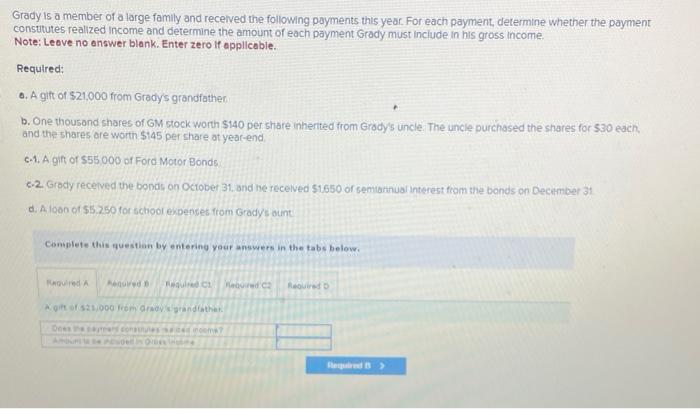

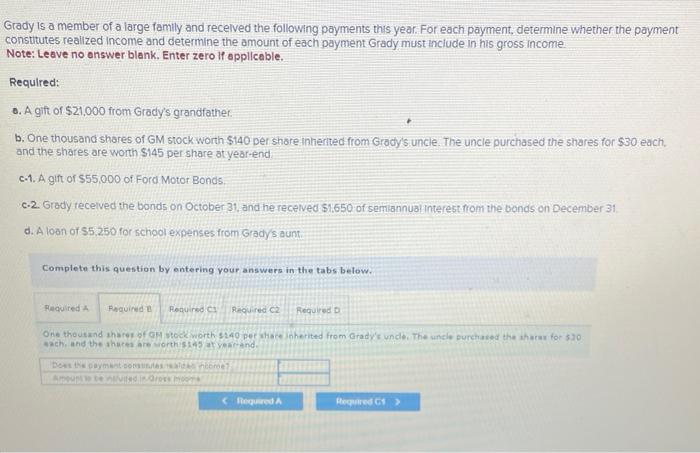

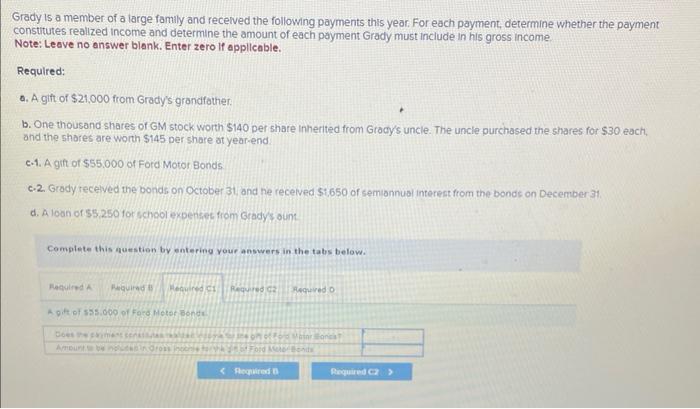

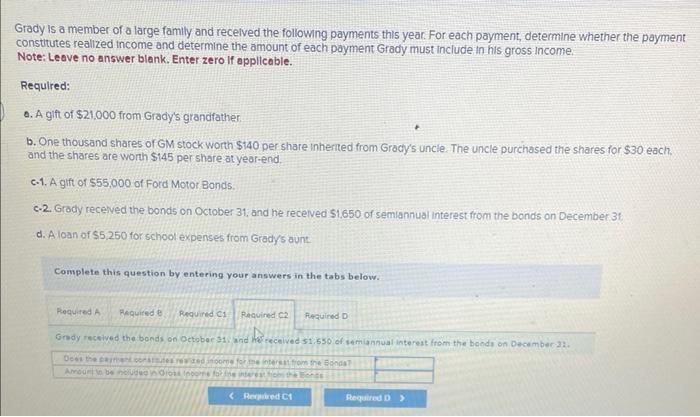

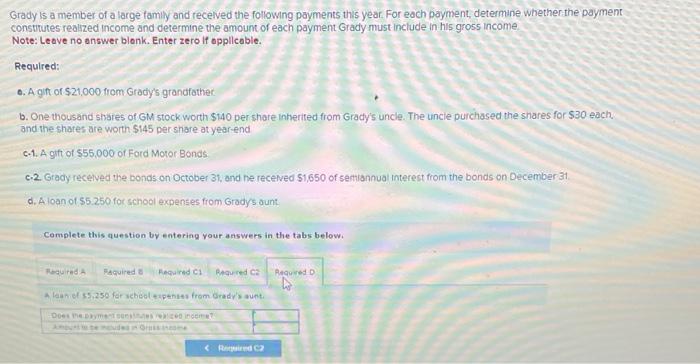

Grady is a member of a large family and received the following payments this year. For each payment, determine whether the payment consututes realized income and determine the amount of each payment Grady must include in his gross income. Note: Leove no answer blank. Enter zero lf applicable. Required: Q. A gitt of \$21,000 from Grady's grandifather b. One thousand shares of 6M stock worth $140 per share inhertied from Grody's uncle. The uncle purchased the shares for $30 each. and the shares ore worth $145 per share at year-end c-1. A gift of $55,000 of Ford Motor Bonds e.2. Grody recelved the bends on Octobet 31, and he recelved $1.650 of semianinual interest from the bonds on December 31. d. A loon of 55250 for school espences from Gradys ount Complete this question by entering your answers in the tabs below. A gitt of s2t. 900 from gradre grandithet. Grady is a member of a large family and recelved the following payments this year. For each payment, determine whether the payment constitutes realized income and determine the amount of each payment Grady must include in his gross income. Note: Leave no onswer blank, Enter zero if applicable. Required: -. A gift of $21,000 from Gradys grandfather. b. One thousand shares of GM stock worth $140 per share inherited from Grady's uncle. The uncle purchased the shares for $30 each, and the shares are worth $145 per share atyear-end. c-1. A gitt of $55,000 of Ford Motor Bonds. c.2. Grady recelved the bonds on October 31 , and he recelved $1.650 of sembannual interest from the bonds on December 31 . d. A loan of $5,250 for school expenses from Grady's aunt. Complete this question by entering your answers in the tabs below. azeh, and the sheres are worth ssas a pear-sid. Grady is a member of a large family and recerved the following payments this year. For each payment, determine whether the payment constitutes realized income and determine the amount of each payment Grady must include in his gross income Note: Leave no answer blank. Enter zero if applicable. Required: a. A gift of $21,000 from Grady's grandfather. b. One thousand