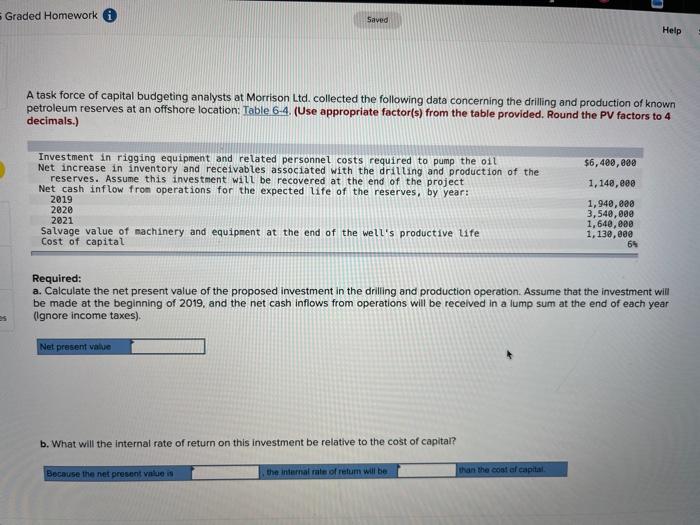

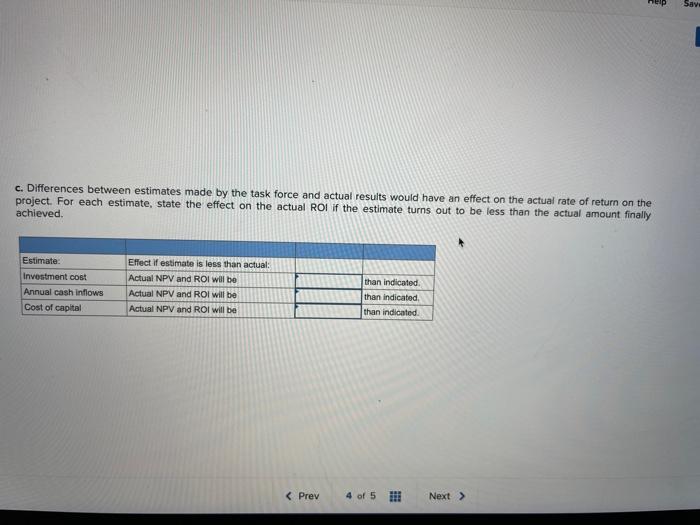

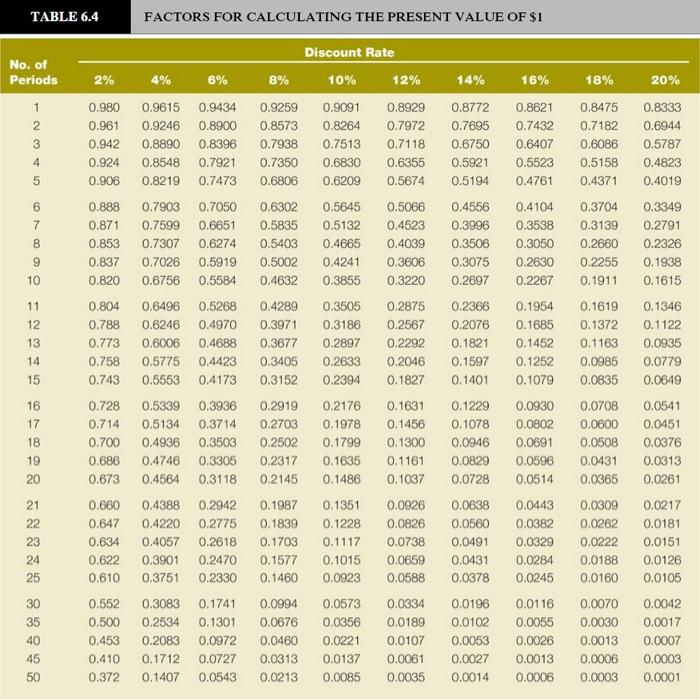

Graded Homework Saved Help A task force of capital budgeting analysts at Morrison Ltd. collected the following data concerning the drilling and production of known petroleum reserves at an offshore location: Table 6-4. (Use appropriate factor(s) from the table provided. Round the PV factors to 4 decimals.) Investment in rigging equipment and related personnel costs required to pump the oil Net increase in inventory and receivables associated with the drilling and production of the reserves. Assume this investment will be recovered at the end of the project Net cash inflow from operations for the expected life of the reserves, by year: 2019 2020 2021 Salvage value of machinery and equipment at the end of the well's productive life Cost of capital $6,400,000 1,140,000 1,940,000 3,540,000 1,640,000 1,130,000 65 Required: a. Calculate the net present value of the proposed investment in the drilling and production operation. Assume that the investment will be made at the beginning of 2019, and the net cash inflows from operations will be received in a lump sum at the end of each year (ignore income taxes). Net present value b. What will the internal rate of return on this investment be relative to the cost of capital? Because the net present vniue is the internal rate of retum will be than the cost of capital Sav. c. Differences between estimates made by the task force and actual results would have an effect on the actual rate of return on the project. For each estimate, state the effect on the actual ROI if the estimate turns out to be less than the actual amount finally achieved. Estimate: Investment cost Annual cash inflows Cost of capital Effectif estimate is less than actual: Actual NPV and ROI will be Actual NPV and ROI will be Actual NPV and ROI will be than indicated than indicated than indicated TABLE 6.4 FACTORS FOR CALCULATING THE PRESENT VALUE OF $1 No. of Periods 2% 6% 8% 14% 16% 18% 20% 0.9615 0.8621 1 2 3 0.980 0.961 0.942 0.924 0.906 0.9434 