Question

Graham Potato Company has projected sales of $7,200 in September, $11,000 in October, $17,200 in November, and $13,200 in December. Of the company's sales, 20

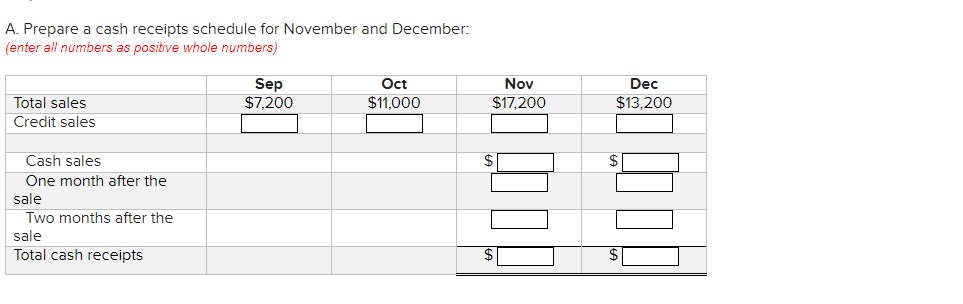

Graham Potato Company has projected sales of $7,200 in September, $11,000 in October, $17,200 in November, and $13,200 in December. Of the company's sales, 20 percent are paid for by cash and 80 percent are sold on credit. Experience shows that 40 percent of accounts receivable are paid in the month after the sale, while the remaining 60 percent are paid two months after. Determine collections for November and December.

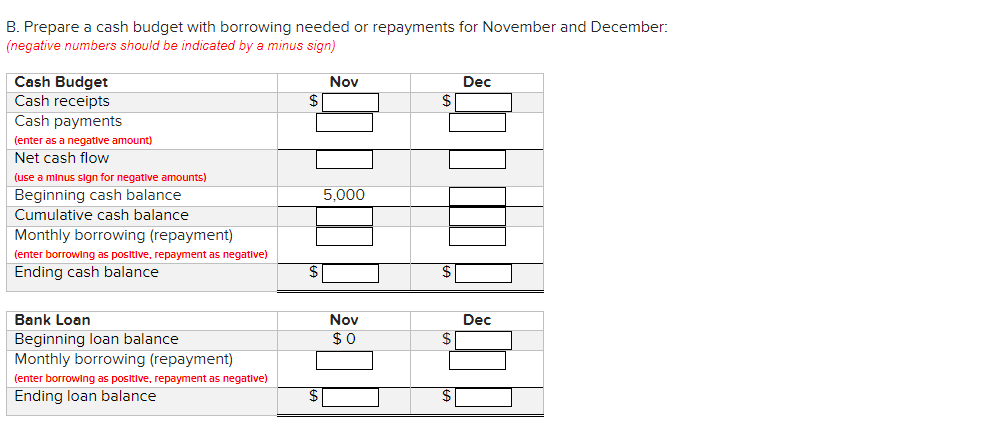

Also assume Graham's cash payments for November and December are $-14,500 and $-7,000, respectively. The beginning cash balance in November is $5,000 $5,000, which is the desired minimum balance. There is no bank loan outstanding at the beginning of November.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started