shares of GM stock worth $140 per share inherited from Grady's uncle. The uncle purchased the shares for $30 each, and the shores are worth $145 per share at year-end c.1. A gitt of $55.000 of Ford Motor Bonds. c.2. Grody recelved the bonds on October 31 , and he receved $1.650 of semiannus interest from the bonds on December 31 . d. A loon of 55.250 for schaol expenses from Gradys ount. Complete this question by entering vour anowers in the tabs below. A pit of 555.060 of ford Meter bondu. Grady is a member of a large family and recelved the following payments this year. For each payment, determine whether the payment constitutes realized income and determine the amount of each payment Grady must include in his gross Income: Note: Leave no answer blank. Enter zero If applicable. Required: . A gift of $21,000 from Grady's grandfather: b. One thousand shares of GM stockworth $140 per share inherted from Grady's uncle. The uncle purchased the shares for $30 each. and the shares are worth $145 per share at year-end. c.1. A gift of $55,000 of Ford Motor Bonds. c-2. Grody receved the bonds on October 31, and he recelved $1.650 of semiannual interest from the bonds on December 31 . d. A loan of $5,250 for school expenses from Grady/s aunt: Complete this question by entering your answers in the tabs below. Gndy recelved the bonds on October 31 , and her cecelved 51,550 of temiannual interest from the bonds on December 22. Grady is a member of a large family and recelved the following payments this year. For eoch payment, determine whether the payment constitutes realized income and determine the amount of each payment Grady must include in his gross income Note: Leave no answer blenk. Enter zero if applicable. Required: 0. A git of $21,000 from Grady's grandfather. b. One thousand shares of GM stock worth $140 per share inherited from Grady's uncle. The uncie purchased the shares for $30 each. and the shares are worth 5145 per share at year-end c-1. A gift of $55,000 of Ford Motor Bonds. c.2. Grady recelved the bonds on Dctober 31, and ne receved $1,650 of semiannual interest from the bonds on December 31 . d. Aloan of $5.250 for school expenses from Gradys dunt. Complete this question by entering your answers in the tabs below. a laahiel 35,250 for sehed eapthies from Grady's ount