0.8900 0.8396 0.7921 0.7473 Discount Rate 10% 12% 0.9259 0.9091 0.8929 0.8573 0.8264 0.7972 0.7938 0.7513 0.7118 0.7350 0.6830 0.6355 0.6806 0.6209 0.5674 0.9246 0.8890 0.8548 0.8219 0.8772 0.7695 0.6750 0.5921 0.5194 0.7432 0.6407 0.5523 0.4761 0.8475 0.7182 0.6086 0.5158 0.4371 0.8333 0.6944 0.5787 0.4823 0.4019 4 5 0.3349 6 7 8 9 10 0.888 0.871 0.853 0.837 0.820 0.7903 0.7599 0.7307 0.7026 0.6756 0.7050 0.6651 0.6274 0.5919 0.5584 0.6302 0.5835 0.5403 0.5002 0.4632 0.5645 0.5132 0.4665 0.4241 0.3855 0.5066 0.4523 0.4039 0.3606 0.3220 0.4556 0.3996 0.3506 0.3075 0.2697 0.4104 0.3538 0.3050 0.2630 0.2267 0.3704 0.3139 0.2660 0.2255 0.1911 0.2791 0.2326 0.1938 0.1615 11 12 13 14 15 0.804 0.788 0.773 0.758 0.743 0.6496 0.6246 0.6006 0.5775 0.5553 0.5268 0.4970 0.4688 0.4423 0.4173 0.4289 0.3971 0.3677 0.3405 0.3152 0.3505 0.3186 0.2897 0.2633 0.2394 0.2875 0.2567 0.2292 0.2046 0.1827 0.2366 0.2076 0.1821 0.1597 0.1401 0.1346 0.1122 0.0935 0.0779 0.0649 0.1954 0.1685 0.1452 0.1252 0.1079 0.0930 0.0802 0.0691 0.0596 0.0514 0.1619 0.1372 0.1163 0.0985 0.0835 0.0708 0.0600 0.0508 0.0431 0.0365 16 0.728 0.714 0.700 17 18 19 20 0.2919 0.2703 0.2502 0.2317 0.2145 0.2176 0.1978 0.1799 0.1635 0.1486 0.1631 0.1456 0.1300 0.1161 0.1037 0.1229 0.1078 0.0946 0.0829 0.0728 0.0541 0.0451 0.0376 0.0313 0.0261 0.686 0.673 0.5339 0.3936 0.5134 0.3714 0.4936 0.3503 0.4746 0.3305 0.4564 0.3118 0.4388 0.2942 0.4220 0.2775 0.4057 0.2618 0.3901 0.2470 0.3751 0.2330 21 22 23 24 25 0.660 0.647 0.634 0.622 0.610 0.1987 0.1839 0.1703 0.1577 0.1460 0.1351 0.1228 0.1117 0.1015 0.0923 0.0926 0.0826 0.0738 0.0659 0.0588 0.0638 0.0560 0.0491 0.0431 0.0378 0.0443 0.0382 0.0329 0.0284 0.0245 0.0309 0.0262 0.0222 0.0188 0.0160 0.0217 0.0181 0.0151 0.0126 0.0105 30 35 40 45 50 0.552 0.500 0.453 0.410 0.372 0.3083 0.1741 0.2534 0.1301 0.2083 0.0972 0.1712 0.0727 0.1407 0.0543 0.0994 0.0676 0.0460 0.0313 0.0213 0.0573 0.0356 0.0221 0.0137 0.0085 0.0334 0.0189 0.0107 0.0061 0.0035 0.0196 0.0102 0.0053 0.0027 0.0014 0.0116 0.0055 0.0026 0.0013 0.0006 0.0070 0.0030 0.0013 0.0006 0.0003 0.0042 0.0017 0.0007 0.0003 0.0001