Question

Investment Selection and Additional Information Research and Discuss recent news articles about the companies that may be helpful in providing additional information about the health

Investment Selection and Additional Information

Research and Discuss recent news articles about the companies that may be helpful in providing additional information about the health of the companies. (Read between the lines. Often times, articles wont directly say how the news may affect the health of a company. You have to speculate how it may affect the company. For example, a news article reports the recall of a product. This could negatively affect sales and impact various ratios. An article might talk about a company opening new stores. This requires significant investments, may require debt financing, and this would impact various ratios as well. Furthermore, expansion could mean increased revenue, etc.) Select one article for each company that you consider to be the most significant current issue facing the company at this time (or in recent history).

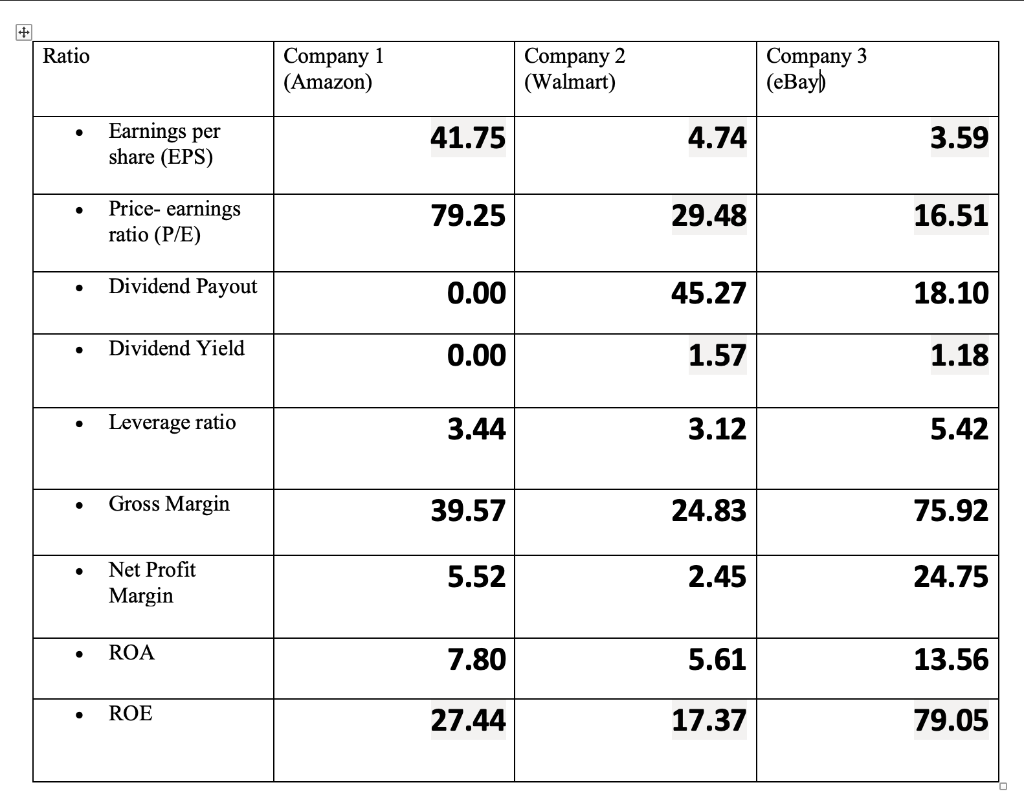

Based on your ratio analysis and additional research of the companies, state which company you would invest in and why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started