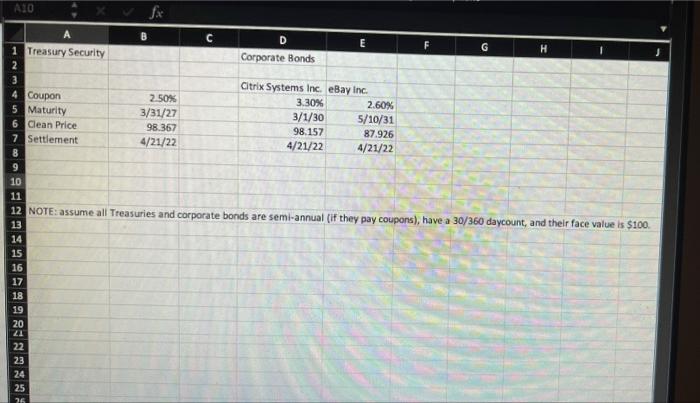

grade) securities Construct the portfolio that you believe is more appropriate for your client, show the percentage and money invested in each bond. Explain why you believe your portfolio is the optimal one for your client. If you need to make assumptions about the future (trajectory of interest rates, state of the economy, etc.) follow the insights from the ML Fixed Income Digest document attached to this assignment; if you disagree with this document, you need to explain why. In addition to the narrative you have to a) Show numerically that your portfolio adds up to $12 million in market value terms. b) Show numerically that it satisfies the constraints set up by your client. c) Compute the D' and DV01 of your portfolio. d) Compute the Altman Z-score for the corporate bonds in your portfolio and compute the par value-weighted Z-score of your portfolio (assume Treasuries have a Z-score of 5). A10 B C E G H 1 Treasury Security Corporate Bonds 3 Citrix Systems Inc. eBay Inc. 4 Coupon 2.50% 3.30% 2.60% 5 Maturity 3/31/27 3/1/30 5/10/31 6 Clean Price 98.367 98.157 87.926 7 Settlement 4/21/22 4/21/22 4/21/22 8 9 10 11 12 NOTE: assume all Treasures and corporate bonds are semi-annual (if they pay coupons), have a 30/360 daycount, and their face value is $100 13 14 15 16 17 18 19 20 21 22 23 24 25 75 grade) securities Construct the portfolio that you believe is more appropriate for your client, show the percentage and money invested in each bond. Explain why you believe your portfolio is the optimal one for your client. If you need to make assumptions about the future (trajectory of interest rates, state of the economy, etc.) follow the insights from the ML Fixed Income Digest document attached to this assignment; if you disagree with this document, you need to explain why. In addition to the narrative you have to a) Show numerically that your portfolio adds up to $12 million in market value terms. b) Show numerically that it satisfies the constraints set up by your client. c) Compute the D' and DV01 of your portfolio. d) Compute the Altman Z-score for the corporate bonds in your portfolio and compute the par value-weighted Z-score of your portfolio (assume Treasuries have a Z-score of 5). A10 B C E G H 1 Treasury Security Corporate Bonds 3 Citrix Systems Inc. eBay Inc. 4 Coupon 2.50% 3.30% 2.60% 5 Maturity 3/31/27 3/1/30 5/10/31 6 Clean Price 98.367 98.157 87.926 7 Settlement 4/21/22 4/21/22 4/21/22 8 9 10 11 12 NOTE: assume all Treasures and corporate bonds are semi-annual (if they pay coupons), have a 30/360 daycount, and their face value is $100 13 14 15 16 17 18 19 20 21 22 23 24 25 75