Answered step by step

Verified Expert Solution

Question

1 Approved Answer

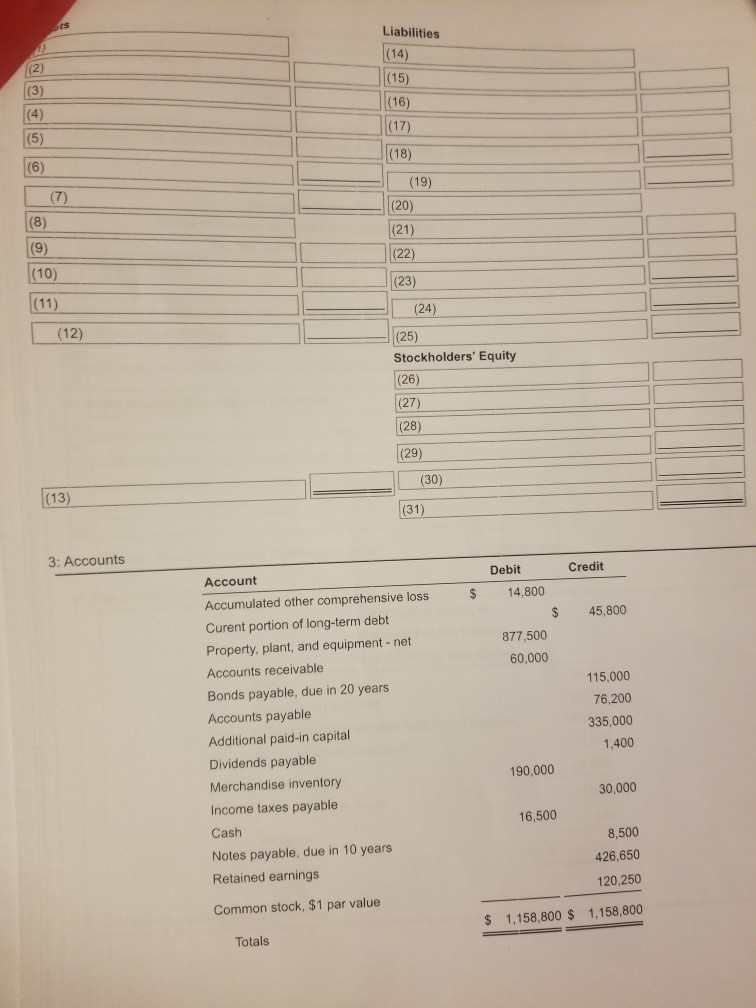

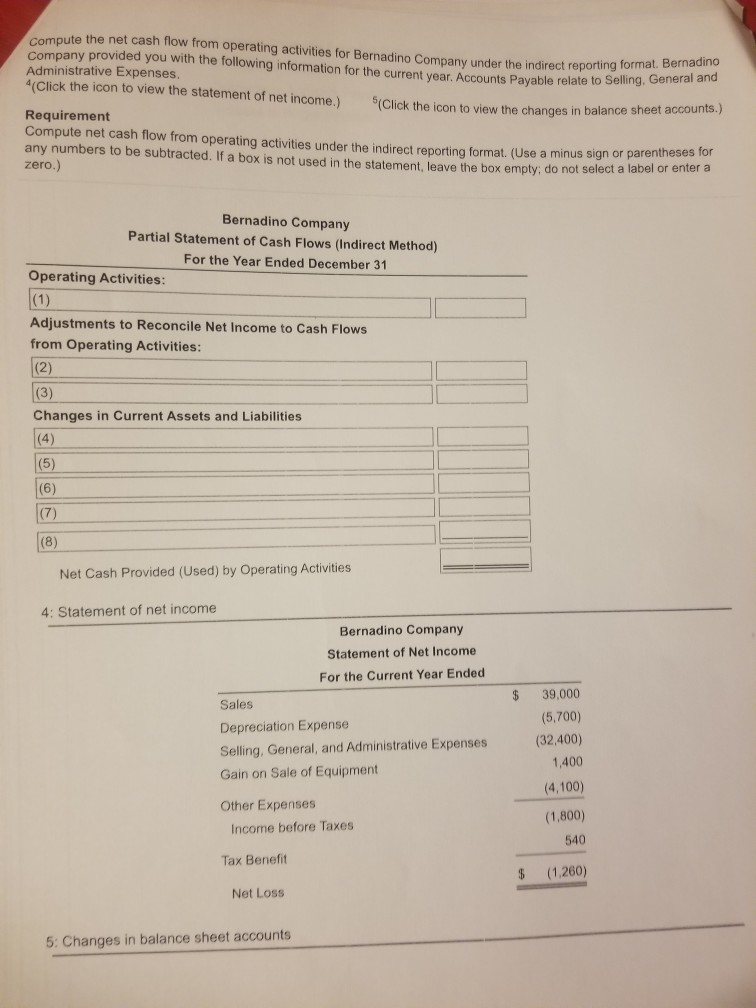

