produce which costs GPK $0.12/bag or $6/unit (box of 50). Add in $1 for packaging and materials and $2 for labor per unit and GPK has a total production cost of $9/unit. Currently they are selling a box for $12 at a $3 profit. According to the information given, if all else remains the same at what price per barrel will GPK's profit margin be completely wiped out? Select one: O a. $62 O b. $73 O c. $82 d. $76Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started