Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Graded Exercise 3 : Due Date: 25 October 2023 (Week 9) Question (20 marks) Senyuman Factory normally produces and sells 30,000 units of RG-6 each

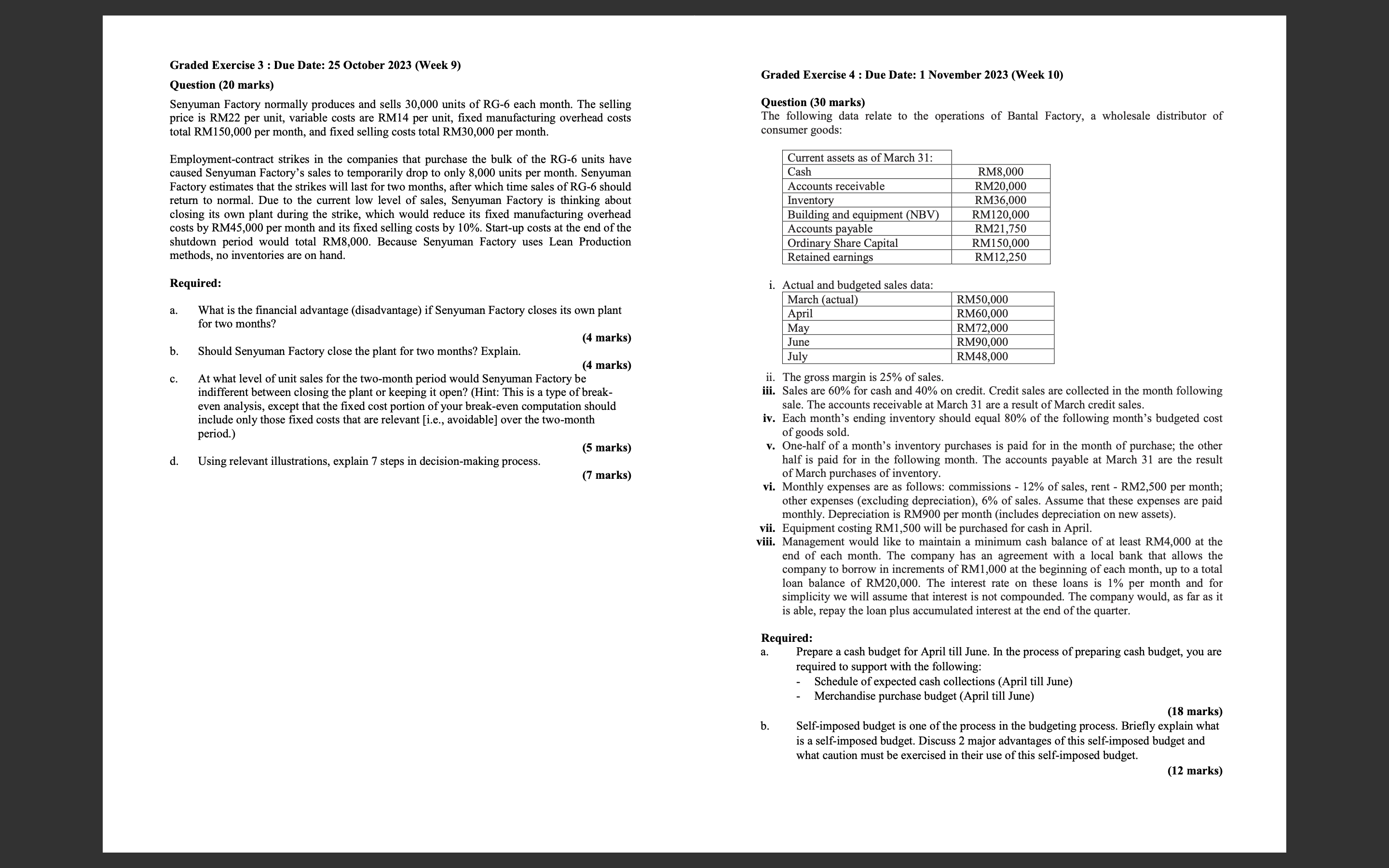

Graded Exercise 3 : Due Date: 25 October 2023 (Week 9) Question (20 marks) Senyuman Factory normally produces and sells 30,000 units of RG-6 each month. The selling price is RM22 per unit, variable costs are RM14 per unit, fixed manufacturing overhead costs total RM150,000 per month, and fixed selling costs total RM30,000 per month. Employment-contract strikes in the companies that purchase the bulk of the RG-6 units have caused Senyuman Factory's sales to temporarily drop to only 8,000 units per month. Senyuman Factory estimates that the strikes will last for two months, after which time sales of RG-6 should return to normal. Due to the current low level of sales, Senyuman Factory is thinking about closing its own plant during the strike, which would reduce its fixed manufacturing overhead costs by RM45,000 per month and its fixed selling costs by 10%. Start-up costs at the end of the shutdown period would total RM8,000. Because Senyuman Factory uses Lean Production methods, no inventories are on hand. Required: a. What is the financial advantage (disadvantage) if Senyuman Factory closes its own plant for two months? b. Should Senyuman Factory close the plant for two months? Explain. (4 marks) (4 marks) c. At what level of unit sales for the two-month period would Senyuman Factory be indifferent between closing the plant or keeping it open? (Hint: This is a type of breakeven analysis, except that the fixed cost portion of your break-even computation should include only those fixed costs that are relevant [i.e., avoidable] over the two-month period.) d. Using relevant illustrations, explain 7 steps in decision-making process. Graded Exercise 4 : Due Date: 1 November 2023 (Week 10) Question (30 marks) The following data relate to the operations of Bantal Factory, a wholesale distributor of consumer goods: i. ii. The gross margin is 25% of sales. iii. Sales are 60% for cash and 40% on credit. Credit sales are collected in the month following sale. The accounts receivable at March 31 are a result of March credit sales. iv. Each month's ending inventory should equal 80% of the following month's budgeted cost of goods sold. v. One-half of a month's inventory purchases is paid for in the month of purchase; the other half is paid for in the following month. The accounts payable at March 31 are the result of March purchases of inventory. vi. Monthly expenses are as follows: commissions - 12% of sales, rent - RM2,500 per month; other expenses (excluding depreciation), 6\% of sales. Assume that these expenses are paid monthly. Depreciation is RM900 per month (includes depreciation on new assets). vii. Equipment costing RM1,500 will be purchased for cash in April. viii. Management would like to maintain a minimum cash balance of at least RM4,000 at the end of each month. The company has an agreement with a local bank that allows the company to borrow in increments of RM1,000 at the beginning of each month, up to a total loan balance of RM20,000. The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the quarter. Required: a. Prepare a cash budget for April till June. In the process of preparing cash budget, you are required to support with the following: - Schedule of expected cash collections (April till June) - Merchandise purchase budget (April till June) (18 marks) b. Self-imposed budget is one of the process in the budgeting process. Briefly explain what is a self-imposed budget. Discuss 2 major advantages of this self-imposed budget and