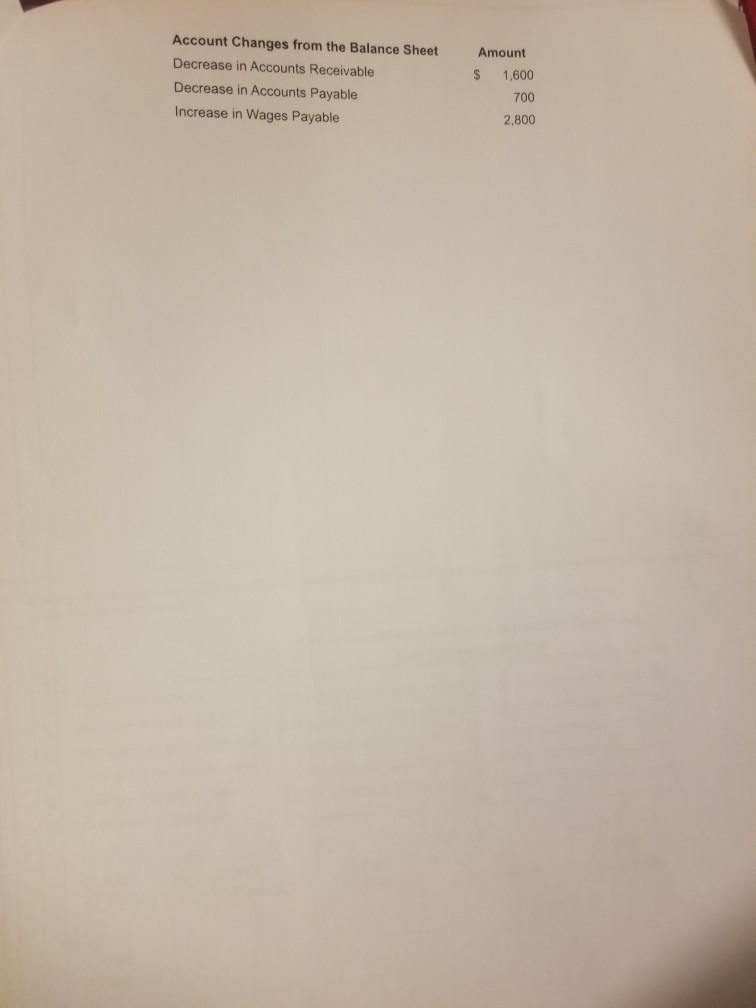

gram Company provided the following list of accounts. Click the icon to view the list of accounts.) Prepare a classified balance sheet using the account

