Question

Grace Charles, Inc. Create a full set of financial statements for 2017 with 2016 presented for comparison purposes (excluding footnotes) for Grace Charles, Inc. based

Grace Charles, Inc.

Create a full set of financial statements for 2017 with 2016 presented for comparison purposes (excluding footnotes) for Grace Charles, Inc. based on a trial balance provided to you. This should be created in an excel file and create a complete set of financial statements which must include a balance sheet, income statement, statement of stockholders' equity, and a cash flow statement (indirect method). It must be created in excell using a format acceptable by GAAP. The trial balance is final, there are no adjustments needed. You must include any work or schedules that were necessary to prepare in order to complete the statements.For example, the line item for Cash on the balance sheet will include more than one cash trail balance account. You must provide a schedule showing that the amount on the financial statement comes from the sum of the trial balance accounts. This must be completed for every financial statemnt line item that is composed of more than one account.

Additional information for Grace Charles, Inc.

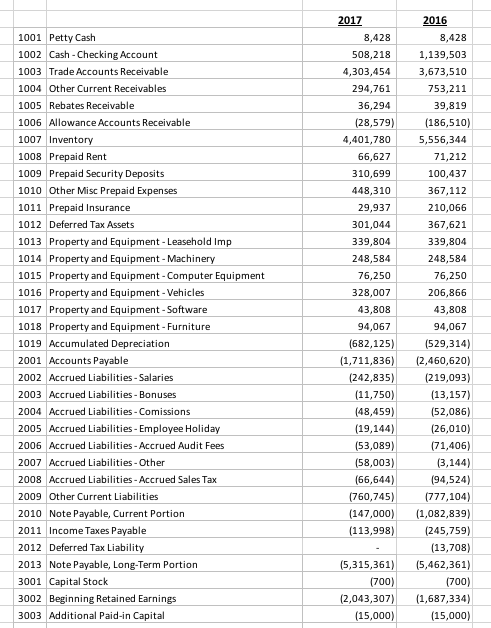

- Credits are negative and debits are positive amounts in the trail balance.

The numbering of the accounts in the trial balance

1000 - Assets

2000 - Liability

3000 - Equity

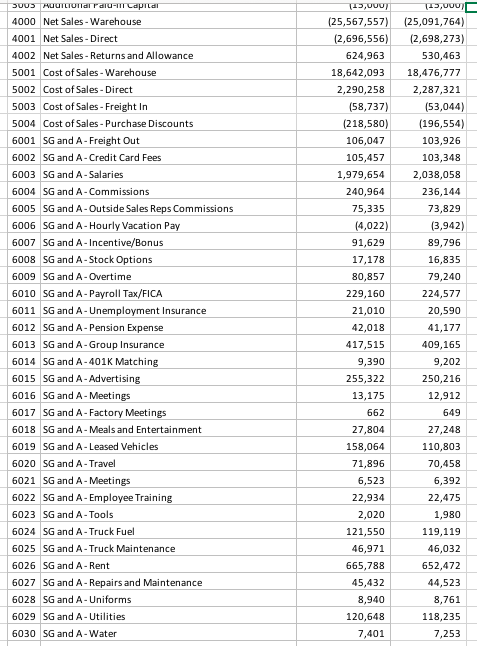

4000 - Revenue

5000 - Cost of Goods Sold

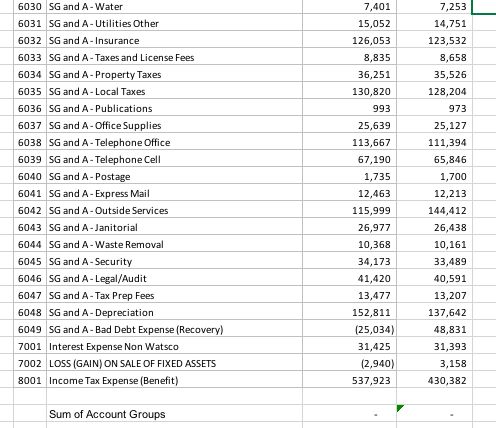

6000 - Operating Expense (Selling, General and Admin)

7000 - Other Income/ Expenses

8000 - Income Tax Expense

Cash payments on the note payable were $1,082,839 for 2017 and $ 210,000 for 2016

A vehicle was sold in 2017 for $10,000. The asset had a cost of $27,060 and accumulated depreciation of $20,000

A piece of machinery was sold in 2016 for $12,000. The asset had a cost of $30,158 and accumulated depreciation of $15,000

Property was purchased in 2017 for $128,201 and in 2016 for $230,297.

Equity:

Remember that the retained earnings amounts in the trial balance represent the beginning balance as of 1/1 of that year

1,000 shares of common stock were authorized and 700 shares were issued and outstanding prior to 2016. The par value is $1 per share

There are no potentially dilutive shares outstanding

No new shares were issued during 2017 and 2016

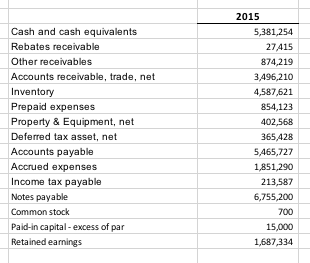

The only reason you need that you need the 2015 Balance Sheet is to prepare the 2016 cash flow statement

Balance Sheet - 2015

Trail Balance - 2017 and 2016 (3 Photos all one continuous trial balance)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started