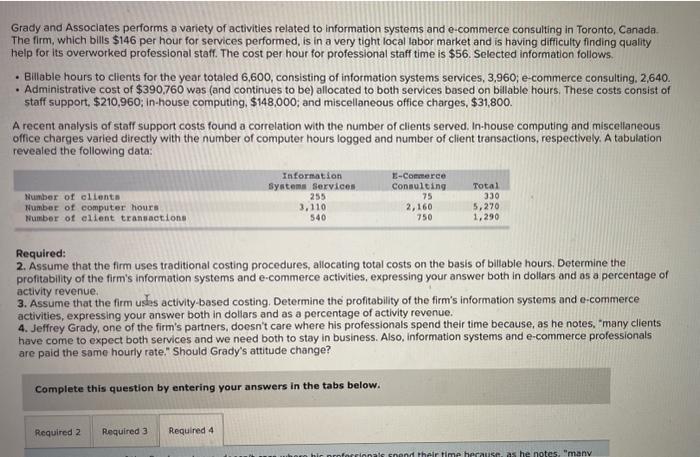

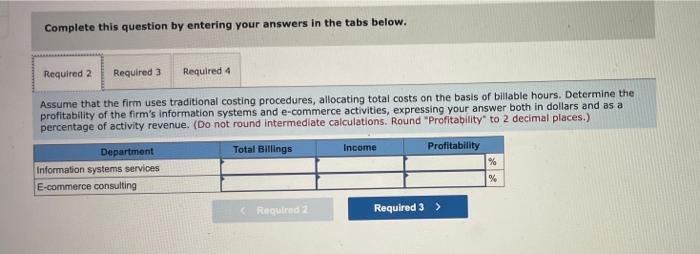

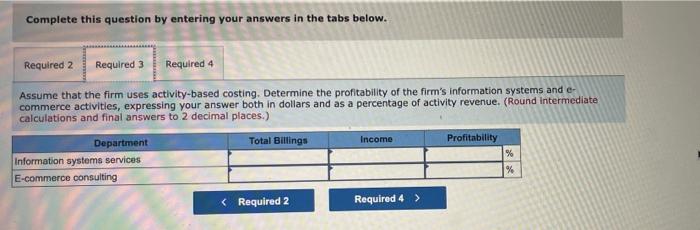

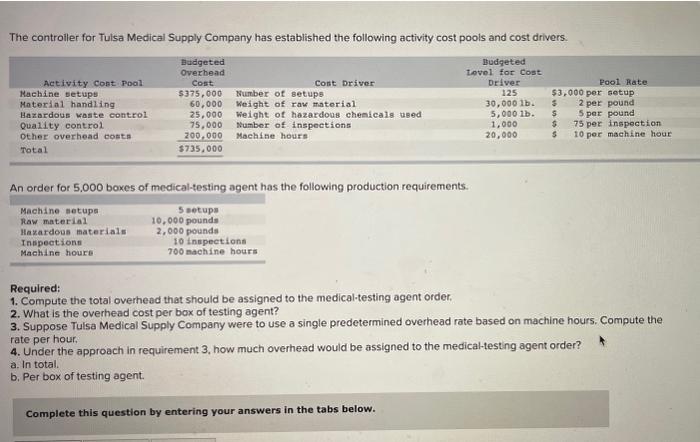

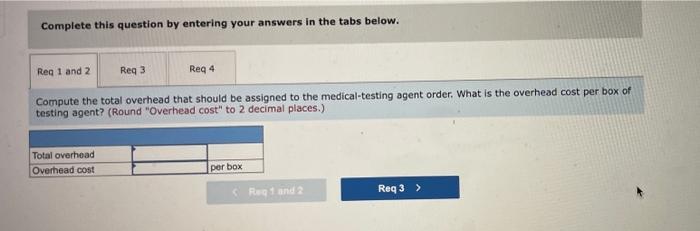

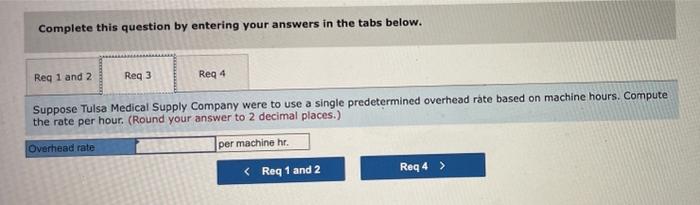

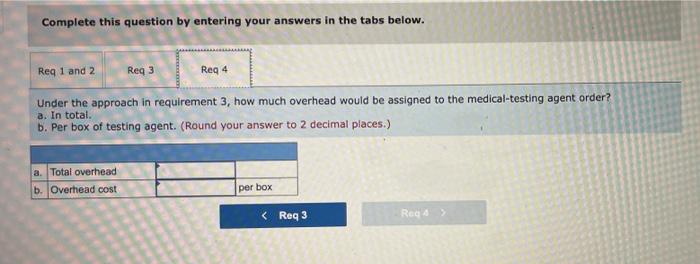

Grady and Associates performs a variety of activities related to information systems and e-commerce consulting in Toronto, Canada. The firm, which bills \$146 per hour for services performed, is in a very tight local labor market and is having difficulty finding quality help for its overworked professional staff. The cost per hour for professional staff time is $56. Selected information follows. - Billable hours to clients for the year totaled 6,600, consisting of information systems services, 3,960; e-commerce consulting. 2,640. - Administrative cost of $390,760 was (and continues to be) allocated to both services based on billable hours, These costs consist of staff support, $210,960; in-house computing, $148,000; and miscellaneous office charges, $31,800. A recent analysis of staff support costs found a correlation with the number of clients served. In-house computing and miscellaneous office charges varied directly with the number of computer hours logged and number of client transactions, respectively, A tabulation revealed the following data: Required: 2. Assume that the firm uses traditional costing procedures, allocating total costs on the basis of billable hours. Determine the profitability of the firm's information systems and e-commerce activities, expressing your answer both in dollars and as a percentage of activity revenue. 3. Assume that the firm uses activity-based costing. Determine the profitability of the firm's information systems and e-commerce activities, expressing your answer both in dollars and as a percentage of activity revenue. 4. Jeffrey Grady, one of the firm's partners, doesn't care where his professionals spend their time because, as he notes, "many clients have come to expect both services and we need both to stay in business. Also, information systems and e-commerce professionals are paid the same hourly rate." Should Grady's attitude change? Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Assume that the firm uses traditional costing procedures, allocating total costs on the basis of billable hours. Determine the profitability of the firm's information systems and e-commerce activities, expressing your answer both in dollars and as a percentage of activity revenue. (Do not round intermediate calculations. Round "Profitability" to 2 decimal places.) Complete this question by entering your answers in the tabs below. Assume that the firm uses activity-based costing. Determine the profitability of the firm's information systems and ecommerce activities, expressing your answer both in dollars and as a percentage of activity revenue. (Round intermediate calculations and final answers to 2 decimal places.) Complete this question by entering your answers in the tabs below. Jeffrey Grady, one of the firm's partners, doesnt care where his professionals spend their time because, as he notes, "many clients have come to expect both services and we need both to stay in business. Also, Information systems and e-commerce professionals are paid the same hourly rate." Should Grady's attitude change? The controller for Tulsa Medical Supply Company has established the following activity cost pools and cost drivers. An order for 5.000 boxes of medical-testing agent has the following production requirements Required: 1. Compute the total overhead that should be assigned to the medical-testing agent order. 2. What is the overhead cost per box of testing agent? 3. Suppose Tulsa Medical Supply Company were to use a single predetermined overhead rate based on machine hours. Compute the rate per hour. 4. Under the approach in requirement 3 , how much overhead would be assigned to the medical-testing agent order? a. In total. b. Per box of testing agent. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Compute the total overhead that should be assigned to the medical-testing agent order. What is the overhead cost per box of testing agent? (Round "Overhead cost" to 2 decimal places.) Complete this question by entering your answers in the tabs below. Suppose Tulsa Medical Supply Company were to use a single predetermined overhead rate based on machine hours. Compute the rate per hour. (Round your answer to 2 decimal places.) Complete this question by entering your answers in the tabs below. Under the approach in requirement 3, how much overhead would be assigned to the medical-testing agent order? a. In total. b. Per box of testing agent. (Round your answer to 2 decimal places.)