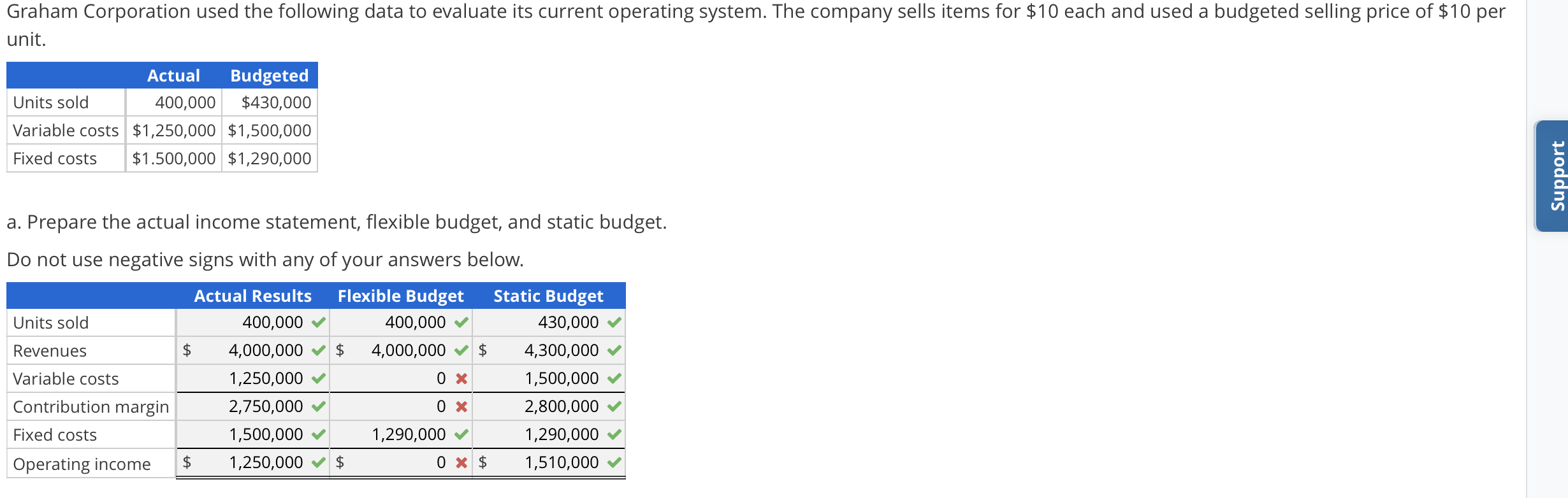

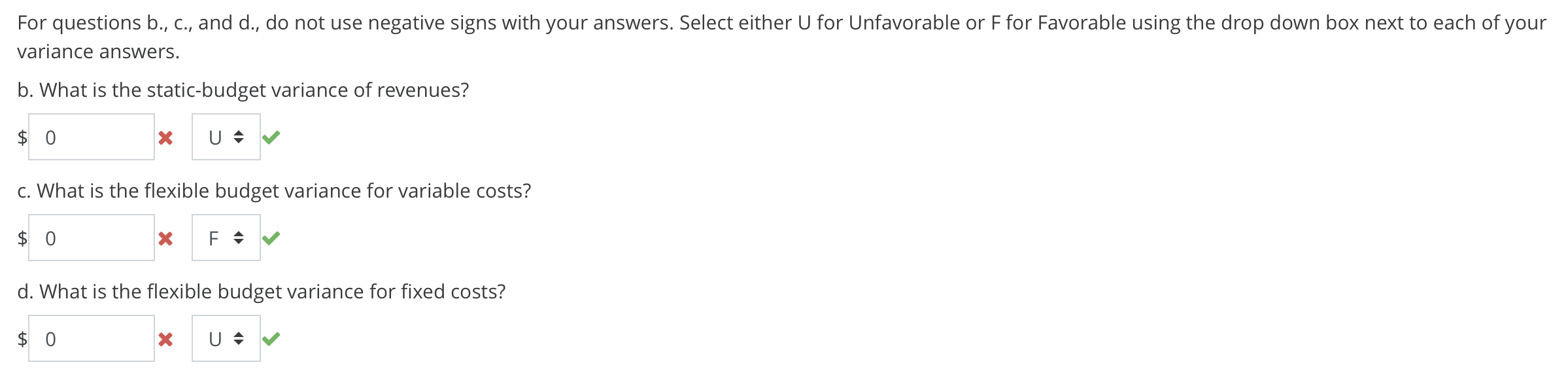

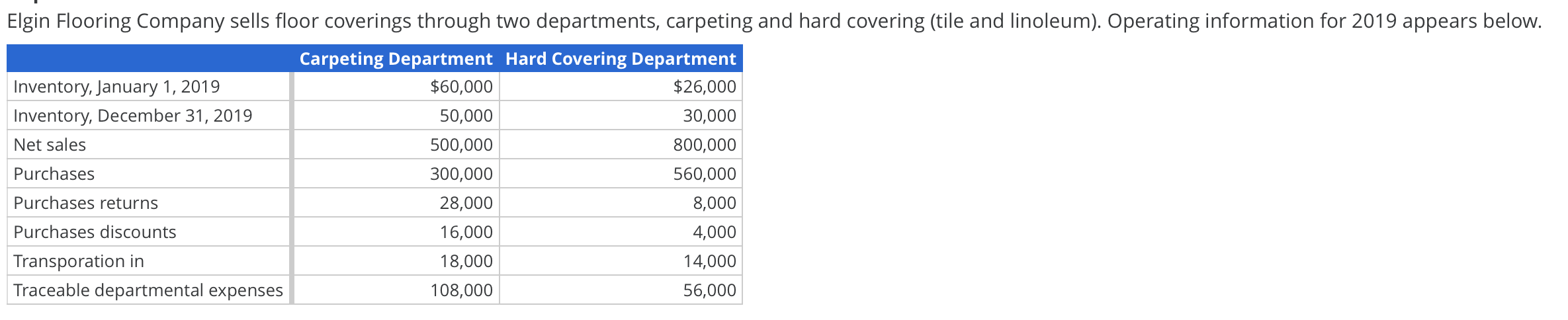

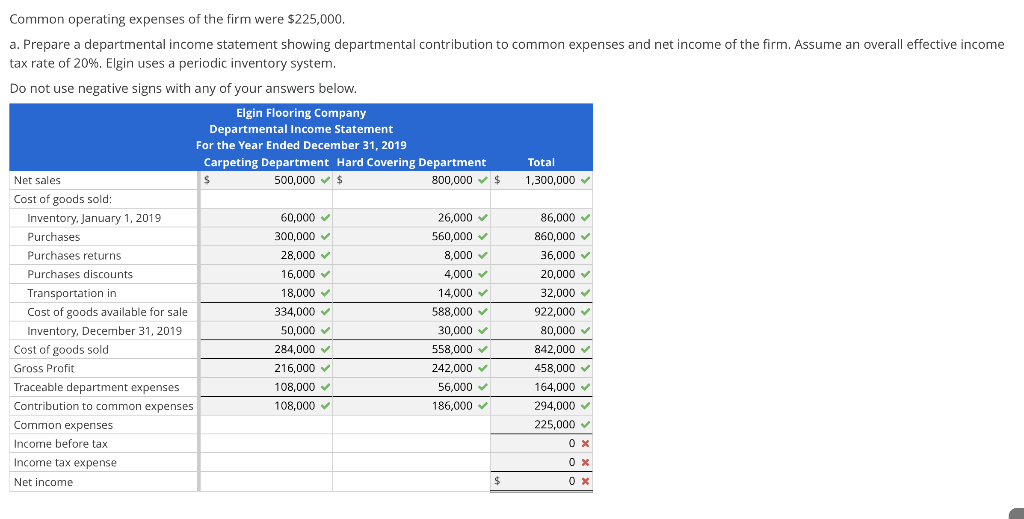

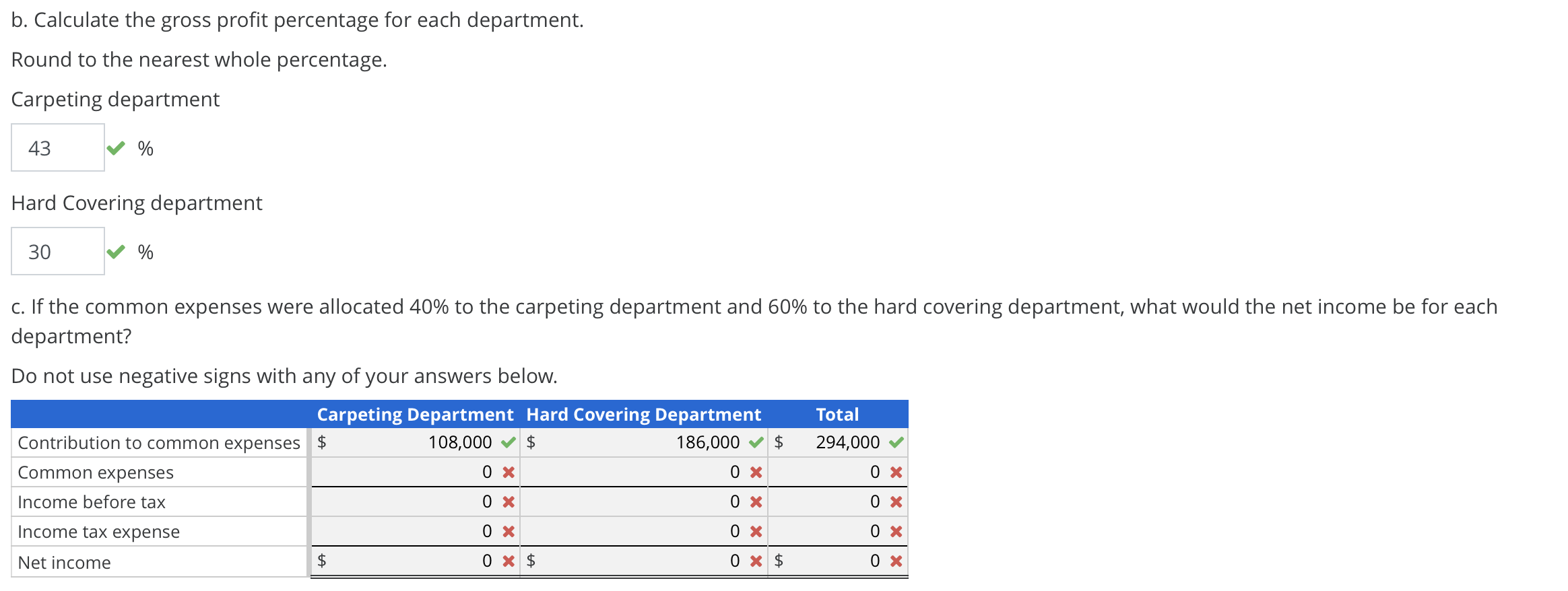

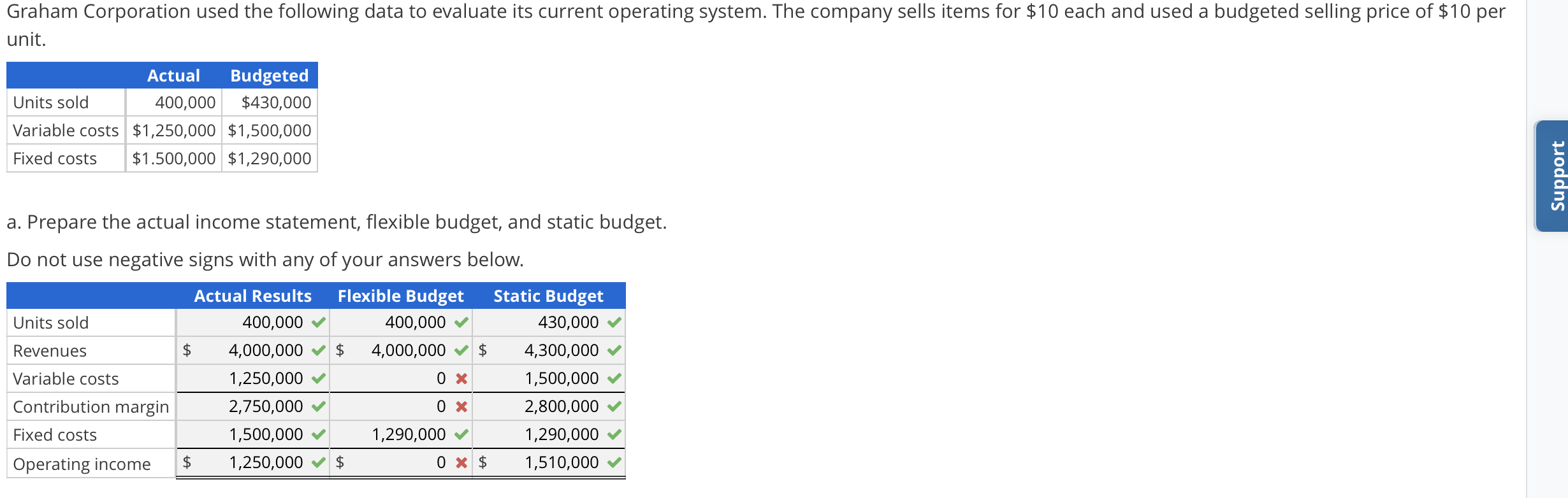

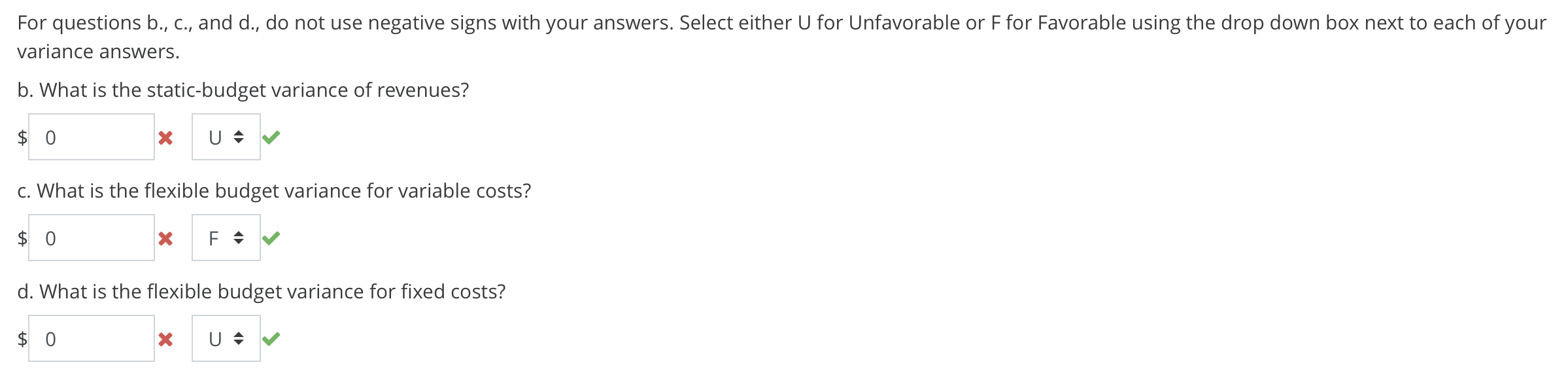

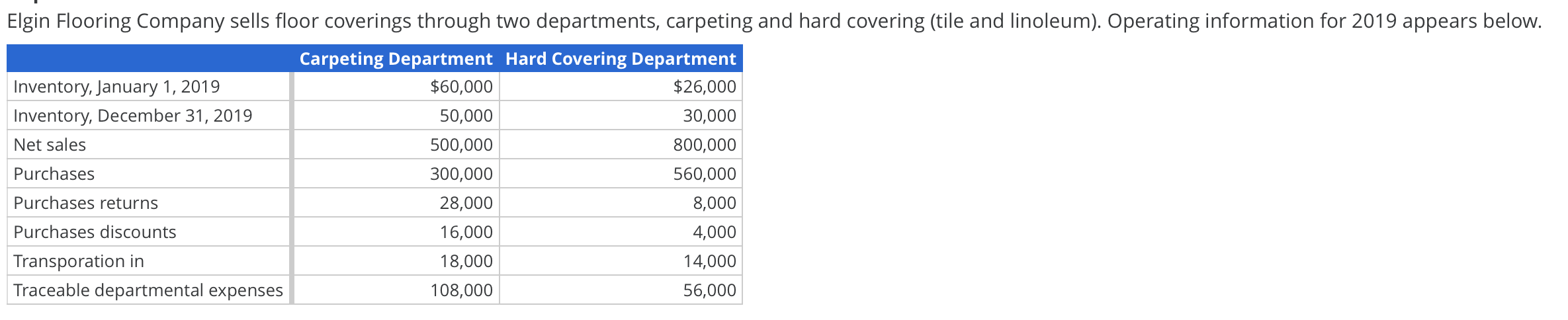

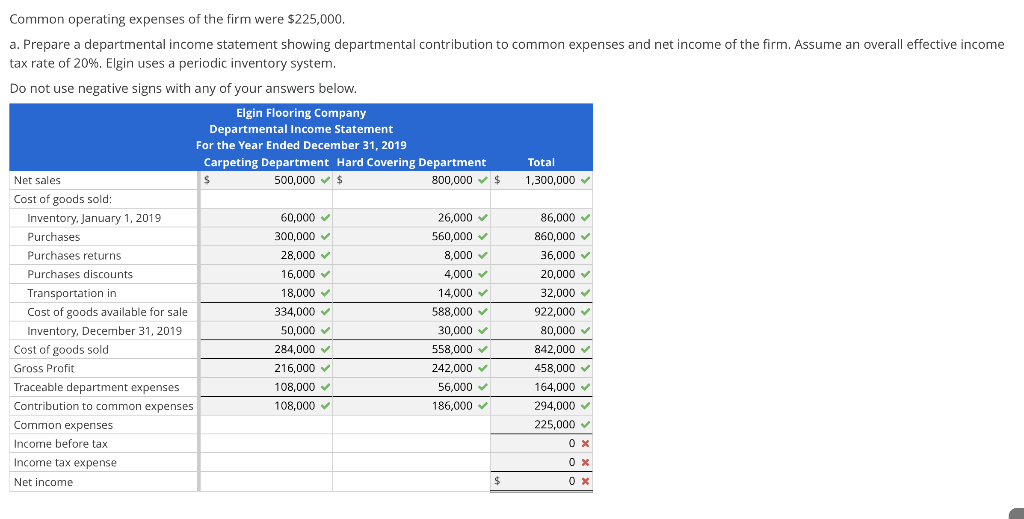

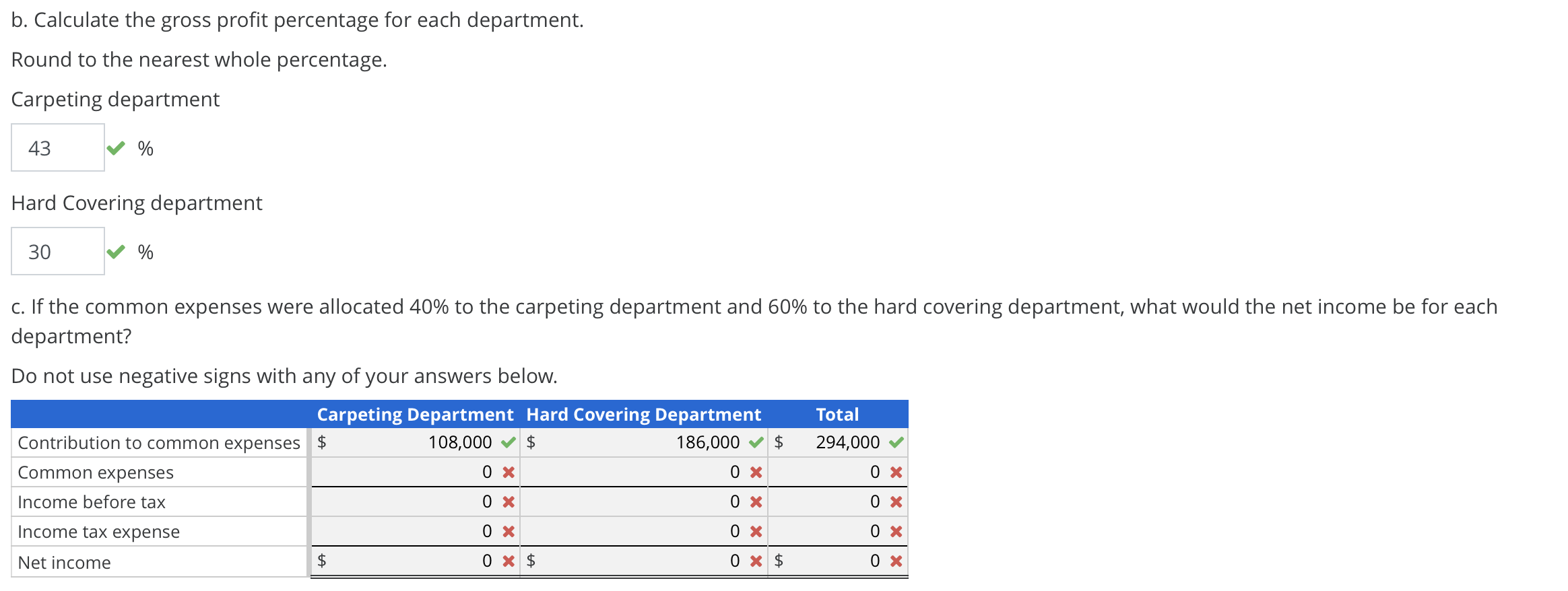

Graham Corporation used the following data to evaluate its current operating system. The company sells items for $10 each and used a budgeted selling price of $10 per unit. Actual Budgeted Units sold 400,000 $430,000 Variable costs $1,250,000 $1,500,000 Fixed costs $1.500,000 $1,290,000 Support a. Prepare the actual income statement, flexible budget, and static budget. Do not use negative signs with any of your answers below. Units sold Revenues Variable costs Actual Results 400,000 ~ $ 4,000,000 1,250,000 2,750,000 ~ 1,500,000 V $ 1,250,000 Flexible Budget Static Budget 400,000 ~ 430,000 $ 4,000,000 $ 4,300,000 0 x 1,500,000 0x 2,800,000 ~ 1,290,000 V 1,290,000 $ 0 x $ 1,510,000 V Contribution margin Fixed costs Operating income For questions b., C., and d., do not use negative signs with your answers. Select either U for Unfavorable or F for Favorable using the drop down box next to each of your variance answers. b. What is the static-budget variance of revenues? $0 x US C. What is the flexible budget variance for variable costs? $ 0 * F d. What is the flexible budget variance for fixed costs? $ 0 Elgin Flooring Company sells floor coverings through two departments, carpeting and hard covering (tile and linoleum). Operating information for 2019 appears below. Inventory, January 1, 2019 Inventory, December 31, 2019 Net sales Purchases Carpeting Department Hard Covering Department $60,000 $26,000 50,000 30,000 500,000 800,000 300,000 560,000 28,000 8,000 16,000 4,000 18,000 14,000 108,000 56,000 Purchases returns Purchases discounts Transporation in Traceable departmental expenses Common operating expenses of the firm were $225,000. a. Prepare a departmental income statement showing departmental contribution to common expenses and net income of the firm. Assume an overall effective income tax rate of 20%. Elgin uses a periodic inventory system. Do not use negative signs with any of your answers below. Elgin Flooring Company Departmental Income Statement For the Year Ended December 31, 2019 Carpeting Department Hard Covering Department Total Net sales 500,000 $ 800,000 $ 1,300,000 Cost of goods sold: Inventory, January 1, 2019 60,000 26,000 86,000 Purchases 300,000 560,000 860,000 Purchases returns 28,000 8,000 36,000 Purchases discounts 16,000 4,000 20,000 Transportation in 18,000 14,000 32,000 Cost of goods available for sale 334,000 588,000 922,000 Inventory, December 31, 2019 50,000 30,000 80,000 Cost of goods sold 284,000 558,000 842,000 Gross Profit 216,000 242,000 458,000 Traceable department expenses 108,000 56,000 164,000 Contribution to common