Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Graham Corp. has been in negotiations with D Corp., to lease a machine. The facts listed below are for a noncancellable lease agreement between

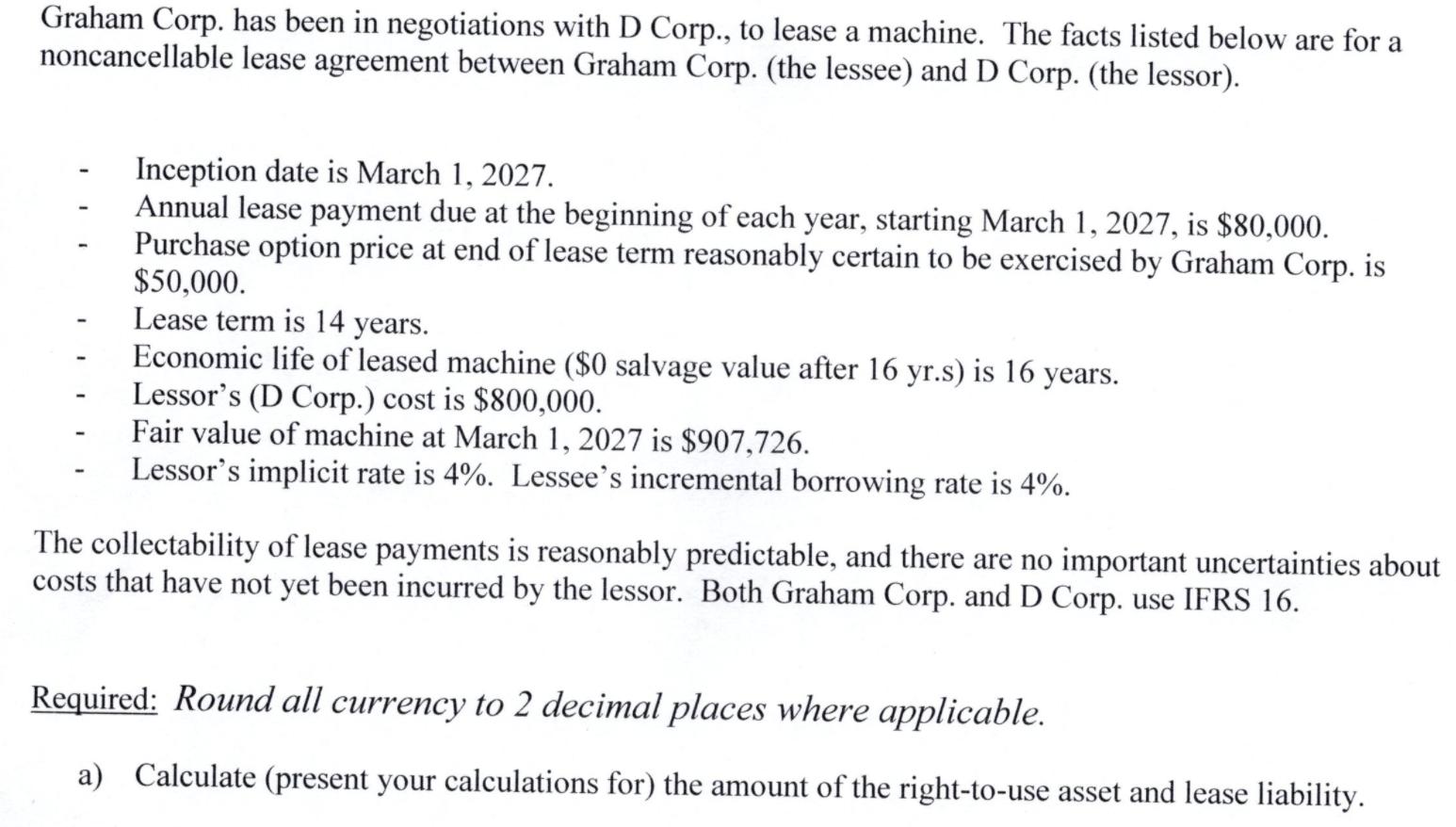

Graham Corp. has been in negotiations with D Corp., to lease a machine. The facts listed below are for a noncancellable lease agreement between Graham Corp. (the lessee) and D Corp. (the lessor). Inception date is March 1, 2027. Annual lease payment due at the beginning of each year, starting March 1, 2027, is $80,000. Purchase option price at end of lease term reasonably certain to be exercised by Graham Corp. is $50,000. Lease term is 14 years. Economic life of leased machine ($0 salvage value after 16 yr.s) is 16 years. Lessor's (D Corp.) cost is $800,000. Fair value of machine at March 1, 2027 is $907,726. Lessor's implicit rate is 4%. Lessee's incremental borrowing rate is 4%. The collectability of lease payments is reasonably predictable, and there are no important uncertainties about costs that have not yet been incurred by the lessor. Both Graham Corp. and D Corp. use IFRS 16. Required: Round all currency to 2 decimal places where applicable. a) Calculate (present your calculations for) the amount of the right-to-use asset and lease liability.

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

A Right of use assets Leas liability at inception date P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started