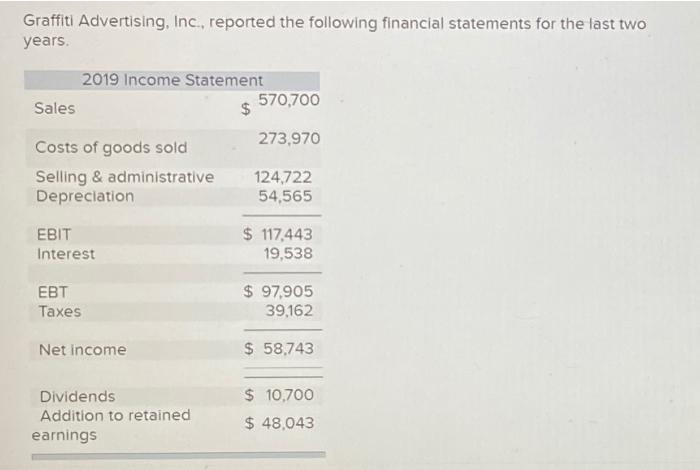

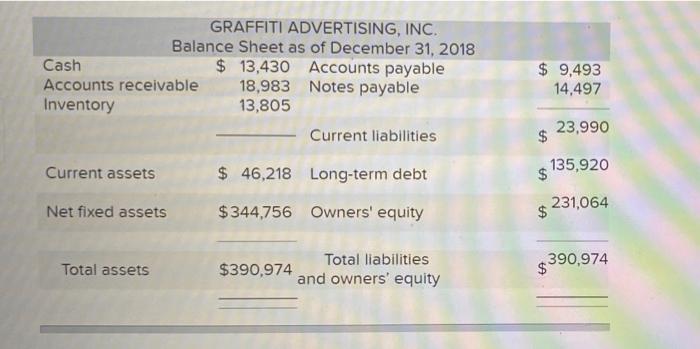

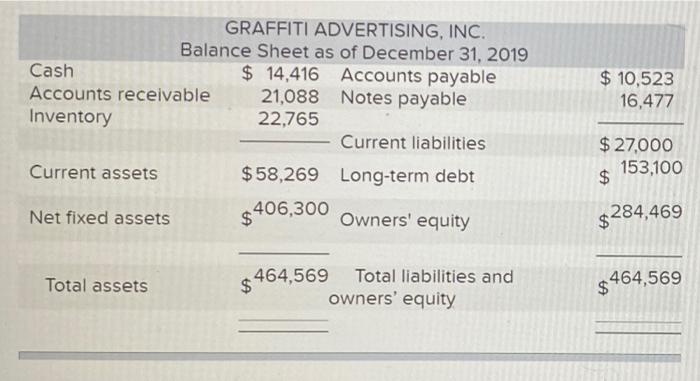

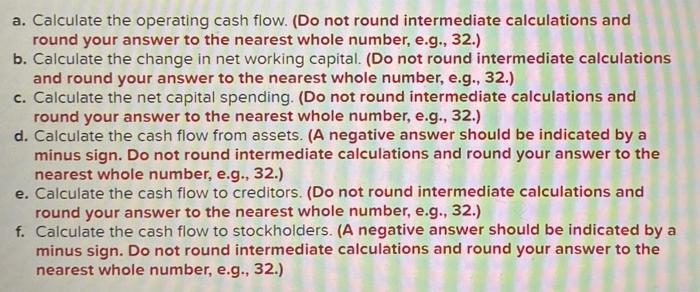

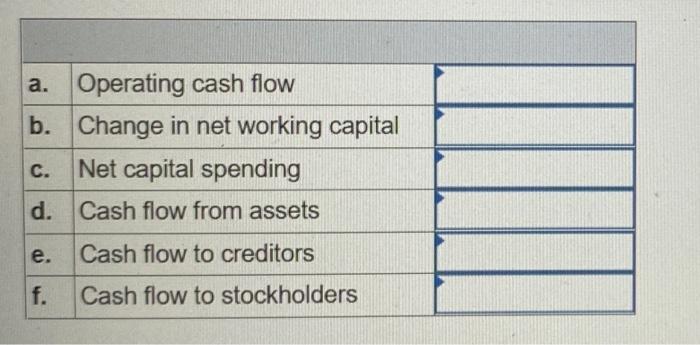

Graffiti Advertising, Inc., reported the following financial statements for the last two years. 2019 Income Statement Sales $ 570,700 Costs of goods sold 273,970 Selling & administrative 124,722 Depreciation 54,565 EBIT Interest $ 117,443 19,538 EBT Taxes $ 97,905 39,162 Net income $ 58,743 Dividends Addition to retained earnings $ 10,700 $ 48,043 GRAFFITI ADVERTISING, INC. Balance Sheet as of December 31, 2018 Cash $ 13,430 Accounts payable Accounts receivable 18,983 Notes payable Inventory 13,805 Current liabilities $ 9,493 14,497 23,990 $ Current assets 135,920 $ $ 46,218 Long-term debt $344,756 Owners' equity Net fixed assets $ 231,064 390,974 Total assets Total liabilities $390,974 and owners' equity GRAFFITI ADVERTISING, INC. Balance Sheet as of December 31, 2019 Cash $ 14,416 Accounts payable Accounts receivable 21,088 Notes payable Inventory 22,765 Current liabilities Current assets $58,269 Long-term debt $ 10,523 16,477 $ 27,000 $ 153,100 Net fixed assets $406,300 Owners' equity $ 284,469 Total assets $ 464,569 Total liabilities and owners' equity $ 464,569 a. Calculate the operating cash flow. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. Calculate the change in net working capital. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) C. Calculate the net capital spending. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) d. Calculate the cash flow from assets. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) e. Calculate the cash flow to creditors. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) f. Calculate the cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) a. Operating cash flow b. Change in net working capital C. Net capital spending d. Cash flow from assets e. Cash flow to creditors f. Cash flow to stockholders