expenses 108,000 186,000 294,000 Common expenses 225,000 Income before tax OX Income tax expense Net income b. Calculate the gross profit percentage for each department. Round to the nearest whole percentage. Carpeting department 43 v % Hard Covering department 30 % c. If the common expenses were allocated 40% to the carpeting department and 60% to the hard covering department, what would the net income be for each department? Do not use negative signs with any of your answers below. Carpeting Department Hard Covering Department Contribution to common expenses $ 108,000 $ 186,000 $ Common expenses Ox 0 x Income before tax OX 0 X Income tax expense OX 0 x Net income 0 x $ 0 x $ Total 294,000 0 x 0 X 0 x 0 x Graham Corporation used the following data to evaluate its current operating system. The company sells items for $10 each and used a budgeted selling price of $10 per unit. Actual Budgeted Units sold 400,000 $430,000 Variable costs $1,250,000 $1,500,000 Fixed costs $1.500,000 $1,290,000 Support a. Prepare the actual income statement, flexible budget, and static budget. Do not use negative signs with any of your answers below. Units sold Revenues Variable costs Actual Results 400,000 ~ $ 4,000,000 1,250,000 2,750,000 ~ 1,500,000 V $ 1,250,000 Flexible Budget Static Budget 400,000 ~ 430,000 $ 4,000,000 $ 4,300,000 0 x 1,500,000 0x 2,800,000 ~ 1,290,000 V 1,290,000 $ 0 x $ 1,510,000 V Contribution margin Fixed costs Operating income For questions b., C., and d., do not use negative signs with your answers. Select either U for Unfavorable or F for Favorable using the drop down box next to each of your variance answers. b. What is the static-budget variance of revenues? $0 x US C. What is the flexible budget variance for variable costs? $ 0 * F d. What is the flexible budget variance for fixed costs? $ 0 Elgin Flooring Company sells floor coverings through two departments, carpeting and hard covering (tile and linoleum). Operating information for 2019 appears below. Inventory, January 