Answered step by step

Verified Expert Solution

Question

1 Approved Answer

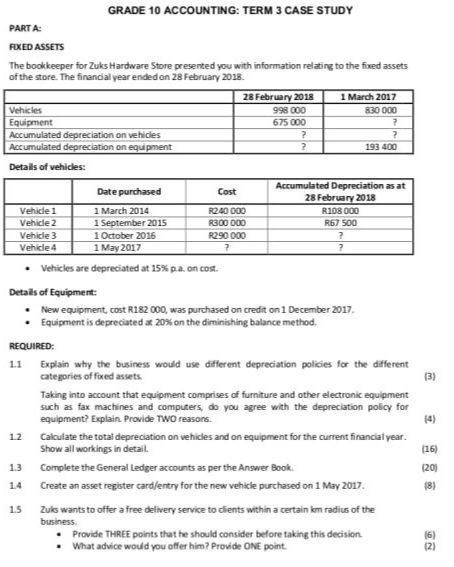

GRADE 10 ACCOUNTING: TERM 3 CASE STUDY PART A: FXED ASSETS The bockkeeper for Zuks Hardware Store presented you with information relating to the fixed

GRADE 10 ACCOUNTING: TERM 3 CASE STUDY PART A: FXED ASSETS The bockkeeper for Zuks Hardware Store presented you with information relating to the fixed assets of the store. The financlal year ended on 28 February 2018. Detalls of vehicles: - Vehicles are depreciated at 15% p.a. on cost. Details of Equipment: - New equipment, cost R182 000, was purchased on credit on 1 December 2017. - Equipment is depreciated ar. 20% on the diminishing balance method. REQUIRED: 1.1 Explain why the business would use different depreciation policies for the different categories of fored assets. (3) Taking into account that equipment comprises of furniture and other electronic equipment such as fax machines and computers, do you agree with the depreciation policy for equipment? Explain. Provide TWO reasors. (4) 12 Calculate the total depreciation on vehicles and on equipment for the current financlal year. Show all workings in detail. 1.3 Complete the General Ledger accounts as per the Answer Book. 1.4 Create an asset register card/entry for the new vehicle purchased on 1 May 2017. 1.5 Zuks wants to offer a free delivery service to clients within a certain km radius of the business. - Provide THREE points that he should consider before taking this decision. (6) - What advice would you offer him? Provide ONE point. (2) GRADE 10 ACCOUNTING: TERM 3 CASE STUDY PART A: FXED ASSETS The bockkeeper for Zuks Hardware Store presented you with information relating to the fixed assets of the store. The financlal year ended on 28 February 2018. Detalls of vehicles: - Vehicles are depreciated at 15% p.a. on cost. Details of Equipment: - New equipment, cost R182 000, was purchased on credit on 1 December 2017. - Equipment is depreciated ar. 20% on the diminishing balance method. REQUIRED: 1.1 Explain why the business would use different depreciation policies for the different categories of fored assets. (3) Taking into account that equipment comprises of furniture and other electronic equipment such as fax machines and computers, do you agree with the depreciation policy for equipment? Explain. Provide TWO reasors. (4) 12 Calculate the total depreciation on vehicles and on equipment for the current financlal year. Show all workings in detail. 1.3 Complete the General Ledger accounts as per the Answer Book. 1.4 Create an asset register card/entry for the new vehicle purchased on 1 May 2017. 1.5 Zuks wants to offer a free delivery service to clients within a certain km radius of the business. - Provide THREE points that he should consider before taking this decision. (6) - What advice would you offer him? Provide ONE point. (2)

GRADE 10 ACCOUNTING: TERM 3 CASE STUDY PART A: FXED ASSETS The bockkeeper for Zuks Hardware Store presented you with information relating to the fixed assets of the store. The financlal year ended on 28 February 2018. Detalls of vehicles: - Vehicles are depreciated at 15% p.a. on cost. Details of Equipment: - New equipment, cost R182 000, was purchased on credit on 1 December 2017. - Equipment is depreciated ar. 20% on the diminishing balance method. REQUIRED: 1.1 Explain why the business would use different depreciation policies for the different categories of fored assets. (3) Taking into account that equipment comprises of furniture and other electronic equipment such as fax machines and computers, do you agree with the depreciation policy for equipment? Explain. Provide TWO reasors. (4) 12 Calculate the total depreciation on vehicles and on equipment for the current financlal year. Show all workings in detail. 1.3 Complete the General Ledger accounts as per the Answer Book. 1.4 Create an asset register card/entry for the new vehicle purchased on 1 May 2017. 1.5 Zuks wants to offer a free delivery service to clients within a certain km radius of the business. - Provide THREE points that he should consider before taking this decision. (6) - What advice would you offer him? Provide ONE point. (2) GRADE 10 ACCOUNTING: TERM 3 CASE STUDY PART A: FXED ASSETS The bockkeeper for Zuks Hardware Store presented you with information relating to the fixed assets of the store. The financlal year ended on 28 February 2018. Detalls of vehicles: - Vehicles are depreciated at 15% p.a. on cost. Details of Equipment: - New equipment, cost R182 000, was purchased on credit on 1 December 2017. - Equipment is depreciated ar. 20% on the diminishing balance method. REQUIRED: 1.1 Explain why the business would use different depreciation policies for the different categories of fored assets. (3) Taking into account that equipment comprises of furniture and other electronic equipment such as fax machines and computers, do you agree with the depreciation policy for equipment? Explain. Provide TWO reasors. (4) 12 Calculate the total depreciation on vehicles and on equipment for the current financlal year. Show all workings in detail. 1.3 Complete the General Ledger accounts as per the Answer Book. 1.4 Create an asset register card/entry for the new vehicle purchased on 1 May 2017. 1.5 Zuks wants to offer a free delivery service to clients within a certain km radius of the business. - Provide THREE points that he should consider before taking this decision. (6) - What advice would you offer him? Provide ONE point. (2) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started