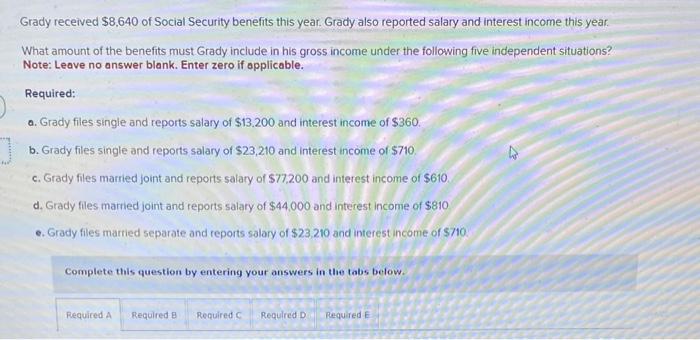

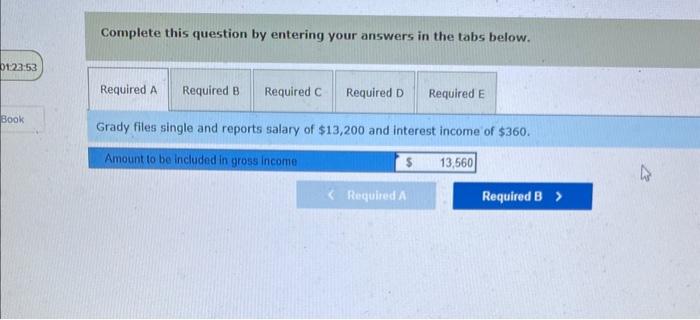

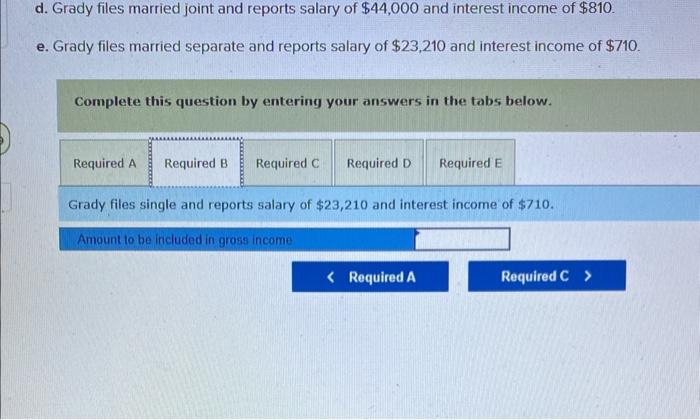

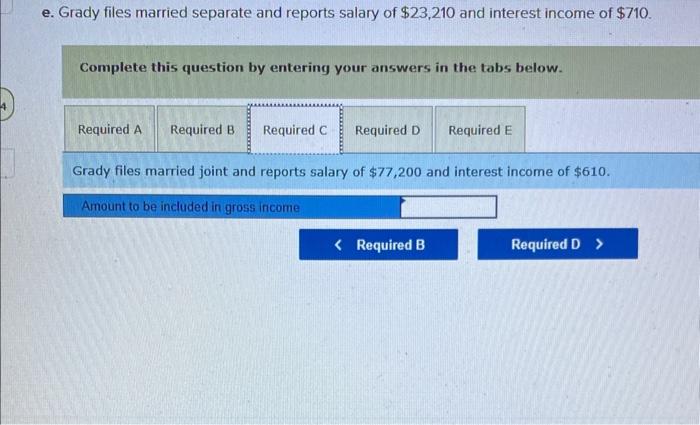

Grady received $8,640 of Social Security benefits this year. Grady also reported salary and interest income this year. What amount of the benefits must Grady include in his gross income under the following five independent situations? Note: Leave no answer blank. Enter zero if applicable. Required: a. Grady files single and reports salary of $13.200 and interest income of $360. b. Grady files single and reports salary of $23,210 and interest income of $710. c. Grady files married joint and reports salary of $77,200 and interest income of $610. d. Grady files married joint and reports salary of $44,000 and interest income of $810 e. Grady files married separate and reports salary of $23,210 and interest income of $710. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Grady files single and reports salary of $13,200 and interest income of $360. d. Grady files married joint and reports salary of $44,000 and interest income of $810. e. Grady files married separate and reports salary of $23,210 and interest income of $710. Complete this question by entering your answers in the tabs below. Grady files single and reports salary of $23,210 and interest income of $710. Amount to be included in gross income Grady files married separate and reports salary of $23,210 and interest income of $710. Complete this question by entering your answers in the tabs below. Grady files married joint and reports salary of $77,200 and interest income of $610. Grady files married separate and reports salary of $23,210 and interest income of $710. Complete this question by entering your answers in the tabs below. Grady files married joint and reports salary of $44,000 and interest income of $810. Grady files married joint and reports salary of $44,000 and interest income of $810. . Grady files married separate and reports salary of $23,210 and interest income of $710. Complete this question by entering your answers in the tabs below. Grady files married separate and reports salary of $23,210 and interest income of $710