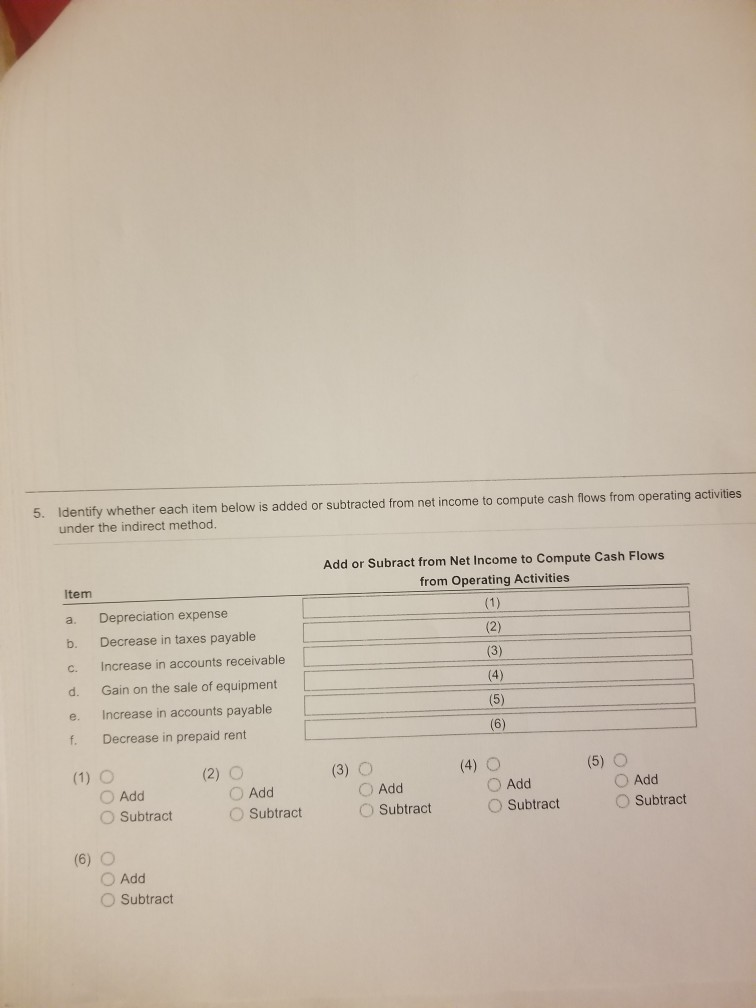

gram Company provided the following list of accounts. Click the icon to view the list of accounts.) Prepare a classified balance sheet using the account format. begin by preparing the asset section of the balance sheet and then prepare the liabilities and stockholder (Use a minus sign or parentheses for any loss amounts If a box is not used in the statement leave the box om are the liabilities and stockholders' equity sections. select a label or enter a zero.) in the statement leave the box empty: do not Ingram Company Balance Sheet At December 31 Liabilities (14) (15) (16) (19) (8) (21) (22) (10) I (12) I (24) (25) Stockholders' Equity (26) (27) (28) (29) L (30) (13) (31) 3: Accounts Credit Debit 14,800 $ $ 45,800 877,500 60,000 Account Accumulated other comprehensive loss Curent portion of long-term debt Property, plant, and equipment - net Accounts receivable Bonds payable, due in 20 years Accounts payable Additional paid-in capital Dividends payable Merchandise inventory Income taxes payable Cash Notes payable, due in 10 years Retained earnings 115,000 76,200 335.000 1,400 190.000 30,000 16,500 8,500 426,650 120.250 Common stock, $1 par value $ 1,158,800 $ 1,158,800 Totals mpute the net cash flow from operating activities for Bernadino Company under the indirect reporting Company provided you with the following information for the current year. Accounts Payable relate to Sem der the indirect reporting format. Bernadino Administrative Expenses. o current year. Accounts Payable relate to Selling, General and (Click the icon to view the statement of net income.) Click the icon to view the changes in bala the icon to view the changes in balance sheet accounts.) Requirement Compute net cash flow from operating activities under the indirect reporting format. (Use a minus sign of a any numbers to be subtracted. If a box is not used in the statement leave the box empty, do not select a la eporting format. (Use a minus sign or parentheses for zero.) Bernadino Company Partial Statement of Cash Flows (Indirect Method) For the Year Ended December 31 Operating Activities: Adjustments to Reconcile Net Income to Cash Flows from Operating Activities: (2) Changes in Current Assets and Liabilities (8) Net Cash Provided (Used) by Operating Activities 4: Statement of net income Bernadino Company Statement of Net Income For the Current Year Ended $ Sales Depreciation Expense Selling, General, and Administrative Expenses Gain on Sale of Equipment 39,000 (5,700) (32,400) 1,400 (4,100) Other Expenses Income before Taxes (1,800) 540 Tax Benefit $ (1,260) Net Loss 5: Changes in balance sheet accounts Account Changes from the Balance Sheet Decrease in Accounts Receivable Decrease in Accounts Payable Increase in Wages Payable Amount $ 1,600 700 2,800 5. Identify whether each item below is added or subtracted from net income to compute cash flows from operating activities under the indirect method. Add or Subract from Net Income to Compute Cash Flows from Operating Activities Item a. b. Depreciation expense Decrease in taxes payable Increase in accounts receivable Gain on the sale of equipment Increase in accounts payable Decrease in prepaid rent d. e. f. (2) O (5) O (1) O O Add Subtract Add Subtract (3) o Add Subtract Add Subtract Add Subtract (6) O Add Subtract

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started