Graded Exercise 3 : Due Date: 25 October 2023 (Week 9) Question (20 marks) Senyuman Factory normally produces and sells 30,000 units of RG-6 each month. The selling price is RM22 per unit, variable costs are RM14 per unit, fixed manufacturing overhead costs total RM150,000 per month, and fixed selling costs total RM30,000 per month. Employment-contract strikes in the companies that purchase the bulk of the RG-6 units have caused Senyuman Factory's sales to temporarily drop to only 8,000 units per month. Senyuman Factory estimates that the strikes will last for two months, after which time sales of RG-6 should return to normal. Due to the current low level of sales, Senyuman Factory is thinking about closing its own plant during the strike, which would reduce its fixed manufacturing overhead costs by RM45,000 per month and its fixed selling costs by 10%. Start-up costs at the end of the shutdown period would total RM8,000. Because Senyuman Factory uses Lean Production methods, no inventories are on hand. Required: a. What is the financial advantage (disadvantage) if Senyuman Factory closes its own plant for two months? b. Should Senyuman Factory close the plant for two months? Explain. (4 marks) (4 marks) c. At what level of unit sales for the two-month period would Senyuman Factory be indifferent between closing the plant or keeping it open? (Hint: This is a type of breakeven analysis, except that the fixed cost portion of your break-even computation should include only those fixed costs that are relevant [i.e., avoidable] over the two-month period.) d. Using relevant illustrations, explain 7 steps in decision-making process. Graded Exercise 4 : Due Date: 1 November 2023 (Week 10) Question (30 marks) The following data relate to the operations of Bantal Factory, a wholesale distributor of consumer goods: i. ii. The gross margin is 25% of sales. iii. Sales are 60% for cash and 40% on credit. Credit sales are collected in the month following sale. The accounts receivable at March 31 are a result of March credit sales. iv. Each month's ending inventory should equal 80% of the following month's budgeted cost of goods sold. v. One-half of a month's inventory purchases is paid for in the month of purchase; the other half is paid for in the following month. The accounts payable at March 31 are the result of March purchases of inventory. vi. Monthly expenses are as follows: commissions - 12% of sales, rent - RM2,500 per month; other expenses (excluding depreciation), 6\% of sales. Assume that these expenses are paid monthly. Depreciation is RM900 per month (includes depreciation on new assets). vii. Equipment costing RM1,500 will be purchased for cash in April. viii. Management would like to maintain a minimum cash balance of at least RM4,000 at the end of each month. The company has an agreement with a local bank that allows the company to borrow in increments of RM1,000 at the beginning of each month, up to a total loan balance of RM20,000. The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the quarter. Required: a. Prepare a cash budget for April till June. In the process of preparing cash budget, you are required to support with the following: - Schedule of expected cash collections (April till June) - Merchandise purchase budget (April till June) (18 marks) b. Self-imposed budget is one of the process in the budgeting process. Briefly explain what is a self-imposed budget. Discuss 2 major advantages of this self-imposed budget and Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started