1, 2019 Inventory, December 31, 2019 Net sales Purchases Carpeting Department Hard Covering Department $60,000 $26,000 50,000 30,000 500,000 800,000 300,000 560,000 28,000 8,000 16,000 4,000 18,000 14,000 108,000 56,000 Purchases returns Purchases discounts Transporation in Traceable departmental expenses Common operating expenses of the firm were $225,000. a. Prepare a departmental income statement showing departmental contribution to common expenses and net income of the firm. Assume an overall effective income tax rate of 20%. Elgin uses a periodic inventory system. Do not use negative signs with any of your answers below. Elgin Flooring Company Departmental Income Statement For the Year Ended December 31, 2019 Carpeting Department Hard Covering Department Total Net sales 500,000 $ 800,000 $ 1,300,000 Cost of goods sold: Inventory, January 1, 2019 60,000 26,000 86,000 Purchases 300,000 560,000 860,000 Purchases returns 28,000 8,000 36,000 Purchases discounts 16,000 4,000 20,000 Transportation in 18,000 14,000 32,000 Cost of goods available for sale 334,000 588,000 922,000 Inventory, December 31, 2019 50,000 30,000 80,000 Cost of goods sold 284,000 558,000 842,000 Gross Profit 216,000 242,000 458,000 Traceable department expenses 108,000 56,000 164,000 Contribution to common expenses 108,000 186,000 294,000 Common expenses 225,000 Income before tax OX Income tax expense Net income b. Calculate the gross profit percentage for each department. Round to the nearest whole percentage. Carpeting department 43 v % Hard Covering department 30 % c. If the common expenses were allocated 40% to the carpeting department and 60% to the hard covering department, what would the net income be for each department? Do not use negative signs with any of your answers below. Carpeting Department Hard Covering Department Contribution to common expenses $ 108,000 $ 186,000 $ Common expenses Ox 0 x Income before tax OX 0 X Income tax expense OX 0 x Net income 0 x $ 0 x $ Total 294,000 0 x 0 X 0 x 0 x