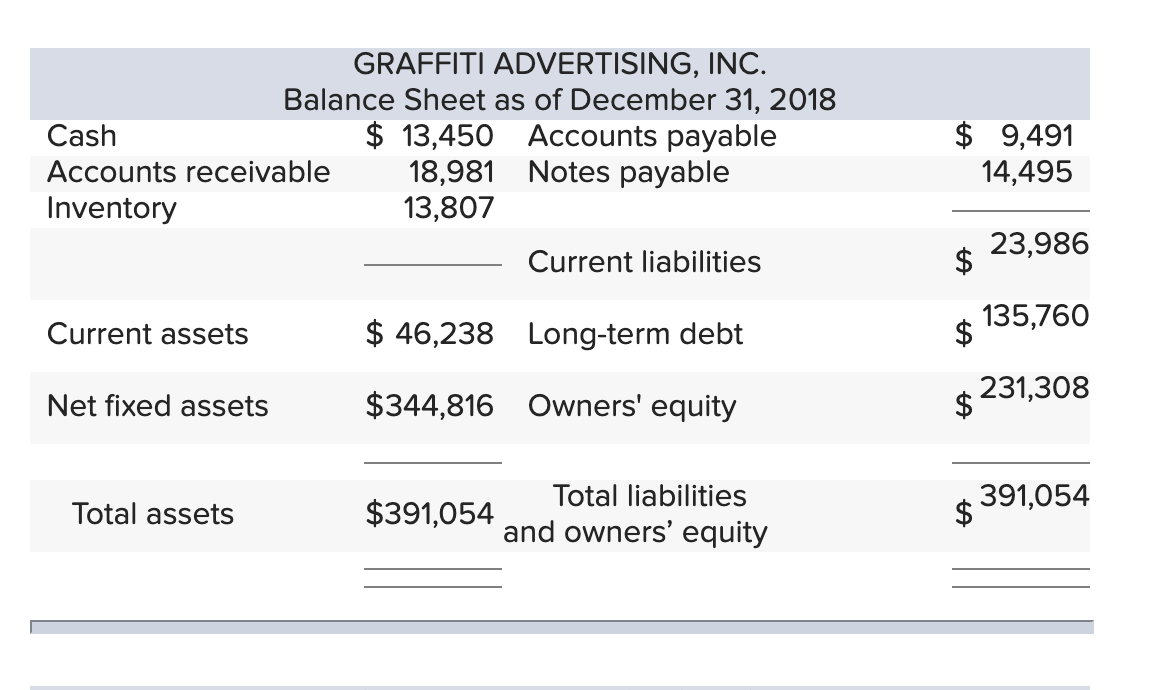

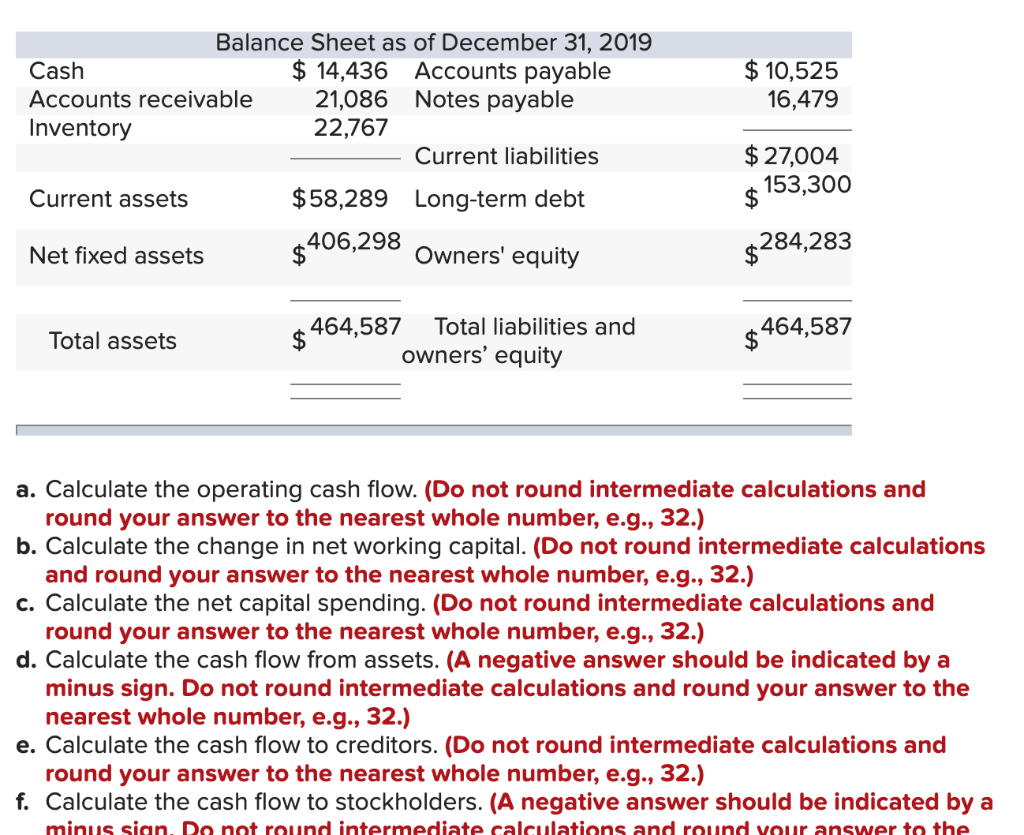

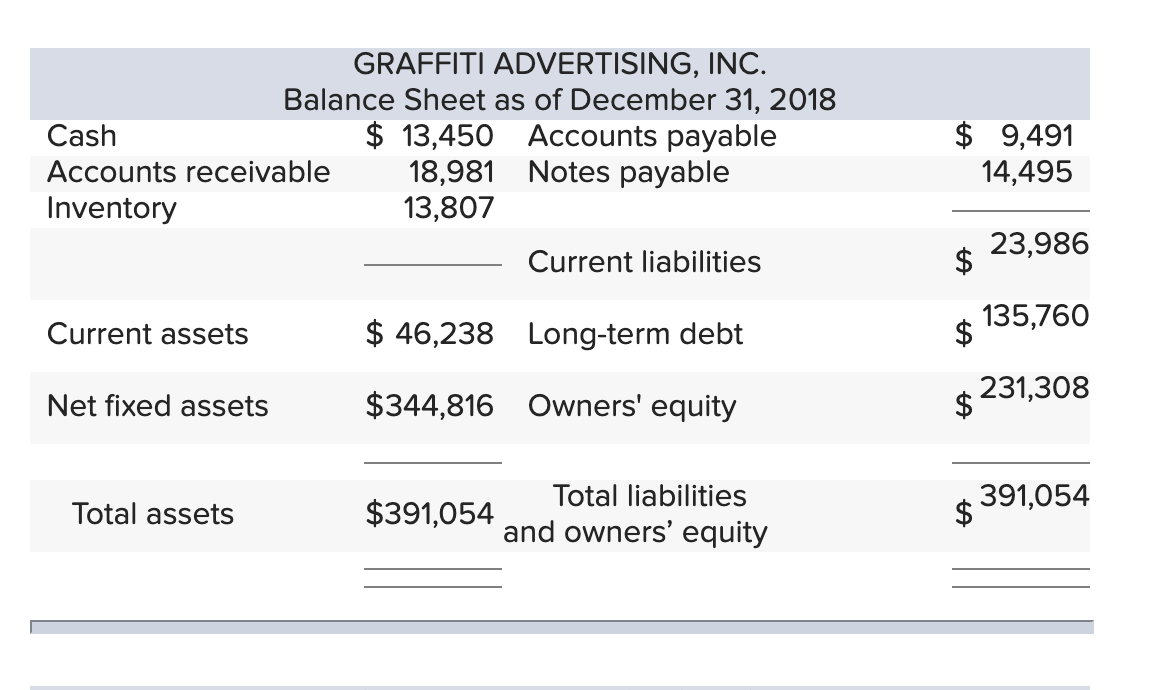

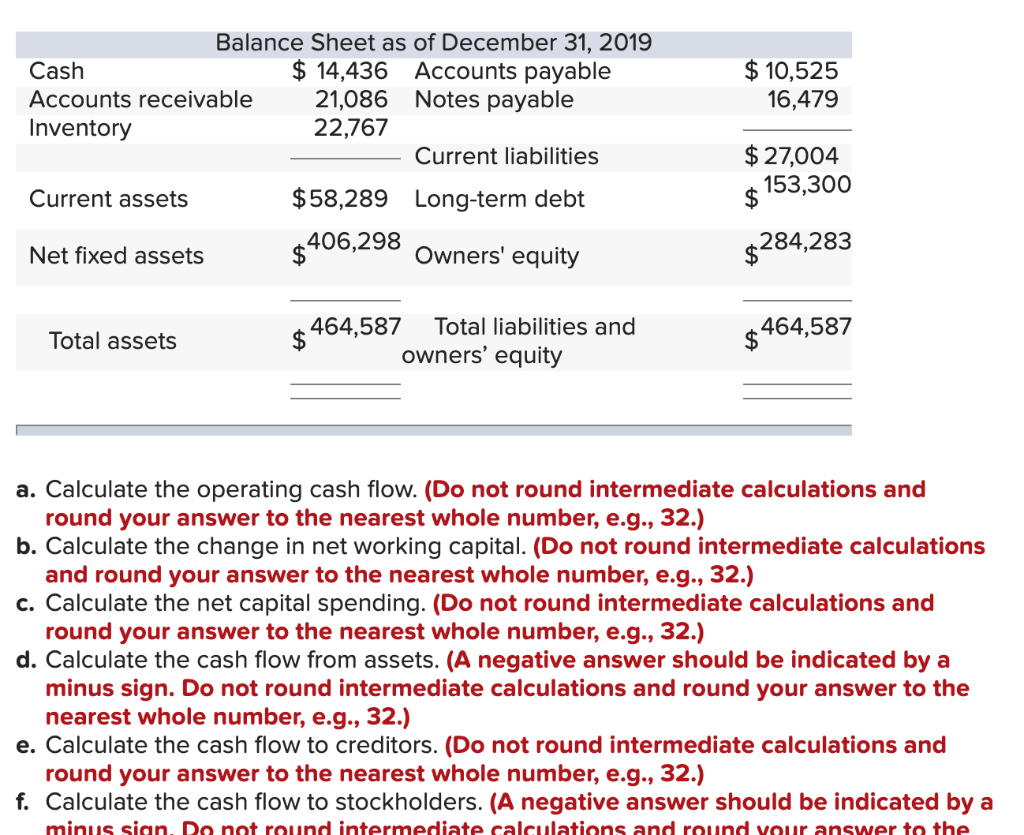

GRAFFITI ADVERTISING, INC. Balance Sheet as of December 31, 2018 Cash $ 13,450 Accounts payable Accounts receivable 18,981 Notes payable Inventory 13,807 $ 9,491 14,495 Current liabilities 23,986 $ 135,760 Current assets $ 46,238 Long-term debt $ Net fixed assets $344,816 Owners' equity 231,308 $ Total assets Total liabilities $391,054 and owners' equity 391,054 $ Balance Sheet as of December 31, 2019 Cash $ 14,436 Accounts payable Accounts receivable 21,086 Notes payable Inventory 22,767 Current liabilities $ 10,525 16,479 $ 27,004 153,300 $ Current assets $58,289 Long-term debt 406,298 Net fixed assets Owners' equity $284,283 Total assets $ 464,587 Total liabilities and owners' equity $ 464,587 a. Calculate the operating cash flow. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. Calculate the change in net working capital. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) c. Calculate the net capital spending. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) d. Calculate the cash flow from assets. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) e. Calculate the cash flow to creditors. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) f. Calculate the cash flow to stockholders. (A negative answer should be indicated by a minus sian. Do not round intermediate calculations and round your answer to the GRAFFITI ADVERTISING, INC. Balance Sheet as of December 31, 2018 Cash $ 13,450 Accounts payable Accounts receivable 18,981 Notes payable Inventory 13,807 $ 9,491 14,495 Current liabilities 23,986 $ 135,760 Current assets $ 46,238 Long-term debt $ Net fixed assets $344,816 Owners' equity 231,308 $ Total assets Total liabilities $391,054 and owners' equity 391,054 $ Balance Sheet as of December 31, 2019 Cash $ 14,436 Accounts payable Accounts receivable 21,086 Notes payable Inventory 22,767 Current liabilities $ 10,525 16,479 $ 27,004 153,300 $ Current assets $58,289 Long-term debt 406,298 Net fixed assets Owners' equity $284,283 Total assets $ 464,587 Total liabilities and owners' equity $ 464,587 a. Calculate the operating cash flow. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. Calculate the change in net working capital. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) c. Calculate the net capital spending. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) d. Calculate the cash flow from assets. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) e. Calculate the cash flow to creditors. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) f. Calculate the cash flow to stockholders. (A negative answer should be indicated by a minus sian. Do not round intermediate calculations and round your answer to the