Answered step by step

Verified Expert Solution

Question

1 Approved Answer

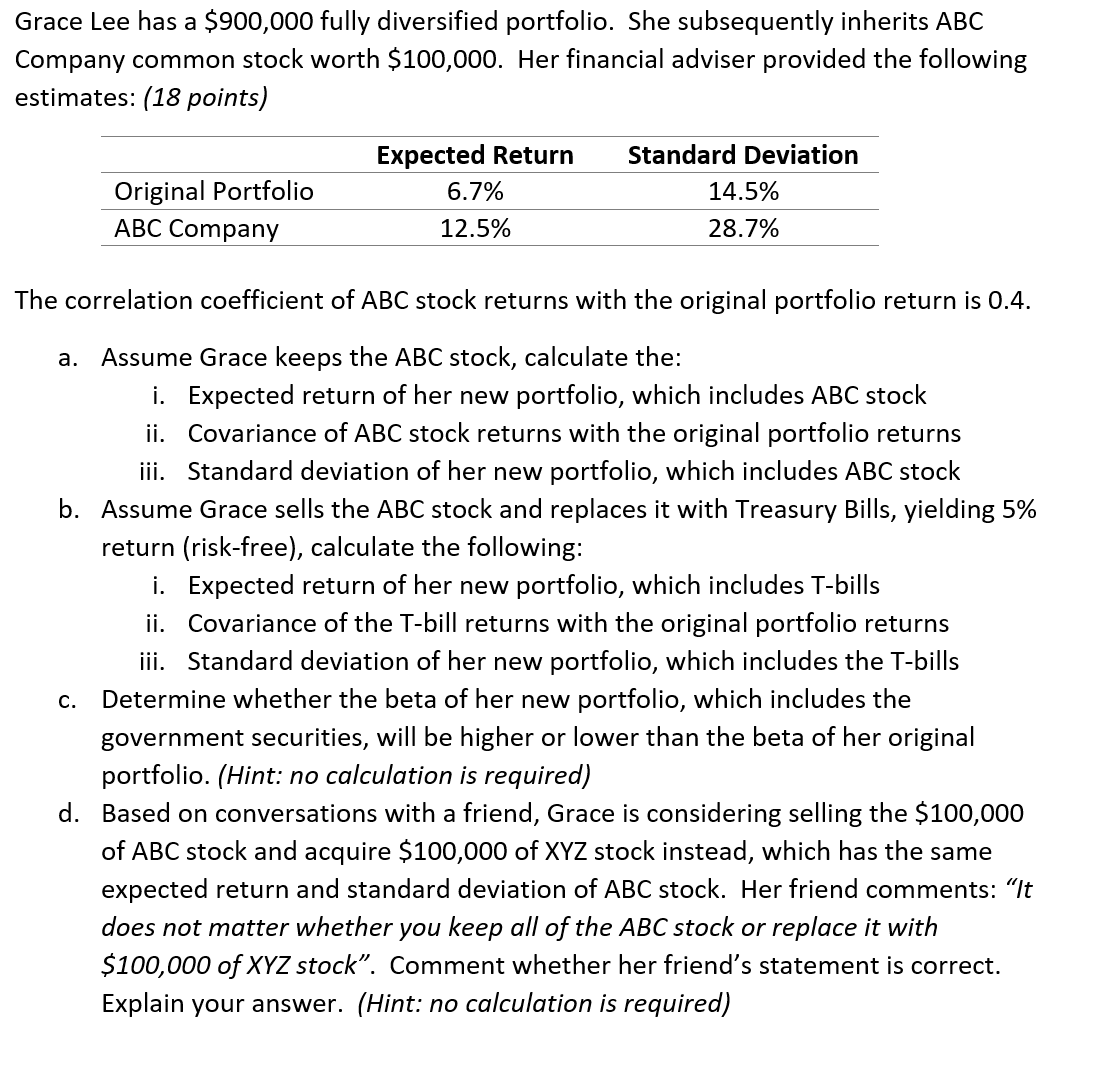

Grace Lee has a $900,000 fully diversified portfolio. She subsequently inherits ABC Company common stock worth $100,000. Her financial adviser provided the following estimates: (18

Grace Lee has a $900,000 fully diversified portfolio. She subsequently inherits ABC Company common stock worth $100,000. Her financial adviser provided the following estimates: (18 points) The correlation coefficient of ABC stock returns with the original portfolio return is 0.4 . a. Assume Grace keeps the ABC stock, calculate the: i. Expected return of her new portfolio, which includes ABC stock ii. Covariance of ABC stock returns with the original portfolio returns iii. Standard deviation of her new portfolio, which includes ABC stock b. Assume Grace sells the ABC stock and replaces it with Treasury Bills, yielding 5% return (risk-free), calculate the following: i. Expected return of her new portfolio, which includes T-bills ii. Covariance of the T-bill returns with the original portfolio returns iii. Standard deviation of her new portfolio, which includes the T-bills c. Determine whether the beta of her new portfolio, which includes the government securities, will be higher or lower than the beta of her original portfolio. (Hint: no calculation is required) d. Based on conversations with a friend, Grace is considering selling the $100,000 of ABC stock and acquire $100,000 of XYZ stock instead, which has the same expected return and standard deviation of ABC stock. Her friend comments: "It does not matter whether you keep all of the ABC stock or replace it with $100,000 of XYZ stock". Comment whether her friend's statement is correct. Explain your answer. (Hint: no calculation is required)

Grace Lee has a $900,000 fully diversified portfolio. She subsequently inherits ABC Company common stock worth $100,000. Her financial adviser provided the following estimates: (18 points) The correlation coefficient of ABC stock returns with the original portfolio return is 0.4 . a. Assume Grace keeps the ABC stock, calculate the: i. Expected return of her new portfolio, which includes ABC stock ii. Covariance of ABC stock returns with the original portfolio returns iii. Standard deviation of her new portfolio, which includes ABC stock b. Assume Grace sells the ABC stock and replaces it with Treasury Bills, yielding 5% return (risk-free), calculate the following: i. Expected return of her new portfolio, which includes T-bills ii. Covariance of the T-bill returns with the original portfolio returns iii. Standard deviation of her new portfolio, which includes the T-bills c. Determine whether the beta of her new portfolio, which includes the government securities, will be higher or lower than the beta of her original portfolio. (Hint: no calculation is required) d. Based on conversations with a friend, Grace is considering selling the $100,000 of ABC stock and acquire $100,000 of XYZ stock instead, which has the same expected return and standard deviation of ABC stock. Her friend comments: "It does not matter whether you keep all of the ABC stock or replace it with $100,000 of XYZ stock". Comment whether her friend's statement is correct. Explain your answer. (Hint: no calculation is required) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started